Introduction

I had assumed that S&P 500 inclusion is a pretty well understood topic in

Tesla investment communities, but I've noticed quite a bit of confusion and a lot of misunderstandings, so I decided to write this post and do a deep dive into the topic.

Furthermore, although I believe that it's extremely hard to predict exactly

what will happen to the stock price and I mostly just plan to sit back, relax,

and watch the show, I am curious if I can make some estimations as to the

magnitude of the forces at play, and if those estimations can help me make a

more data based prediction as to what will happen to the stock price.

We'll find out the answers to these questions by the end of the post, but

first let's cover some prerequisite information necessary for full

understanding of this topic.

Table of Contents:

-

The S&P 500

-What is the S&P 500?

-How to get included

in the S&P 500

-What happens when a new stock is included in the

S&P 500

-S&P 500 quarterly rebalancing

-

S&P 500 Inclusion Case Studies

-Yahoo

-Twitter

-Facebook

-

TSLA's S&P 500 Inclusion

-The big factors in play during TSLA's

S&P 500 inclusion

-Simplifying S&P 500 inclusion to a supply

& demand issue

-An estimation of the make-up of TSLA

shareholders

-TSLA post-inclusion stock price prediction

1: The S&P 500

What is the S&P 500?

The S&P 500 is an index comprising 500 of the U.S.' largest stocks, just

like I could select 3 stocks, say TSLA, AAPL, and AMZN, group them together,

and call it the "Frank 3". Nobody would care about my index though, but the

S&P 500 is different. It's quite a big a deal according to

the official factsheet:

The S&P 500 is widely regarded as the best single gauge of large-cap

U.S. equities. There is over 11.2 trillion indexed or benchmarked to the

index, with indexed assets comprising approximately 80% of available

market capitalization.

The index is one of the factors in computation of the Conference Board

leading Economic Index, used to forecast the direction of the

economy.

This isn't just something somebody came up with in their basement. Vast

amounts of money track this prestigious index.

How to get included in the S&P 500

Universe. All constituents must be U.S.

companies.

Eligibility Market Cap. To be included, companies must have an

unadjusted market cap of USD 8.2 billion or greater.

Public Float. Companies must have a float market cap of at

least USD 4.1 billion.

Financial Viability. Companies must have positive as-reported

earnings over the most recent quarter, as well as over the most recent four

quarters (summed together).

Adequate Liquidity and Reasonable Price. Using composite

pricing and volume, the ratio of annual dollar value traded (defined as

average closing price over the period multiplied by historical volume) to

float-adjusted market capitalization should be at least 1.00, and the stock

should trade a minimum of 250,000 shares in each of the six months leading

up to the evaluation date.

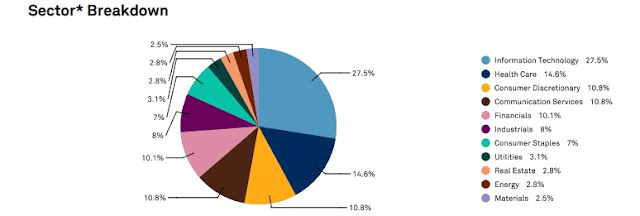

Sector Representation. Sector balance, as measured by a

comparison of each GICS sector's weight in an index with its weight in the

S&P Total Market index, in the relevant market capitalization range, is

also considered in the selection of companies for the indices.

Company Type. All eligible U.S. common equities listed on

eligible U.S. exchanges can be included. REITs are also eligible for

inclusion. Closed-end funds, ETFs, ADRs, ADS, and certain other types of

securities are ineligible for inclusion.

Tesla fulfills all but one of these requirements:

- Tesla is a U.S. company

- Tesla's market cap is well over $8.2B

- Tesla's float market cap is well over $4.1B

-

Tesla's annual dollar value traded is currently around $1.5T, so the ratio

to float adjusted market capitalization is around 7.0, and the lowest

number of shares traded in a month during the past 6 months was June with

volume of 256M shares.

-

Tesla is

considered "consumer discretionary"

by the GICS, which is the third largest sector represented in the S&P

500 at 10.8%. The largest sector is Information Technology at 27.5%.

- Tesla is a U.S. common equity.

The only requirement Tesla doesn't currently fulfill is the financial

viability requirement, because it has never shown TTM (Trailing Twelve Months) GAAP profitability.

Timing of Changes S&P 1500 Composite Indices. Changes to index

composition are made on an as-needed basis. There is no scheduled

reconstitution. Rather, changes in response to corporate actions and

market developments can be made at any time. Index additions and deletions

are announced with at least three business days advance notice. Less than

three business days' notice may be given at the discretion of the Index

Committee. Announcements are available to the public via our Web site,

www.spdji.com, before or at the same

time they are available to clients or the affected companies.

Announcements. Announcements of additions and deletions for the

S&P 500, S&P MidCap 400, and S&P SmallCap 600 are made at 05:15

PM Eastern Time. Press releases are posted on our Web site,

www.spdji.com, and are released to major

news services.

To summarize, if Tesla posts a profit this quarter and thereby shows TTM GAAP

profitability, it will fulfill all the requirements necessary to be included

in the S&P 500. It'll ultimately be up to the committee to actually

include TSLA, but considering their objective is to "track the market

performance of U.S. stocks trading on U.S. exchanges", it'd be very strange to

exclude the currently #13 largest U.S. stock, which at this rate will enter

the top 10 in another one or two trading days.

If you've been following the TSLA S&P 500 story, you might've heard

some people mention that the S&P committee has previously changed the

rules to target and exclude one very specific company, Snap. The S&P

changed the rules to exclude new companies with multiple share classes from

the index. Until now, I assumed that Snap had qualified for the S&P 500

and that because the committee did not want Snap in it for some reason, they

came up with this rule to specifically exclude Snap. However, the first thing

I found out when looking into this was that Snap never actually qualified for

the S&P 500:

Snap has only been profitable during one quarter in its history, which

by the way was after the S&P rule change, and it has never shown

TTM GAAP profitability, so it never qualified for the S&P 500 in the first

place. So what did happen?

