This is a follow-up to my previous S&P inclusion post:

This post is also, in a way, a continuation of my TSLA Holders series:

The model I am presenting in this blog post can be viewed and downloaded here:

The "S&P" tab is the model I am presenting in this blog post. The "#" tab is my TSLA Holders spreadsheet, in which I've been keeping track of Tesla's largest shareholders. The "%" tab is the same data in percentages. The "TSLA" tab has some miscellaneous data. The "S&P old version" tab is a primitive, old version of the model I am presenting in this blog post for the super curious, who want to take a look at how this prediction model came about.

Table of Contents:

1: Introduction

If you are only interested in Tesla as a company, you will likely be disappointed in this post. Tesla is very much on track to succeed in a big way over the next decade, but current stock movements have very little to do with that. FSD does have the potential to significantly move the stock, but my personal guess is that it will take quite a bit more time before the market realises Tesla's FSD and AMaaS (Autonomous Mobility as a Service) potential, even if the FSD software continues to improve rapidly.

Apart from FSD, most current and near-term Tesla developments should have very little influence on the stock price. A year ago, developments around the MiC M3 program might've been received slightly positively by the market, the first MiC MY deliveries will not move the stock. Even Tesla's very solid Q3 financials did absolutely nothing for the stock price. No, as of right now, Tesla's stock price is all about the S&P 500 inclusion. Buying pressure from the S&P 500 inclusion event will be so large that it overshadows all buying and selling pressure from minor, and even a lot of major, news events.

The morning after the S&P 500 inclusion announcement, I immediately bought some near-term TSLA call options (24Dec $500s and $600s), because based on everything I knew about:

- TSLA's loyal retail investors.

- The very high long-term price targets many of TSLA's long-term institutional investors are likely to have, because of Tesla's enormous potential.

- TSLA's humongous options market, 10x larger than any other, and the resulting delta hedging mechanisms, which take a large number of shares out of circulation.

I thought that TSLA would very likely rise enough over the next few weeks for those options to pay off.

During the following weekend (21st & 22nd), I felt like I wanted to approach things more scientifically. Although I knew about the aforementioned things, there were still a lot of assumptions that I was making about the S&P 500 inclusion. And the more assumptions are embedded in one's conclusions, even if these assumptions are each 90% or 95% likely to be accurate, the more likely those conclusions are to be incorrect in some way.

Therefore, I spent 15-16 hours non-stop on Monday the 23rd (Sunday night US time) working to create a model that estimates buying pressure as part of TSLA's S&P 500 inclusion, and at the same time estimates selling pressure as the stock price rises. I hoped to be able to use it to find a new equilibrium post-inclusion stock price, at which buying pressure from the inclusion and selling pressure from a rising stock price evened out.

I am happy to inform you that I have succeeded. Although there are still assumptions embedded within my model, and as always there are a number of ways in which it could fail and turn out to be inaccurate, I do believe it's turned out to be a very useful tool to interpret a lot of data, and make some estimations as to what will happen over the coming weeks. The purpose of this blog post is to share this model, and to explain it, because it is rather complex.

In this post, I will first discuss eight groups of the largest 80 or so current TSLA shareholders and a handful of soon-to-be TSLA investors, and explain how I've attempted to predict their behaviour over the coming weeks. At the end, there will be sections that explain how to use the model, and how I personally see things unfolding.

Lastly, here are a few links to blog posts from earlier this year, that are important to understand parts of this post. If you haven't read my in-depth breakdown of this entire S&P 500 ordeal yet, I suggest you read this post first:

Furthermore, parts of this blog may be difficult to understand if you don't understand TSLA's options market, and the accompanying delta hedging mechanisms. You can either skip over those parts, or read these posts for references and explanations:

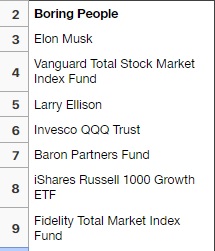

2: Boring people

Let's start easy. This first group, consisting of 'boring people', will do absolutely nothing over the next few weeks:

Elon is quite obvious.

