Tesla Q4'19 Earnings Forecast

Tesla's Q4'19 earnings are upon us, and could be released as early as Wednesday the 22nd of January. This blog will be pretty short and simple. I just want to share my earnings predictions. I have a few ideas for future blogs, but I'm not sure yet when I'll feel like writing something longer again. I think I'll probably share my predictions for Q1'20 very early though, because I think it has the potential to be a huge quarter, and it could have large implications for S&P 500 inclusion.

My Q2 earnings and Q3 earnings forecasts were way off the mark, but third time's the charm, so let's give this another shot. Besides, in Q2 I had only just created my quarterly financial model, so it was not very detailed and I needed more practice. I predicted GAAP EPS of between -$1.46 and +$1.00 in Q2, but it turned out to be -$2.31, so my prediction was too bullish.

Then in Q3 I improved my model and understanding of various line items, so I thought I'd be closer that time with my prediction of in between -$2.21 and -$1.23, but Tesla ended up surprising not just me but everybody with their +$0.80 EPS, so my prediction was too bearish.

This time I've once again improved a number of things, so I hope that as long as Tesla doesn't surprise us all again, my model will be pretty accurate this time. This doesn't mean I'm not rooting for a similar surprise like Q3 though, because I'd love another epic rally like we've had over the past few months.

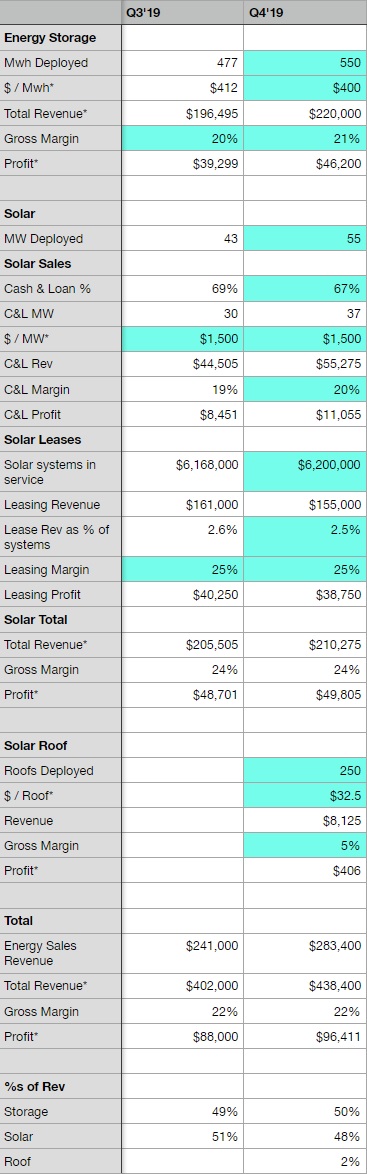

Anyway, here is my model for Q4'19:

My Q2 earnings and Q3 earnings forecasts were way off the mark, but third time's the charm, so let's give this another shot. Besides, in Q2 I had only just created my quarterly financial model, so it was not very detailed and I needed more practice. I predicted GAAP EPS of between -$1.46 and +$1.00 in Q2, but it turned out to be -$2.31, so my prediction was too bullish.

Then in Q3 I improved my model and understanding of various line items, so I thought I'd be closer that time with my prediction of in between -$2.21 and -$1.23, but Tesla ended up surprising not just me but everybody with their +$0.80 EPS, so my prediction was too bearish.

This time I've once again improved a number of things, so I hope that as long as Tesla doesn't surprise us all again, my model will be pretty accurate this time. This doesn't mean I'm not rooting for a similar surprise like Q3 though, because I'd love another epic rally like we've had over the past few months.

Anyway, here is my model for Q4'19:

Energy

I'm not going to go over this in detail. This is my first time using this energy model, so I'll need some time to see how accurate it is and to maybe fine tune things, but I think the overall revenue of $438.4M and 22% margins are pretty reasonable estimates on their own.

Automotive

- A slight price increase on M3, because prices were raised at the start of Q4.

- Slight COGS reductions, because of higher volume. Tesla could surprise with further margin improvements, but I don't think we'll see improvements as large as we saw in Q3.

- I have credits pretty low at $100M, because I suspect Tesla would rather recognize more credits in Q1'20 to help achieve S&P 500 inclusion if they have this flexibility. Tesla could easily sell $50M more credits though.

- I think we'll see a bit of a boost in leasing revenue, because the start of Model 3 leasing should start to kick in a bit. Especially in Q3 a lot of S, X, and 3s were sold as leases.

Income

I'm hopeful for another small margin improvement in "Services and other" to further reduce those losses. I think OPEX will increase slightly, but probably not by that much. Once some of the new R&D centers in China, Berlin, and Israel start coming online we should see larger increases in OPEX.

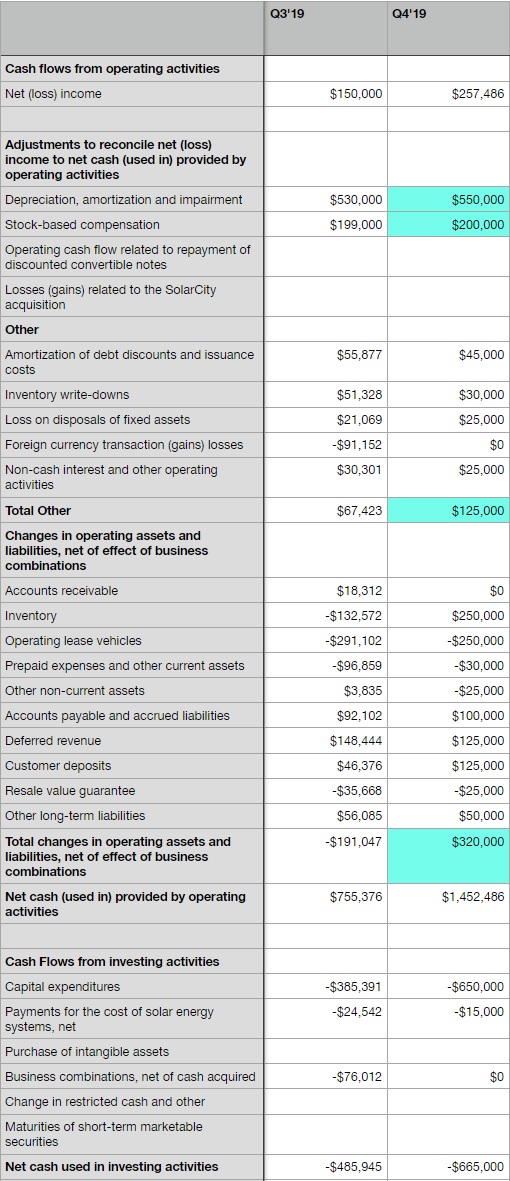

Cash Flows

The huge inventory reduction in Q4'19 should lead to very strong cash flows. Customer deposits for MiC M3s and Cybertruck should also boost cash flows. Capex should increase a fair bit though, because of Giga 3 and ongoing preparations for Model Y. Tesla's overall cash position would've also increased significantly, but will be held back a bit by the repayment of a $500M convertible note in November.

Summary

- Automotive Revenue = $6.21B

- Automotive Sales Gross Margin Excluding Credits = 20.6%

- Automotive Sales Gross Margin Including Credits = 22.0%

- Total Revenue = $7.22B

- Gross Profit = $1.43B

- EBIT = $467M

- GAAP EPS = $1.39

- Non-GAAP EPS = $2.47

- Free Cash Flow = $787M

Comments

Post a Comment