According to

this CNBC article, Snap has different share classes. The Class A shares that are publicly

tradable on the NYSE, have no voting rights whatsoever, whereas Class B shares

are reserved for executives and pre-IPO investors and have one vote per share,

and Class C shares held exclusively by the two founders have ten votes per

share. This is similar to the Google classes of shares, but in the case of

Google the one vote per share shares are publicly tradable. Snap is different

from Berkshire Hathaway, which introduced two classes of shares primarily to

offer a cheaper way to invest in the company, because the Class A shares were

so expensive.

It really seems like the S&P rule change to exclude stocks with multiple

share classes going forward was primarily to signal their disapproval of this

type of corporate governance, in which founders hold on to an abnormal amount of

control of the company, and exclude post-IPO investors from having any input

in the company whatsoever. Although this example is occasionally brought up as

evidence why TSLA might not be included even if it fulfills the final

profitability requirement, I think it's extremely unlikely TSLA will not be

included once it shows TTM GAAP profitability.

What happens when a new stock is included in the S&P 500

There is over USD 11.2 trillion indexed or benchmarked to the index, with

indexed assets comprising approximately USD 4.6 trillion of this

total.

The S&P 500's total market cap at the time

was $25.64T,

which means that $4.6T / $25.64T = 17.9% of all publicly available shares of

S&P 500 companies were held by funds indexed to the S&P 500, and

($11.2T - $4.6T) / $25.64T = 25.7% of all publicly available shares of S&P

500 companies may have been held by funds benchmarked to the S&P 500 (more

on the difference between "indexed" and "benchmarked" soon).

It is important to note that the S&P 500 is weighted by float-adjusted

market capitalization. For Tesla, this means that shares held by Elon are

excluded from the market cap calculation on which TSLA's S&P 500 weighting

is based. Here's an example:

Say the S&P 500 only had 5 stocks: TSLA, AAPL, UBER, NVDA, and NFLX. These

companies currently (12th of July) have the following share prices, shares

outstanding, and public floats taken from

Marketwatch:

TSLA

SP: $1,545

Shares outstanding: 185M

Public float: 145M

AAPL

SP: $385

Shares

outstanding: 4,330M

Public float: 4,330M

UBER

SP: $33

Shares outstanding: 1,730M

Public float: 890M

NVDA

SP: $420

Shares outstanding: 615M

Public float: 590M

NFLX

SP: $550

Shares outstanding: 440M

Public float: 430M

The total market cap of the S&P 500 would in this case be calculated by

multiplying the stock price of each company with the number of shares in the

public float, and then adding them all together:

$1,545 * 145M + $385 * 4,330M + $33 * 890M + $420 * 590M + $550 * 430M = $2,4T

TSLA's weighting in the index would in this case be calculated as follows:

$1,545 * 145M / $2.4T = 9.3%

In this scenario, all funds indexed to the S&P 500 will have to keep 9.3%

of their assets invested in TSLA, and thus 9.3% of all assets indexed to the

S&P 500 will be invested in TSLA. Funds indexed to the S&P 500 are

passive funds, and have no leeway in this. If TSLA stock goes up a lot and

somehow becomes 15% or 20% of the S&P 500 index, these funds will then

have 15% or 20% of their total assets in TSLA.

Whereas funds indexed to the S&P 500 are passive funds and make no

investment decisions, funds benchmarked to the S&P 500 are actively

managed funds and do have freedom in what stocks they invest in. Being

benchmarked to the S&P 500 means that the fund's performance will be

compared to the performance of the S&P 500, and therefore the fund

manager will be praised for gains made compared to the S&P 500 and

blamed for losses made compared to the S&P 500.

I do not have experience working in the mutual funds industry, so I do not

know exactly how fund managers approach the fact that their performance will

be measured against the S&P 500, but I imagine that different funds and

fund managers have different approaches. I imagine that some funds are very

conservative, take the S&P 500 as their base, and only deviate from it

slightly where they think they can eek out slightly better returns. As a

results these funds behave quite similarly to S&P 500 index funds. However, I'd

imagine there are also funds that deviate from the index more, and even funds

that only use the S&P 500 as a benchmark, but basically have their own

unique investment strategy and philosophy.

Regardless, TSLA is a very large stock, and if it were to be added to the

S&P 500, it would make up around 1% of the entire index. Previously, fund

managers that were skeptical about TSLA or simply didn't know a lot about TSLA

could ignore it, but this is no longer the case. Even if a fund has its own

unique investment strategy, after TSLA is in the S&P 500, a 50% drop in

TSLA will mean a more than -0.5% loss to the index and a 100% gain in TSLA

will mean a more than 1% gain. The 20-year annualized average return of the

S&P 500 is currently 5.9%, so this matters quite a bit, and therefore at

the very least all fund managers, whose funds are benchmarked to the S&P

500, will have to take a serious look at TSLA and consider whether they think

it will under- or outperform the rest of the index. They can choose to not own

TSLA, but if that turns out to be a mistake, they will have to answer for it,

and be able to articulate why they thought it would underperform the index.

So to summarize, upon inclusion into the index, some of the $4.6T indexed to the

S&P 500 will for certain be liquidated, in order to buy 17.9% of TSLA's

146.36M shares float, which comes out to 26,198,440 shares.

Furthermore, an additional $6.6T benchmarked to the index will have to decide

whether to own 25.7% of TSLA's 146.36M shares float, which comes out to

37,614,520 shares. Some funds will allocate that exact amount to TSLA,

some bearish funds will decide to allocate less, and some bullish funds will

decide to allocate more. If the bearish and bullish benchmarked funds were to

even out, funds indexed and benchmarked to the S&P 500 could end up owning

a combined 63,812,960 shares.

Some actively managed

benchmarked funds are limited by what stocks they can invest in, and are not allowed to invest in stocks outside of the S&P 500, or are not allowed to hold stock of companies that are unprofitable. These funds are unable to buy TSLA until after Q2 ER,

assuming GAAP profits, or until after the official inclusion. However, other

funds are not bound by such rules and may have bought TSLA many years ago,

believing that it'd outperform the S&P 500 index, or months ago,

foreseeing that TSLA would be included in the S&P 500 soon.

As a result, it's hard to calculate the exact number of shares that funds will

buy throughout this whole S&P 500 inclusion event. It probably won't be

64M shares, because even if a lot of the benchmarked funds are bullish and

want to go overweight TSLA, a number of them likely have already owned TSLA

for a while. However, it'll be at least well north of 26M shares.