Larry may be slightly less certain than Elon, but he's a Tesla board member, and I find it very unlikely he will sell off shares.

The two Total Stock Market Index Funds are ETFs that hold every single stock. They are 100% price inelastic and will not sell TSLA as a result of any run-up or move downwards.

The QQQ Trust is also a price-inelastic ETF. It follows the QQQ to the dot.

The iShares Growth ETF is a growth ETF. It only holds growth stocks, but it seems very passive, and its top holdings appear to be weighted exactly in accordance with their respective market caps:

|

| https://fintel.io/i/ishares-trust-ishares-russell-1000-growth-etf |

The Baron Partners Fund has held the exact same number of TSLA shares as far back as I've seen their SEC filings go (Q3'19), and judging from Ron Baron's CNBC appearances, I don't think his fund will be selling any shares any time soon. Most recently, he proclaimed that he wanted to buy more shares.

... or so I thought. When I wrote this about the Baron Partners Fund, it had not yet reported its Q3'20 holdings, but in the middle of writing this post it did, and it reported a reduction in its TSLA stake of ~8%. This is the first time that I know of that the fund made any change to its TSLA share-count, but the fund still has a staggering 40% of its assets invested in TSLA:

|

| https://fintel.io/i/baron-select-funds |

The main reason why I expect this was a one-time thing, and why I still expect the fund will most likely not sell any TSLA during the coming weeks, is because it does not seem to have deployed the assets it divested from TSLA anywhere else. If the fund had sold TSLA and invested the money in other stocks, I'd have had to assume there to be at least a chance the fund wanted to start to divest from TSLA, but because the funds were not deployed elsewhere, it makes me think it's most likely some partner cashed out (part of) its stake in the fund. So for the time being, unless this happens again, I assume Ron Baron and partners will continue to enjoy maximum TSLA profits.

3: Index funds that file 13F

Before we dive into this post further, it's important to better understand the breakdown of assets indexed and benchmarked to the S&P 500. Take this table from the S&P's official website:

|

https://spglobal.com/spdji/en/documents/index-news-and-announcements/spdji-indexed-asset-survey-2019.pdf

|

For the longest time, I couldn't figure out why the S&P said that over $4T in assets are indexed to the S&P 500, yet when I added up all the AUM of the S&P 500 index funds that file 13Fs and are listed on fintel.io, it would only amount to a little over $1T. The answer to this lies in the table above, because it turns out that less than $1T of the assets indexed to the S&P 500 belong to ETFs. Over 80% of the indexed assets come in the form of mutual funds, institutional funds, separately managed accounts, etc. It appears that most of these don't file 13Fs, which is why I couldn't find them before.

This "Index Funds Filing 13F" category consists of the S&P 500 index funds that file 13Fs. These are mostly ETFs (SPY), but there are also a few Mutual Funds mixed in (VFINX). Over 90% of this category is made up of simple index funds that will 100% go equal-weight TSLA upon inclusion.

A few of the tiny funds, making up a few percentage points, are S&P 500 growth ETFs. They are most likely benchmarked to the S&P 500, but just like the iShares Russell 1000 Growth ETF, these funds appear to have no leeway in their weightings, and appear to distribute their assets exactly in accordance with (float adjusted) market caps:

|

| https://fintel.io/i/vanguard-admiral-funds-vanguard-s-p-500-growth-index-fund-etf-shares |

In the model, I've assumed all funds in this group go equal-weight TSLA upon inclusion. Here is what this looks like:

There are more funds like this, but they are so small that they don't add much to the total number, nor the overall accuracy of the model. As is, this group will buy almost 39M shares of TSLA upon S&P 500 inclusion.

