TSLA Q3'19 Earnings Forecast & An attempt to model TSLA Automotive Leasing Financials

This is mostly a short blog for finance and spreadsheet nerds like me, because I've attempted to make a financial model for TSLA automotive leasing, and I am interested to see other people's opinion on it. But because it's earnings week next week, I figured I may as well also throw in my predictions for that. Last quarter I was quite far off, but I think that with some much appreciated feedback from a few TMC forum members, I was able to make my model more accurate, so I expect to be at least closer to reality this time.

As always, if you're on a PC, it will be easiest to follow along with this blog by opening these spreadsheets yourself:

This is the model I've created to estimate Tesla's automotive leasing financials. There is once again a little bit of a lack of data, because Tesla changed the way they report lease accounting at the start of 2018. But a year and a half of accurate data is not that bad.

As always, if you're on a PC, it will be easiest to follow along with this blog by opening these spreadsheets yourself:

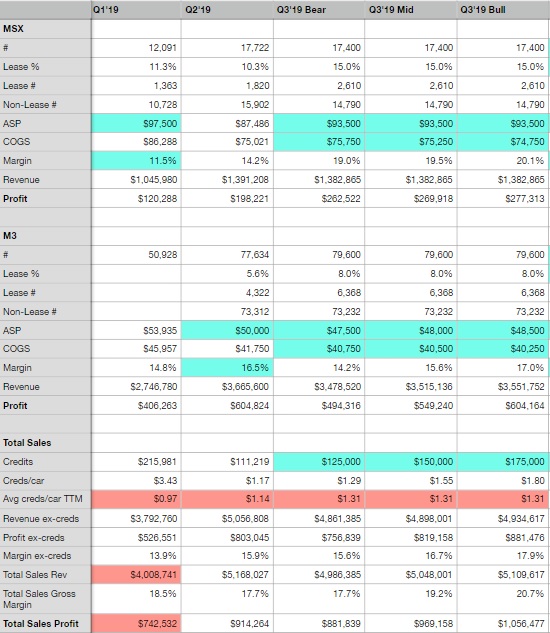

Q3'19 Earnings Forecast Automotive

|

| Automotive Sales |

- MS+X ASPs and Margins are very hard to estimate at the moment, because they've been so irregular as of late. Especially in Q2'19 the S+X had very low ASPs because Tesla got rid of its pre-Raven update S+X inventory at a discount. Therefore both ASPs and margins should trend up significantly in Q3, but exactly by how much is hard to guess.

- M3 should be easier. Tesla stated that M3 ASPs were very close to 50k in Q2, so considering there was a price cut of ~1k (more for performance version), and it was the first quarter with full volume M3 SR+ deliveries in EU, ASPs should be a bit lower than the 50k from Q2. I'm guessing ~48k. Margins should be a bit lower for the same reasons.

- In terms of credits, Tesla sold a particularly low amount in Q2. It's a pure guess exactly how much it will be in Q2, especially since they changed the way they report credit revenue at the start of this year, so we only have two quarters of data. But ~150M is what I went with.

|

| Automotive Leasing + Automotive Totals |

This is the model I've created to estimate Tesla's automotive leasing financials. There is once again a little bit of a lack of data, because Tesla changed the way they report lease accounting at the start of 2018. But a year and a half of accurate data is not that bad.

The way I've gone about this is to take the value of Tesla's operating lease vehicles from their balance sheet, which are the COGS (Cost of Goods Sold) minus depreciation of the cars that Tesla is leasing out. As I understand it, leasing revenue isn't just lease payments from the OLV (operating lease vehicles), and also includes the revenue from the sale of vehicles at the end of their leases. Nonetheless I think that looking at leasing revenue as a return on investment on the OLV Tesla owns, should give reasonably accurate estimations.

Before 2018 under the old lease accounting, Tesla had leasing revenue of about 0.075$ per 1$ of OLV on their balance sheet, but since 2018 it's been in between 0.1$ and 0.12$, and seems to average out at about 0.105$. Leasing margins can also fairly easily be estimated by looking at leasing margins from the past. It was in between 30% and 40% before 2018, and has been in between 40% and 50% since the new lease accounting was adopted in 2018.

So far so good, and so far it's pretty easy. However, estimating how the value of Tesla's OLV on its balance sheet will change over time is slightly more difficult. This model already includes leasing percentages and COGS, so it's straightforward to calculate the balance sheet value of the cars that are added to Tesla's OLV fleet each quarter. That just leaves estimating the value that Tesla's OLV fleet will lose each quarter due to leases ending and due to depreciation.

I've calculated this through an OLV depreciation percentage. Since the new lease accounting started in 2018, this has been in between 9% and 13%, with a one quarter exception of 17% in Q4'18. Leasing revenue was also particularly high that quarter, so I am guessing a lot of leases may have ended and may have been sold to customers that quarter. Until further data comes out, I'm going to guess this OLV depreciation percentage is going to be ~11%.

All of this adds up to ~240M$ in automotive leasing revenue, and close to 110M$ in automotive leasing profits. I can't be super confident in the accuracy of this model yet due to somewhat limited data, but I'm curious to see how accurate it is over time.

I expect total automotive revenue of ~5.2B$ - 5.35B$, and profits of ~1B$ - 1.15B$.

Q3'19 Earnings Forecast Income Statement

- I'm estimating Energy revenue and profits to be slightly higher than Q2 due to seasonality, just like last year.

- I expect services revenue and losses to continue increasing. It's hard to say exactly by how much though. In terms of services margins it'd be a pleasant surprise if Tesla has been able to slightly improve upon the -25%, but I'm not counting on it.

- I expect R&D expenses to go up slightly. R&D has recently been trending down due to restructurings and lay-offs, but Tesla is still aggressively hiring as we can see from their recent 'acquihire' of DeepScale.

- Some people in the TMC forums seem to expect that SG&A expenses will stay the same. This'd be an awesome surprise if true, but I feel like there has got to be some hiring and expansion due to the ongoing Gigafactory 3 ramp up.

All of this leads to a GAAP EPS of in between -2.21 and -1.23, meaning I'm expecting Tesla to at best break even if measured in non-GAAP.

There are some other things that could provide further upside such as an increase in FSD deferred revenue recognition, and of course positive comments during the conference call about Gigafactory 3, Model Y, Pick-up truck unveil, etc. But overall I'm guessing this quarter's earnings won't impact sentiment around Tesla that much. If anything moves it, I feel like it'll be good news from Giga 3/China.

There are some other things that could provide further upside such as an increase in FSD deferred revenue recognition, and of course positive comments during the conference call about Gigafactory 3, Model Y, Pick-up truck unveil, etc. But overall I'm guessing this quarter's earnings won't impact sentiment around Tesla that much. If anything moves it, I feel like it'll be good news from Giga 3/China.

Summary of my TSLA Q3'19 Earnings Forecast

- Automotive Revenue = 5.2B ~ 5.35B

- Automotive Sales Gross Margin Excluding Credits = 15.5% ~ 18%

- Automotive Sales Gross Margin Including Credits = 17.5% ~ 20.5%

- Total Revenue = 6.25B ~ 6.4B

- Gross Profit = 0.875B ~ 1.05B

- Income From Ops = -200M ~ 0M

- GAAP EPS = -2.25$ ~ -1.25$

- Non-GAAP EPS = -1.00$ ~ 0.00$

- Free Cash Flow = -150M ~ 50M

Ouch! I hope you learned that it's impossible to predict the short term with a high degree of accuracy.

ReplyDelete