Another thing that is hard to know for sure is exactly when all this buying will

take place. According to

Rob Maurer's recent podcast on the S&P 500 topic, an insider told him that index funds can start buying a month prior to the

announcement and speculate on which companies will be added next, and can also

buy until a month after the announcement, but I'm not buying this.

The article that Rob refers to mentions that index fund portfolio managers have the freedom to spread

out their buying over a few days or a few weeks, but it only states that hedge

funds and speculators can speculate on which stocks will be added in the

future, not index funds.

A TMC poster also expressed a similar opinion, and quoted

the prospectus of the SPY, one of the largest S&P 500 index funds:

Specifically, the Trustee is required to adjust the composition of the

Portfolio whenever there is a change in the identity of any Index Security

(i.e., a substitution of one security for another) within three (3)

Business Days before or after the day on which the change is scheduled to

take effect.

My own conclusion is that index funds can probably start to buy around the

time of the announcement, and will try to buy most of the shares they need

within a few days after the inclusion happens. They might try to time some

of their buys in the weeks after inclusion for a better price, but doing so

for a majority of the shares they need, is extremely risky. Of course

speculators that plan to take advantage of buying concentrated around the

announcement and inclusion will try to take advantage of this and buy much

sooner, so in that way it does get spread out a bit more. And obviously a

lot of benchmarked funds will have more leeway and are allowed to speculate

on upcoming inclusions, and buy ahead of time, or well after the inclusion

happens.

S&P 500 quarterly rebalancing

Every quarter the S&P 500 is rebalanced. I've seen some people who think

this works as follows. If the S&P 500 consisted of the following four

stocks:

TSLA

SP: $100

Shares outstanding: 20

Public float: 10

Float-adjusted market cap: $1,000

AAPL

SP: $200

Shares outstanding: 20

Public float: 20

Float-adjusted market cap: $4,000

NFLX

SP: $10

Shares outstanding: 40

Public float: 30

Float-adjusted market cap: $300

AMZN

SP: $100

Shares outstanding: 60

Public float: 40

Float-adjusted market cap: $4,000

The S&P 500 total float-adjusted market cap would then be $1,000 + $4,000

+ $300 + $4,000 = $9,300.

I've seen some people who believe that TSLA's weighting would then be $1,000 /

$9,300 = 10.8%, and that a fund that managed $1,000, would free up $108 and

invest it in TSLA. Thus, if TSLA's stock price doubled to $200 the next day

before the fund could invest, it'd only buy $108 / $200 = 0.504 shares rather

than 1.08 shares.

If this were how it worked, a company, whose stock price doubled in between

two rebalancings, would see S&P 500 index funds sell off half of their

stakes in the stock, only to double their stakes once again after rebalancing,

because it wants to keep its $ value invested in TSLA the same. This would

create enormous, unnecessary market volatility. Alas, this is not how it

works. How it does work is as follows:

An S&P 500 index is created with 10 + 20 + 30 + 40 = 100 shares, and each

company receives its appropriate number of shares in this index. TSLA would

have 10 shares and 10% of the index. An index fund with AUM (Assets Under

Management) of $930, a tenth of the total S&P 500 index, would have to buy

10% of the index; they would have to buy 10 shares, 1 share in TSLA, 2 shares

in AAPL, 3 shares in NFLX, and 4 shares in AMZN. It doesn't matter whether the

price of those individual shares go up or down.

The reason that the S&P 500 does a rebalancing each quarter is because of

situations like this:

TSLA

SP: $100

Shares outstanding: 20 -> 30

Public float: 10 -> 20

Float-adjusted market cap: $1,000

TSLA did a public offering of 10 shares

AAPL

SP: $200

Shares outstanding: 20

Public float: 20

Float-adjusted market cap: $4,000

NFLX

SP: $10

Shares outstanding: 40

Public float: 30

Float-adjusted market cap: $300

AMZN

SP: $100

Shares outstanding: 60

Public float: 40 -> 30

Float-adjusted market cap: $4,000

AMZN did a share buyback of 10 shares

Now, the new S&P 500 index would still have 20 + 20 + 30 + 30 = 100

shares. However, TSLA would now be 20 shares and 20% of the index. A fund

with AUM of $930, would now have to own 2 TSLA shares, 2 AAPL shares, 3 NFLX

shares, and 3 AMZN shares.

In summary, S&P 500 quarterly rebalancing is mostly just to adjust for

changes to the public floats of companies. There are some other rebalancing

rules, but these rarely, if ever, come into play, and are along the lines of

"no more than 23% of the entire index can be in a single stock".

2: S&P 500 Inclusion Case Studies

For a lot of stocks, not that much happens when they are included in the

S&P 500. This is due to most stocks simply being moved from the S&P

400 mid cap index to the S&P 500 large cap index, because of an increase

in market cap. In this case, institutions can simply move shares from their

S&P 400 funds to their S&P 500 funds, and adjustments that have to

be made are relatively small.

However, sometimes a stock that was previously not in any of the S&P

indices is added to the S&P 500, because it previously did not qualify

based on one of the requirements, such as a lack of profitability. In this

case, the amount of shares that need to be bought, and the resulting affect

on the stock price are more profound.

Although as we'll later discuss no S&P 500 inclusion before has ever

quite been the same as TSLA's upcoming inclusion, to give some context as to

what might happen to TSLA stock price upon inclusion, let's first do a few

case studies of other companies that were included directly into the S&P

500, without being in any S&P indices previously.

Yahoo

Because of

this recent Yahoo! Finance article

that compared YHOO's S&P 500 inclusion to TSLA's upcoming inclusion, I

wanted to do a case study on YHOO's inclusion and see if we could learn

anything from it. However, I don't think much can be learned from it.

The biggest issue is the lack of available data. I have been unable to find

a more detailed YHOO stock chart than the one above, because YHOO was

acquired by Verizon in 2017. Furthermore, Google Search also isn't

particularly helpful, because I cannot even find a single news article

talking about YHOO's S&P 500 inclusion, let alone any speculation about

an upcoming inclusion ahead of the announcement. And most importantly,

although the CNBC article seems to suggest YHOO's inclusion was similar to

TSLA's, I can't even find out for sure whether YHOO was in the S&P 400

before being included in the S&P 500 or not.