4: Index fund look-a-likes

So if the index funds that file 13F only account for $1.5T out of the currently $5T+ (SPY has gone up >10% since the $4.4T number was published) worth of assets supposedly indexed to the S&P 500, where is the other $3.5T? I've been wondering about this for some time now, but I think I may have finally found the answer.

The first clues are these:

Vanguard's holdings as of end of Q3'20

|

| https://fintel.io/i/vanguard-group |

MSFT to AAPL ratio: 4.33 / 4.91 = 0.88

V to AAPL ratio: 0.96 / 4.91 = 0.20

NVDA to AAPL ratio: 0.87 / 4.91 = 0.18

BABA to AAPL ratio: 0.61 / 4.91 = 0.12

TSLA to AAPL ratio: 0.61 / 4.91 = 0.12

Blackrock's holdings as of end of Q3'20

|

| https://fintel.io/i/blackrock |

MSFT to AAPL ratio: 4.01 / 4.57 = 0.88

V to AAPL ratio: 0.94 / 4.57 = 0.21

NVDA to AAPL ratio: 0.88 / 4.57 = 0.19

BABA to AAPL ratio: 0.97 / 4.57 = 0.21

TSLA to AAPL ratio: 0.60 / 4.57 = 0.13

State Street Corp's holdings as of end of Q3'20

|

| https://fintel.io/i/state-street |

MSFT to AAPL ratio: 4.44 / 5.32 = 0.83

V to AAPL ratio: 1.03 / 5.32 = 0.19

NVDA to AAPL ratio: 0.94 / 5.32 = 0.18

BABA to AAPL ratio: 0.75 / 5.32 = 0.14

TSLA to AAPL ratio: 0.46 / 5.32 = 0.09

Nuveen's holdings as of end of Q3'20

|

| https://fintel.io/i/nuveen-asset-management-llc |

MSFT to AAPL ratio: 4.54 / 4.99 = 0.91

V to AAPL ratio: 1.15 / 4.99 = 0.23

NVDA to AAPL ratio: 1.10 / 4.99 = 0.22

BABA to AAPL ratio: 0.65 / 4.99 = 0.13

TSLA to AAPL ratio: 0.87 / 4.99 = 0.17

Parametric's holdings as of end of Q3'20

|

| https://fintel.io/i/parametric-portfolio-associates-llc |

MSFT to AAPL ratio: 4.78 / 4.56 = 1.05

V to AAPL ratio: 0.94 / 4.56 = 0.21

NVDA to AAPL ratio: 0.72 / 4.56 = 0.16

BABA to AAPL ratio: 0.23 / 4.56 = 0.05

TSLA to AAPL ratio: 0.31 / 4.56 = 0.07

Float-adjusted market caps as of end of Q3'20:

AAPL = $115.81 * 16.99B = $1,968B

MSFT = $210.33 * 7.45B = $1,567B

V = $199.97 * 1.69B = $338B

NVDA = $541.22 * 593.04M = $321B

BABA = $293.98 * 2.7B = $794B

TSLA = $429.01 * 758.18M = $325B

Ratios of float-adjusted market caps as of end of Q3'20:

MSFT to AAPL ratio: $1,567B / $1,968B = 0.80

V to AAPL ratio: $338B / $1,968B = 0.17

NVDA to AAPL ratio: $321B / $1,968B = 0.16

BABA to AAPL ratio: $794B / $1,968B = 0.40

TSLA to AAPL ratio: $325B / $1,968B = 0.17

The first thing we can observe from this data is that a number of large institutional investors distribute assets across the biggest S&P 500 companies very similarly to S&P 500 index funds.

MSFT's weight in the S&P 500 index is 80% of AAPL's, and these large investors allocated to MSFT between 83% and 105% of what they've allocated to AAPL.

V's weight in the S&P 500 index is 17% of AAPL's, and these large investors allocated to V between 19% and 23% of what they've allocated to AAPL.

NVDA's weight in the S&P 500 index is 16% of AAPL's, and these large investors allocated to NVDA between 16% and 22% of what they've allocated to AAPL.