Therefore, it seems like all we can learn from YHOO is:

- It was included in late 1999.

-

The stock shot up some amount, 64% in five trading days if the article

is to be believed, but this was around the time of the dot com bubble.

-

YHOO's market cap was large, but only ~0.5% of the S&P 500 at the

time, whereas TSLA will be around 1%.

-

YHOO's stock price completely crashed not long after inclusion... as

part of the dot com bubble bursting.

This doesn't give us much to go on when looking at TSLA.

Twitter

|

TWTR 2018

|

|

|

TWTR 23/4/18 - 30/6/18

|

|

|

NYSE 23/4/18 - 30/6/18

|

Twitter announced Q1'18 earnings on the 23rd of April 2018, the S&P

500 inclusion announcement happened on the 4th of June, and it was officially

included as of the 7th of June. I was unable to find any mentions to an

upcoming TWTR S&P 500 inclusion through Google Search in the first half of

2018 before the official announcement on the 4th of June, so it seems like it

mostly came as a surprise.

Looking at Twitter's profits at the time, it only barely made it in by

achieving $15M of TTM net income, and it was only Twitter's 2nd profitable

quarter ever, so I doubt many people were expecting TWTR's S&P 500

inclusion before Q1'18 ER was announced, but looking at how strong TWTR's

stock held up during bad macros during the last week of May, I would not be

surprised if a number of active funds were positioning themselves ahead of

what they knew would be TWTR's upcoming S&P 500 inclusion.

TWTR's total shares outstanding at the time were 766M. It's tough to find out

what its public float was at the time, but assuming the number of shares held by insiders

hasn't changed too much since then, it's likely its public float was

approximately 735M shares, giving TWTR a float-adjusted market cap of around

$22.1B at the time of the Q1'18 ER.

The S&P 500's market cap was ~$23T at the time, meaning TWTR made up about

0.1% of the S&P 500. I haven't been able to find out the exact amount of

money indexed and benchmarked to the S&P 500 at the time, but assuming

this has also not changed too much in the past two years, passive index funds

had to buy approximately 735M * 17.9% = 132M shares, and actively managed

funds had to own approximately 735M * 25.7% = 189M shares to be equalweight.

Starting a few days before the official S&P 500 inclusion announcement and

ending 1-2 weeks after, TWTR trading volume was much larger than usual. From

the 1st of June until the 15th of June, 567M shares were traded in 11 trading

sessions. It's hard to say exactly what percentage of trades are 'real trades'

where a share goes from one long investor to another. It probably depends on

the stock and the situation, but I think it's safe to say the majority of

trades are made by high frequency traders, market makers, day traders, etc.

Either way, it looks like there was enough volume to allow all of the index

funds to buy their 132M shares, and likely some active funds to add to their

positions as well. However, I reckon the vast majority of active funds already

positioned themselves ahead of inclusion. I don't think that 567M shares

traded during those 11 trading days allowed for over 300M shares worth of

buying by passive and active funds as part of the S&P 500 inclusion.

TWTR stock in total went up about 50% from Q1'18 ER to S&P 500 inclusion.

It seemed to hold on to its new valuation very well for some time in spite of

bad macros. Although, looking at the 2018 stock chart, you might think that

the S&P 500 inclusion's effect on the stock price was not permanent and

was undone late July, that'd be overlooking an important piece of information,

because on July 27th

Twitter announced Q2'18 earnings, a decline in monthly active users, and

gave very weak guidance. Without that, it seems quite possible that Twitter would've held onto its

higher post-inclusion valuation.

Facebook

|

FB July 2013 - June 2014

|

|

FB 29/10/13 - 31/12/13

|

|

|

NASDAQ 29/10/13 - 31/12/13

|

Although many people believe TWTR's S&P 500 inclusion is the best

comparison to TSLA's, I think FB is more similar in one particular way, namely

that its inclusion wasn't entirely unexpected. Although just like TWTR, TSLA's

last requirement it needs to fulfill to be eligible is profitability, unlike

TWTR it is not an unexpected inclusion, and some people have been talking

about it since at least late last year. This is similar to FB, whose last

requirement was that it

had to have been a publicly traded company for at least 6-12 months, and whose inclusion was also not totally unexpected.

This article

and

this article indicate that people were expecting FB to be included some time in the

near future as early as early 2013. FB's Q3'13 earnings were on October 30th,

the official inclusion announcement came on December 11th, and the inclusion

happened more than a week later after market close on December 20th.

FB's outstanding shares at the time were 1.87B, giving it a market cap of

$90-100B. Once again, I have not been able to find historical data for the

public float, but assuming the shares in the hands of insiders stayed about

the same since this period at 20M, FB's float-adjusted market cap was about

the same as its total market cap. It's interesting to note that Zuckerberg's

shares are considered part of the public float of FB.

The S&P 500's market cap at the time was ~$17T, meaning FB made up about

0.5% of the index upon inclusion. Once again assuming the amount of money

tracking the S&P 500 stayed about the same, because I can't find

historical data for this, means approximately 1.85B * 17.9% = 331M shares had

to be bought by index funds, and 1.85B * 25.7% = 475M shares had to be owned

by funds benchmarked to the index for them to be equalweight.

Interestingly, although FB trading volume was on the high side from the day

the inclusion was announced until the day after it was officially added, it

wasn't unusually high except for on the very day it was added. On that day

~240M shares traded hands, and on the 8 trading days following the

announcement 844M shares were traded. I'd imagine that there being such a

large gap between the announcement and actual inclusion allowed for the buying

to be more spread out. Volume of 884M, and maybe some additional volume in the

1-2 weeks after inclusion, might've allowed 331M shares to flow to index

funds, but only barely when you consider that the majority of trades are

usually attributable to day traders, high-frequency traders, market makers, etc.

I'd imagine that the vast majority of funds benchmarked to the S&P 500 had

already positioned themselves before the announcement. This was likely made

easier by the fact that FB was already a profitable company when it IPO'ed,

because I've heard TMC member ReflexFunds, who has written extensively about

TSLA's S&P 500 inclusion since late last year, mention that some funds

are only allowed to invest in profitable companies.

The reaction of FB's stock price to the S&P 500 inclusion was mild, but

still noticeable. FB stock was in a little bit of a slump during the 1-2

months before the inclusion,

due to some concerns over teenagers preferring alternative social

networks. However, from a week or so before the announcement until after the official

inclusion, FB stock rallied from ~$47.5 to ~$57.5 for an increase of about

20%. Although there was a small dip after to $55, it was temporary, and FB

being a growth company never saw its stock drop below these levels ever again.

3: TSLA's S&P 500 Inclusion

Although these case studies give some useful context when looking at what might

happen to TSLA upon its inclusion in the S&P 500, TSLA's inclusion is

unique and unprecedented in a number of ways. It's the largest ever in terms

of market cap, as well as when looking at what percentage of the index it will make up after inclusion. It's also unique in how large the option market

surrounding TSLA is, and in the extent to which delta hedging mechanisms are

affecting the stock. Last but certainly not least, it's unique in how

different people's opinions are on the true value of this stock.

The big factors in play during TSLA's S&P 500 inclusion

1) Passive index funds buying

We've calculated that the number of shares that will have to be bought by

passive index funds is approximately 17.9% of TSLA's 146.36M shares float,

which comes out to 26,198,440 shares. The only way this number

could turn out to be incorrect is if the dollar amount indexed to the S&P

500 as reported by the S&P is inaccurate. Barring that, ~26M shares will

100% have to be bought by index funds, mostly between the announcement and the

official inclusion, and perhaps a smaller amount in the weeks after inclusion.

2) Active benchmarked funds buying

We've calculated that the number of shares that active funds benchmarked to

the S&P 500 in order to be equalweight is 25.7% of TSLA's 146.36M shares

float, which comes out to 37,614,520 shares. This once again

assumes that the number reported by the S&P is accurate. It is more

difficult though to figure out what sort of buying pressure will stem from

this. I don't think I know enough to give a good estimation, but

I'll just share a few things I've looked into.

First of all, I've wondered about what it actually means when some of the big

institutional holders say they have millions of TSLA shares. Companies like

Vanguard and Blackrock for example, in addition to managing mutual funds and

index funds that hold shares in companies, they also claim to hold shares in

companies themselves. Looking at institutional ownership in

TSLA and

AAPL, Vanguard and Blackrock are

among the top institutional investors. Vanguard in particular is an investment

management company, not an investment company, and is

100% owned by its customers. So are the shares they report as such part of their asset management? Do

these shares actually belong to Vanguard's customers who asked Vanguard to

manage their assets? If so, is any of this benchmarked to the S&P 500? I'm

not sure.

The reason I looked into this is because if you add up

all the AAPL shares owned by mutual funds, you only get to about 800M shares, which is only about 16% of the AAPL float. Even if every single one of these funds used the S&P 500 as its

benchmark, that'd still mean that mutual funds as a whole are significantly

underweight AAPL. I'd say it's more likely that other, non-mutual funds assets

are also benchmarked to the S&P 500, perhaps some of the shares that are

reportedly held by companies such as Vanguard and Blackrock. When you add up

all the mutual funds invested in TSLA, it comes out to well over 30M shares, which is well over 20% of its float,

meaning more mutual funds hold TSLA than AAPL. Most of the TSLA funds are

growth funds, and unlikely to be indexed to the S&P 500, but still.

Another thing I've looked into is who uses the S&P 500 as their benchmark.

It appears that TSLA's largest investor, Baillie Gifford, does not use the

S&P 500 as its benchmark, but rather

MSCI indices. TSLA's second largest investor, Capital World Investors, also

seems to use MSCI

rather than the S&P. I haven't been able to find as much about benchmarks

used at companies like Blackrock and State Street Corp, and I could also

imagine that certain assets being benchmarked to an MSCI index doesn't completely rule out it also being benchmarked to the S&P 500 in some way,

and therefore being included in the S&P's statistics. Bigger numbers make

the S&P look better after all.

I realise that all this raises more questions than it answers, but I don't think I

have enough to make even a semi-accurate estimation to the number of TSLA

shares that active funds will buy as a result of S&P 500 inclusion. I'd

imagine there'll definitely be some amount of buying, but my guess is it'll be

less severe than the 26M shares that will have to be bought by index funds.

3) The large options market and resulting delta hedging mechanisms

I've written about this topic before a number of times, so if you want to

learn in-depth about how this works, I suggest you check out these two blog

posts:

The first post has a section explaining how delta hedging works, and the

second post dives into the TSLA options market and how insanely large it is.

To put it extremely simply, option buyers bet on the stock going in a certain

direction. In order for the market makers who sell these options to not lose

money when the stock moves in that direction, they have to buy shares as the

stock goes up, and sell shares as the stock goes down. This means that when

the stock goes up, more shares will be bought by market makers, further

amplifying the movement upwards. And when the stock goes down, shares

will be sold by market makers, further amplifying the movement downwards.

Basically, due to the large size of the TSLA options market, any stock

movement is amplified. Whereas a normal stock might move 2% on good news, TSLA

might move 5% or 6%.

With that being said, it does seem like the delta hedging mechanisms are

getting slightly less strong than they were before. Somebody on TMC shared

this a while

back, which keeps track of the delta hedging requirements of market makers. In

February and March, there were times when market makers had to buy/sell 15-20M

shares for a $100 price movement to stay delta neutral. Recently this number

has been hovering around 5M shares. A $100 price movement is a smaller

percentage movement now that the stock is trading at $1,500 than it was when

the stock was trading at $800 and $400 though, so the delta hedging still has

a fairly strong influence on stock price movements, but a little less than before. I believe the biggest

reason for the dampened effect is that a lot of the 2021 and 2022 LEAPs are

already deep ITM, so these options have minimal effect on delta hedging

requirements at the current share price.

The table also shows that market makers currently have to own ~40M TSLA shares

in order to be delta neutral, although these numbers are likely somewhat

smaller in reality, because the table is calculated based on all open

interest, even though market makers' true delta exposure is lower than that.

Regardless,

Citadel Securities LLC, a TSLA market maker, reported owning almost 8M shares as of the middle of

April. I wouldn't be surprised if at this point Citadel owns close to 15M TSLA

shares, and is forced to be the largest holder of TSLA shares just to stay delta neutral.