There are some exceptions. Nuveen, for example, has allocated a significantly smaller amount of assets than one would expect to JNJ. But for the most part these ratios are quite accurate among a fairly large number of large institutional investors. To me, this looks like a large number of the assets held by these investors are indexed to the S&P 500, probably in internal funds.

Vanguard's VOO is likely one of these index funds that is reported under the Vanguard Group Inc umbrella. It does not appear to file independently with the SEC, but it's an S&P 500 index fund with $175B in AUM. I'm not sure why some ETFs and Mutual Funds report to the SEC independently and others don't, but I am quite confident a lot of the assets reported by institutions like Vanguard, Blackrock, State Street, Nuveen, etc. are actually indexed to the S&P 500.

The second piece of evidence that supports this theory is the fact that these investors' allocations to non-S&P 500 stocks vary far more.

If BABA was in the S&P 500 index, its weight would be 40% of AAPL's. These large investors allocated to BABA between 5% and 21% of what they've allocated to AAPL.

If TSLA was in the S&P 500 index, its weight would be 17% of AAPL's. These large investors allocated to TSLA between 7% and 17% of what they've allocated to AAPL.

The third and final clue, which in my opinion makes it almost undeniable that part of these institutions' assets are indexed to the S&P 500, is this:

TWTR's Q2'18 Top Shareholders

|

| https://fintel.io/so/us/twtr?d=2018-06-30 |

Most of the institutions I just talked about significantly increased their stakes in TWTR during Q2'18, the quarter in which TWTR was included in the S&P 500. Nuveen is a notable exception and reduced its TWTR stake by 9%, but Vanguard increased its stake by 26%, Blackrock by 28%, State Street Corp by 100%, Northern Trust Corp by 42%, Bank of New York Mellon Corp by 69%, etc. These are the exact institutions that allocate assets to S&P 500 stocks very similarly to the stocks' weights in the S&P 500.

I've labeled this group of institutional investors "Index fund look-a-likes", because they look a lot, and seem to behave a lot like index funds. These aren't quite as clear cut as the previous group of index fund investors that will 100% go exactly equal-weight TSLA upon S&P inclusion, because some might end up overweight TSLA and some might end up underweight TSLA, but I think that assuming these investors will go equal-weight TSLA upon inclusion should turn out to be a reasonably close approximation.

However, calculating a TSLA equal-weight allocation for these institutions is a little bit more complicated, because these funds aren't index funds, and although the ratios between the S&P 500 stocks they own are similar, the portfolio allocations of these stocks are not the same as their weights in the S&P 500.

Therefore, I believe the best way to go about this is by assuming these institutions will end up owning TSLA in a similar ratio to other S&P 500 stocks. For this model, I've calculated the number of shares these institutions would have to buy/sell to go 'equal-weight' TSLA based on three different ratios to AAPL, NVDA, and MSFT. The "TSLA Demand" column shows the average of the three:

There are a few other institutional investors that also seem fairly similar to index funds, some of which manage a lot of assets, such as Price T Rowe, which manages almost $1T. However, I've not included them, because they just barely have enough anomalies to make me question whether they will really buy a significant amount of TSLA. Here is Price T Rowe as an example:

|

| https://fintel.io/i/price-t-rowe-associates-inc-md- |

PTR's (Price T Rowe's) top 6 or 7 holdings look innocent enough. PTR might be a little underweight AAPL, it's pretty much the top 6 S&P 500 stocks plus BABA. After this though, a couple of notable names are missing from PTR's top holdings:

- PTR only has 0.14% of its assets in BRK.B

- PTR only has 0.29% of its assets in JNJ

- PTR only has 0.13% of its assets in PG

PTR also does not have much invested in TSLA these days, only 0.11% of its assets. Upon inclusion this might change, but it might not. I'm not confident enough that PTR, and others like it, will go so far as to go equal-weight TSLA to put it in this "Index fund look-a-likes" group, but we will discuss what to do with these later.