The effect all this has on S&P 500 inclusion is that any forced buying by

passive and active funds will lead to more buying by market makers in order to

stay deltra neutral. If the buying of 26M shares pushes the stock to $2,200,

perhaps market makers will have to buy another 10M shares and push the stock

price up further towards $2,500.

4) TSLA Price Targets

Piper Sandler: $2,322

JMP: $1,500

Credit Suisse: $1.400

Goldman Sachs: $1,300

Wedbush: $1,250

Jefferies: $1,200

Deutsche Bank: $1,000

Roth Capital: $750

Morgan Stanley: $740

Baird: $700

Royal Bank of Canada: $615

Bank of America: $485

Citi: $450

Cowen: $300

Barclays: $300

J.P. Morgan: $295

GLJ Research: $87

Even taking away the $87 target by the obvious bear troll and oil shill,

Gordon Johnson, the street's highest price target is about 8 times the lowest.

This excludes ARK's price target of $7,000 (with a $15,000 bull case), my own

target of ~$25,000 (bear case ~$8,000 and bull case ~$60,000), Ron Baron who

thinks Tesla will do $1T in revenue in 10 years, and the price targets of many

other bullish retail investors.

Although there are undoubtedly large investors who will happily take profits,

or even sell their entire position at $1,800 or $2,000, there are likely just

as many investors who will not sell anything below $5,000. This is not common,

and has undoubtedly contributed to the crazy run TSLA has been on over the

past 12 months. We'll get back to how this will influence the S&P 500 inclusion in

more detail later.

5) Speculators and traders

Lastly, we need to keep in mind that, as always, there will be speculators and

traders. These entities are always present, but more so when it comes to TSLA

because speculators/traders profit off of volatility, and TSLA is arguably the

most volatile stock in the market right now. The effect of speculators and

traders on TSLA will be further amplified with S&P 500 inclusion in play,

because not just are some able to speculate on and front-run the S&P 500

inclusion, volatility will also likely be much higher leading up to and during

the event. We'll talk more about how these entities will influence the stock price in the next section.

Simplifying S&P 500 inclusion to a supply & demand issue

I hope you're still with me, because this entire S&P 500 inclusion thing is admittedly pretty complicated. Fortunately enough, now it's time to simplify things,

because in essence a stock's price is determined by simple supply and demand.

At $1 per share everybody would want to own TSLA, and at $1,000,000 per share

probably nobody would. The current equilibrium stock price where supply of

~145M shares (ex-Elon) exactly matches demand of 145M shares is ~$1,500.

As we've discussed, S&P 500 inclusion will lead to additional demand for

TSLA of 26M+ shares at any price from index funds, and potentially more somewhat price-inelastic demand from benchmarked funds that want to be

equalweight TSLA. The 26M shares of demand at any share price from index funds

means that 26M shares worth of current TSLA investors will be able to ask any

price they want for these shares. The question thus becomes, at what stock

price are current investors willing to part with 26M+ shares? Will it be

$1,800? $2,000? $2,500? More? Another way in which I like to describe this is

as follows:

Imagine an ice cream truck just sold 145M ice creams to 145M children at

$1,500 a piece. Now imagine a school bus arriving with an additional 26M

children, who are so hot, sweaty, and hungry, that they will buy ice cream at

any price. The question now is at what price the 26 millionth kid will be

willing to sell his ice cream to one of the hungry sweaty kids.

In essence this is what S&P 500 inclusion is, but in reality two things

complicate this simple scenario. First of all, speculators and traders will

not only be buying up some shares before the actual inclusion (you can think of them as ice cream scalpers), they will also

be speculating on what the peak will be, because they all want to make maximum

profit. If a speculator buys up 100k shares, and in total speculators buy up

10M shares pre-inclusion, this 100k shares speculator would ideally wait until

investors sell 25.9M and the stock price peaks before selling off quickly

dumping his own 100k shares for max profit to the last index funds who need to

buy shares. With all speculators/traders trying to aim for this peak, it's

likely there will be some sort of drop off at some point after S&P 500

inclusion, but it's impossible to predict when this happens, and how large the

dip will be.

The second thing that complicates the simple scenario laid out is delta

hedging. Imagine that demand for TSLA stock drops by 26M at a stock price of

$2,500, allowing index funds to buy the shares they need. Due to the rise in

stock price, at this point market makers might also have scooped up an

additional 10M share to stay delta neutral, meaning that at $2,500 an

additional 10M shares still have to be bought. Perhaps investors are willing to

part with these for $2,850, but by then market makers will need more shares to

stay delta neutral, and perhaps that additional buying would further push up

the stock price to $3,000, before finally market makers are delta neutral and

index funds have been able to accumulate a total of 26M shares.

In summary, simple supply & demand dictates that the forced buying of 26M+

shares should drive up the stock price to some extent, further amplified by

the delta hedging mechanisms, as well as speculators/traders, who also spread

out the buying to some extent by front-running, but whether they're

front-running inclusion to the tune of 1M, 10M, or 20M+ shares, nobody knows

for sure. Last but not least, something not mentioned thus far is the fact that

TSLA short interest is still quite high, so additional short covering could

also add more fuel to the fire.

An estimation of the make-up of TSLA shareholders

According to this spreadsheet, which I shared in

my TSLA Holders blog post, the top 60 TSLA shareholders (ex-Elon) hold approximately 115M shares out

of the total 145M + ~20M (synthetic shorted shares) = 165M shares. All of the

data in this section is based on the end of Q1'20, which is the most recent

point in time from when we have accurate data of the make-up of TSLA

shareholders, due to the nature of 13F filings.

Furthermore, adding up all the shareholders in

fintel.io's list with 20,000 shares

or more gives another 22.5M shares or so, and I'd estimate that a little over

140M shares in total were held by institutions, index funds, and mutual funds

at the end of Q1'20. Furthermore, Citadel, which appears to be TSLA's biggest

market maker, held an additional ~7.5M shares as of that date. Meaning, there

were 165M - 140M - 7.5M = 17.5M shares unaccounted for, which

means they were most likely held by retail investors.

Lastly, let's further break down those 140M shares owned by institutions.