There is one final thing I want to point out here. Looking at these institutions' collective AUM of $11.3T, and the predicted TSLA demand of 67M shares, one might conclude that previous calculations, that predicted ~130M shares will need to be bought by index funds, are incorrect, but this isn't necessarily true.

First, these institutions aren't index funds. AAPL's weight in the S&P 500 is over 6%, but most of these institutions only have 4.x% of their assets in AAPL. Bank of America, managing $700B, even only has 2.3% of its assets in AAPL. Clearly nowhere close to all of these $11T in assets are indexed to the S&P 500.

Furthermore, these institutions have held large stakes in TSLA for years. So these institutions are not just made up of assets indexed to the S&P 500, but also have loads of actively managed assets that have been bullish on TSLA for some time now. Some of these are undoubtedly benchmarked to the S&P 500, and some likely are not.

5: Market makers

To fully understand this section, one needs to understand how the options market and delta hedging work. If you want to fully understand this section, I recommend you read this post first:

However, an extremely simplified explanation of delta hedging is as follows.

Options markets are built on top of the equity markets, and allow investors of all kinds to trade in derivates for a variety of purposes. These markets are far less liquid than the equity markets, so market makers are even more important to provide liquidity. The vast, vast majority of options trades (my guess is 99.x%) have a market maker on one end of the trade.

No market maker is in the business of making directional bets. Market makers exist solely to provide liquidity, and they aim to make a profit off of the spread. In order to do this in the options market, without taking on directional bets, market makers hedge all their options positions by offsetting them against other assets. This is generally done through something called 'delta-hedging', by which market makers buy or sell the underlying stock to offset their options positions.

In essence, when a market participant buys an option from, or sells an option to, a market maker, that market maker will buy or sell a certain amount of the underlying stock, so that the market maker is indifferent to changes in the stock's price. As the stock price moves up and down, the amount of shares market makers need to be 'delta neutral' (indifferent to changes in stock price) changes constantly, so, to remain 'delta neutral', options market makers constantly buy and sell stock to 'delta-hedge' their positions.

TSLA's options market is large. So large in fact that it's

10x larger than any other options market. As a result, the amount of shares bought and sold by TSLA options market makers is also larger than the amount of shares traded by any other options market's market makers. But not just that, TSLA options market makers also take on monumentally large positions in TSLA in order to stay delta neutral. These positions are so large that I believe that, excluding Elon, Tesla's biggest and third biggest shareholders are likely TSLA's two largest options market makers.

|

| Susquehanna Securities and Citadel Securities are the two largest TSLA options market makers |

It's important to clarify that, although Susquehanna Securities is a TSLA options market maker, Susquehanna also has a non-market making entity, called Susquehanna International Group, which has traded in and out of TSLA over the past few years:

|

| https://fintel.io/so/us/tsla/susquehanna-international-group-llp |

And although Citadel Securities is a TSLA options market maker, Citadel also has a non-market making entity, called Citadel Advisors, which has also traded in and out of TSLA over the past few years:

|

| https://fintel.io/so/us/tsla/citadel-advisors-llc |

The way I've been able to estimate the number of TSLA shares Susquehanna's and Citadel's market making entities own is by making use of their 13G filings. They both disclosed 5%+ ownership stakes in TSLA in the past.

|

| https://fintel.io/doc/sec/1318605/000110465920013393/a20-6901_12sc13ga.htm |

Susquehanna Securities disclosed owning 12,134,541 TSLA shares on Dec 31st of 2019.

|

| https://fintel.io/doc/sec/1307720/000110465920050982/tm2016845d1_sc13g.htm |

Citadel Securities disclosed owning 7,864,059 TSLA shares on Apr 16th of 2020.

One more data point I've used is 'total delta hedge inventory' needed by TSLA options market makers to be delta neutral. You can calculate this by looking at all options OI (open interest) data.