According to

this website, ETFs

own approximately 6.8M shares of TSLA. Let's round that up to 7.5M, and now we

get the following make-up of TSLA's shareholders:

Elon Musk: 40M

Institutions & Mutual Funds: 132.5M

ETFs: 7.5M

Citadel, TSLA Market Maker: 7.5M

Retail Investors: 17.5M

Total: 205M

However, the end of Q1 is more than three months ago. We know that short

interest declined to ~15M at the end of June, but that was when the stock

price was ~$1,000. I would guess short interest is around 12.5M right now.

Citadel also probably owns more like 12.5M shares for delta hedging purposes,

and I wouldn't be surprised if retail investors are closing in on 20M shares

if Robinhood sentiment of the last 3 months is anything to go by, because more

than 280k Robinhood users have added TSLA to their portfolio since the end of

Q1.

Therefore, I expect the make-up to look more like this today:

Elon Musk: 40M

Institutions & Mutual Funds: 117.5M

ETFs: 7.5M

Citadel, TSLA Market Maker: 12.5M

Retail Investors: 20M

Total: 197.5M

Shorts: -12.5M

TSLA post-inclusion stock price prediction

So now the core questions that need answers are:

-

At what price point are mostly institutions and to a smaller extent retail

investors willing to sell enough TSLA shares for index and benchmarked

funds to buy the shares they need (at least 26M+ shares)?

-

How many additional shares will market makers have to buy to stay delta

neutral during the rise in share price.

- How many shorts will cover?

Although I have been able to form a somewhat clearer picture than I had before I started writing this post, it sadly enough turns out to be impossible to give exact answers to these questions. However, one can get a

feel for this by looking at who the largest TSLA shareholders are. I wrote

a blog post with details on the ~60 largest shareholders last month, and some of them have recently made comments about TSLA:

The Baron partner fund has not sold any TSLA shares for the past three

quarters. Ron is highly unlikely to sell a single share before Tesla is

worth over a trillion dollars.

Baillie Gifford sold some shares in Q1'20 for the first time in two years.

Perhaps they took profits, perhaps it was COVID-19 related, but TSLA's biggest

shareholder is unlikely to sell a large number of shares given recent comments.

ARK is forced to take some profits as the stock price goes up, due to its

funds' limitations, but it only sells the minimum.

Although there are some less convincing bulls such as JP Morgan and Goldman

Sachs, and I could see various mutual funds focused on growth selling or

taking profits as TSLA enters the S&P 500, the vast majority of TSLA's

largest investors believed in this company 5+ years ago when it only produced

30-40k Model S vehicles per year, so their battle-hardened conviction at this point must be very strong. Take

Geode Capital

for example. Geode has held TSLA since the third quarter of 2013, and added

shares to its position every single quarter. So far Geode has never sold any

shares.

One last thing to consider is that TSLA isn't just any high growth stock. It's

legitimately going after multiple multi-trillion dollar markets, has no competition

to speak of, a 10+ year long proven track record of execution, and a leader

who lands rocket in the ocean. If there's any stock out there for which you

can defend very high valuation bull cases, it is TSLA. Presumably a lot of

investors would happily sell for $10,000 today, but even this could look like

a bargain in 10-15 years, so $2,000, $2,500, and even $3,000 could be a really

really really good bargain if one's investment horizon is long enough.

So there we have it. An investor base with an unusually high conviction, a ton

of buying pressure on the horizon, and mechanisms that will accelerate any

run-up in stock price. So what will TSLA stock price actually end up at post

S&P 500 inclusion? The obvious answer is: "I don't know and I can only

guess and tell you how I feel about it". So keep in mind that I could turn out

to be very wrong. There is too much missing data to attach a high conviction

to my prediction, and there are outside factors (macro-economics, COVID-19)

that could change things drastically.

With that being said, barring crazy macros, I reckon stock price will almost

certainly at least temporarily peak above $2,000 if TSLA is indeed included in

the S&P 500 in the upcoming weeks/months. I also think there's at least a

50-60% chance the stock will more-or-less be permanently revalued above

$2,000, especially considering I expect Q3 and Q4 to be very strong, so I think a pull back off of bad earnings in the second half of the year is unlikely.

I even think there's some chance (maybe ~10%) that TSLA will be permanently

revalued above $3,000 within a couple of weeks after inclusion. I also find it

very difficult to put a ceiling on where TSLA could go to. Although I think

it's quite unlikely, I'd be careful to completely rule out a crazy (probably

temporary) squeeze well in excess of $3,000 due to a shortage of shares,

perhaps to $4,000-5,000 or so. although I'm doubtful that a stock price that

high is sustainable at this point in time.

Conclusion

So in summary, if I had to guess, I'd put my money on TSLA's average stock

price being somewhere in between $2,000 and $3,000 in the weeks following

S&P 500 inclusion, unless macros take a turn for the worse.

Of course there's a pretty good chance I turn out to be wrong in some way,

however, I am highly confident that a different prediction of mine will turn

out to be correct: TSLA's S&P 500 inclusion will be extremely interesting and

exciting to follow. We're guaranteed some massive trading volumes, very large

price increases and probably decreases, and just an overall exciting show to

watch.

So to TSLA longs (especially the ones who don't own options) I say: sit back,

relax, and enjoy the show.

Great breakdown analysis.

ReplyDeleteThanks William!

DeleteGreat read! Thanks for putting in so much effort on the research. Really appreciate it, as with all your posts.

ReplyDeleteThank you! I'm happy to hear it was helpful to you.

DeleteNice and complete! Thanks Frank

ReplyDeleteThanks! You're welcome

DeleteWow! Exhaustive, detailed and hopefully prescient! well done. Thank you!

ReplyDeleteThank you for the praise, Raz!

DeleteWhat would you say to TSLA longs (especially the ones who DO own options)

ReplyDeletePay attention. It's extremely hard to predict a top, and even more so in this particular situation. Therefore, think about your strategy ahead of time. Do you want to deleverage at all at some point? If so, when? Is there anything that would change your mind? Basically just think ahead.

DeletePeople who don't hold options should probably just hold through whatever happens. Things like autonomy are definitely not priced in yet.

This analysis is quality. Thanks for putting this out. 👍

ReplyDeleteThanks Anuj! You're welcome.