@Generalenthu (Twitter and TMC) computes this data daily, and shares it in these tables:

|

| https://tsla-oi.s3.amazonaws.com/index.html |

The column in red shows the total delta hedge inventory TSLA options market makers need to be delta neutral at those specific points in time. These numbers assume that TSLA options market makers are short 100% of options OI and that they delta hedge their positions 100% at all times, which in reality is unlikely to be true. Although these market makers are likely short the vast majority of options OI, they do take on small long positions in options, when a market participant sells a CALL or PUT, and when a market participant enters into an options spread position.

Exactly what percentage of this 'total delta hedge inventory' number TSLA options market makers actually own in TSLA stock is anybody's guess, but my guess is it is highly likely between 60% and 95%, and probably somewhere between 70% and 90%. I say this because of the following calculations:

Although generalenthu's table only calculates TDHI (total delta hedge inventory) back to May 27th of this year, he has data going back to February of this year, and he shared with me the data for April 16th, the day on which Citadel Securities reported its exact TSLA share ownership. On that day, the TDHI number was 33,489,627, and Citadel reported TSLA holdings of 7,864,059 shares, meaning that on that specific day Citadel Securities delta hedged 7,864,059 / 33,489,627 = 23.5% of the TDHI.

Generalenthu does not have data to compare to the 13G filed by Susquehanna on the 31st of December 2019, but fortunately there are two TMC posts from

@ReflexFunds (Twitter and TMC) that can help us out:

|

| https://teslamotorsclub.com/tmc/posts/4303153/ |

In this TMC post from December 17th 2019, ReflexFunds calculated TDHI to be 32.6M shares at that time. Ignore the 4.0 million long from convert hedges, this has to do with the call options Tesla bought on its own stock in a private deal with banks.

|

| https://teslamotorsclub.com/tmc/posts/4454709/ |

In this TMC post from February of this year, ReflexFunds calculated TDHI to be 38.3M shares on January 31st.

Although I don't know of anyone who has the exact data from December 31st 2019, my guess is that the number was likely somewhere in between the 32.6M ReflexFunds calculated for Dec 17th and the 38.3M he calculated for Jan 31st. If one assumes the number was at 35M on December 31st, this would mean that on that specific day Susquehanna Securities delta hedged 12,134,541 / 35,000,000 = 34.7% of the TDHI.

Today, these percentages (23.5% and 34.7%) should be reasonably similar, unless market participants in the TSLA options market are currently taking on a significantly higher percentage of short option positions than when Citadel and Susquehanna reported their 13Gs, which I don't think is likely. There are likely other TSLA options market makers, besides Susquehanna and Citadel, who aren't large enough to have acquired 5%+ stakes in TSLA, and who therefore haven't had to disclose their stakes through 13G filings. So, considering that Citadel and Susquehanna combined already delta hedge 23.5% + 34.7% = 58.2% of TSLA's TDHI, I would say that the percentage of TSLA's TDHI that is delta hedged by all market makers is highly likely to be somewhere between 60% and 95%, and probably somewhere between 70% and 90%.

In case it's not obvious yet, the reason I am talking about this "market makers" group is because, as the stock price goes up, market makers are forced to buy large quantities of TSLA shares in order to remain delta neutral. At the end of Q3'20 on September 30th, the TDHI number was at 189,781,318, according to Generalenthu's data. As of market close on November 25th, this number stood at 226,812,796, meaning that Susquehanna and Citadel were likely net buyers of TSLA over the past two months, to the tune of (226,812,796 - 189,781,318) * 58.2% = 21,552,320 TSLA shares!! If all TSLA market makers combined delta hedge 70% of the TDHI number, you can add another 4,369,714 TSLA shares to that number, for total buying pressure from TSLA market makers of almost 26M shares already in Q4.