DeleteWow, it blew my mind. Nice work! I love the ice cream analogy. While you mention short interest, I would add that on top of the 26M children wanting to buy, there are 14M children that might want to buy ice cream sooner rather than later because they have to return the ice cream they already ate. They already have to pay fees and margin, and the ice cream price will continue raising until most of them buy back.

ReplyDeleteThank you!

DeleteYou're right. The analogy was meant to simplify things, so left out a few details such as the short interest.

Let's wait and see how highly people value ice cream in the next few weeks/months :)

Great job!

ReplyDeleteThanks Steve!

DeleteGreat work

ReplyDeleteThank you!

DeleteGreat article thanks for writing. A whole lot of assumptions but then again assumptions I’d agree with ;-)

ReplyDeleteOne q as this may be me misinterpreting your analogy but you said ”The question now is at what price the 26 millionth kid will be willing to sell his ice cream to one of the hungry sweaty kids.” In my mind I’m thinking you meant to say “at what price will the 145M kids will be willing to sell”. Unless by millionTH you meant the 1st 26M who’d sell out of the 145M? Might me be misinterpreting but thought I’d ask. Thanks again 👍

Thanks Alesss!

DeleteI meant the latter. It'd be interesting to know what price all of the 145M are willing to sell, but what really matters for this S&P 500 inclusion, is what price 26M out of those 145M are willing to sell. And the eventual stock price is decided by the last sell, so the price of the 26Mth kid is what matters.

Great post, Frank! Question: when you say the eventual stock price is decided by the last sell, while don’t you expect it to stay there then? Because people change their minds and will sell at a lower price once they know the peak? And at what level do you predict it will eventually settle?

ReplyDeleteThanks, Mulder!

DeleteThat's a little bit of an oversimplification yes. That's how it'd work if there were only long term investors, but in reality there are always traders/speculators causing more price fluctuations.

Although the last week has been a bit lackluster, I still think it's pretty likely we'll end up settling above $2,000. If somehow not from S&P 500 inclusion, then very likely off of Q3/Q4 results. Of course things like bad macros could impact this negatively.

Frank,

ReplyDeleteThanks for an excellent post. In the last section, I'm reminded of epidemiologists who are fond of saying "All models are wrong, but some are useful". I think you've surpassed the useful threshold by covering the factors at play at an impressive level of detail. Thanks for all the work you put into this!

Jim Carroll

Thank you, Jim!!

DeleteGreat article thanks Frank. Does Tesla have multiple share classes with different voting rights tho? All I can see only is that there is common and preferred stock ie the logic that was used to exclude Snap will not apply to Tesla

ReplyDeleteThanks Allerdyce!

DeleteTesla does not have multiple share classes like Snap, Google, and Berkshire Hathaway, so it will indeed not be held back by the rule you're referring to.

However, I don't believe that rule was specifically targeted to exclude Snap. As I mentioned in this article, Snap has yet to qualify for the S&P 500, and I think the rule was put in place by the S&P to show their disapproval of an increasing number of companies choosing this kind of structure, and to exclude companies like Snap. I don't believe it was specifically targeted to exclude only Snap.

I have seen some speculation that the Index Funds have been buying TSLA already in preparation for the S&P inclusion. I find that hard to believe. I don't think they have free cash to purchase with. I assume they have to reduce some other holding to buy TSLA when time comes. What do you think?

ReplyDeleteThat's true. I do think there has been some positioning ahead of S&P 500 inclusion, but I don't think index funds have done so in a meaningful way.

DeleteWith that being said, I have seen 1 S&P 500 index fund prospectus (I believe Schwab's) that said they may ocassionally own funds that are not in the S&P 500 (yet). But even if that's the case, I still have a hard time seeing index funds own more than a small amount of stocks expected to enter the S&P 500 soon.

Respect! Great piece! I'm really curious how your analysis, if at all, have changed since 7/20, now that TSLA is finally getting included in S&P while trading at $405 (LC). Still think $2k to $3k? :)

ReplyDeleteBeing as this article was written pre 5 to 1 split, the $3K would now represent a $600 share or apx 50% increase. Of course this only accounts for S&P addition and not increased production of both vehicles and gigafactories, fruition of Autonomous driving, production of Cyber Truck, production of Semi Truck, production of $25K vehicle, Roadster production, solar roof and powerwall installations, Powerwall peaker plant production and possible possible battery sales to others. So S&P $600, completion of other aspects $2K to $3K, might be low ball #'s.

DeleteThanks Zaidi!

DeleteI think it's fairly safe to add at least $500 to those pre-split prices. I now think that, barring unforeseen other influences, S&P inclusion will likely bring $500+ (post-split), if not $600+. Something like $800 doesn't seem out of the question, at least temporarily, but everything will depend on supply & demand, and to what extent short-term speculators will be able to squeeze the index funds whom have to buy at any price.

rtbob99 is right I think, that $2k to $3k is looking low at this point in time as a post-split equilibrium.

How do you expect the feedback loop to influence the price? I am thinking that an increase in price will force funds to buy even more and that will then drive the price further etc infinitely.

DeleteIt doesn't quite work like that. Funds have to buy a certain number of shares. Every share they buy, means they have one share less to buy.

DeleteAs the stock price goes up, these shares become more expensive, so the funds will have to sell more other share to be able to afford the TSLA shares they need, but the number of TSLA shares they need to buy does not change as the stock price goes up.

Is it correct that if the index funds own 16% of S&P 500 they need to own 16% of each company regardless of its value?

DeleteYes, that's correct. But keep in mind the S&P 500 is based on float-adjusted market caps, so the index funds need to own 16% of the float of each company regardless of value.

DeleteThank you very much for the research and laying out this information in a easy to read language and format! This is an amazingly well done writing!

ReplyDeleteYou're welcome, AGV. Thank you!

DeleteLove the ice cream analogy

ReplyDeleteYeah, me too :)

DeleteExcellente!! Felt like reading an article that one saw future exactly few months earlier. Motley fool published about quintuple witching date matching to the inclusion date. Perhaps it is somewhat related to your touch point on delta neutral hedging. Thanks once again for the attention to detail.

ReplyDeleteGreat work!

ReplyDeleteThank you!

Delete