These are huge numbers, so it should be clear that delta hedging mechanisms and the shares taken out of circulation during an S&P run-up should be taken into consideration when modelling out buying pressure and selling pressure from various institutions. As mentioned, the TDHI stood at 189,781,318 as of the end of Q3. On Monday the 23rd when the TDHI was 191,217,406, Generalenthu shared with me that, given current options OI, the TDHI would be as follows at various stock prices:

- $600: 191,217,406 + 41,015,572 = 232,232,978

- $700: 191,217,406 + 59,748,333 = 250,965,739

- $800: 191,217,406 + 70,196,605 = 261,414,011

- $900: 191,217,406 + 76,276,857 = 267,494,263

- $1,000: 191,217,406 + 79,832,525 = 271,049,931

However, as of Thanksgiving Thursday, the current TDHI stands at 226,812,796, and the TDHIs for various stock prices have also shifted quite a bit:

- $700: 226,812,796 + 43,224,014 = 270,036,810

- $800: 226,812,796 + 58,531,490 = 285,344,286

- $900: 226,812,796 + 67,385,619 = 294,198,415

- $1,000: 226,812,796 + 72,660,666 = 299,473,462

- $1,100: 226,812,796 + 75,802,316 = 302,615,112

So the options market is constantly in motion, and the TDHI at various stock prices also changes constantly. The TDHI effectively signals what the options market is speculating on. So when the TSLA options market makes more and more bullish bets, these numbers will go up, and when the TSLA options market makes more bearish bets, and/or take bullish bets off the table, these numbers will go down. Options market makers simply buy and sell stock to hedge their risk, approximately in accordance with the TDHI number.

One footnote that must be made is that weekly expirations are also included in these numbers, and the OI for the weeklies rises throughout the week, so that is part of why the TDHIs above have gone up so much between Monday and Thanksgiving Thursday, but it is also quite likely that the market has made more bullish TSLA options bets.

So how do we use all of this data to predict how TSLA options market makers will act throughout S&P 500 inclusion? It's impossible to know exactly, because the options market is constantly shifting. If, when the stock price reaches $700, a huge options whale decides to offload $5B worth of TSLA options, unless he uses the proceeds to buy TSLA shares, the DTHI will dip, the market maker on the other side of his trade will sell shares to keep itself delta neutral, and the stock will dip. However, for the time being it seems like the options market is continuing to make bullish TSLA bets, so it might be a while before options owners start cashing in.

We'll talk in more detail about how to exactly use this entire model in the final section of this post, but it allows you to customize a few numbers, including the amount of shares you expect the DTHI to increase by compared to the end of Q3. It then assumes that Susquehanna and Citadel continue to delta hedge the same percentage as when they filed their 13Gs, and it allows you to customize the percentage of the DTHI you guess is delta hedged by other, smaller market makers. With inputs of a DTHI increase of 80M shares, and "percentage delta hedged by other MMs" at 10% for a total percentage of 58.2% + 10% = 68.2%, the result looks like this:

Just like the "Index fund look-a-likes" section, this part of the model isn't a "these shares will 100% be bought and taken out of circulation" type of number, like the number from the "Index funds that file 13F" section. But I do think that it is quite likely that TSLA options makers will have been net buyers of at least 54.5M TSLA shares, at least at some point during the next four weeks.

6: TSLA haters

Although TSLA haters is a bit of a strong word, I guarantee you that a few of the investors in this group will sell off 100% of their TSLA stake upon inclusion, and the others are likely to sell most or all of their shares.

The two TSLA shareholders in this group that will definitely sell off their entire TSLA stakes are "Vanguard Extended Market Index Fund" and "Fidelity Extended Market Index Fund". Both of these investors' portfolios look something like this:

|

| https://fintel.io/i/fidelity-concord-street-trust-fidelity-extended-market-index-fund |

Note that, excluding its cash position, FSMAX (Fidelity Extended Market Index Fund)'s largest position is TSLA at 6.2% of its portfolio, and its second largest position is SQ at 0.92% of its portfolio. In case you haven't realised what's going on here yet, here are the descriptions for each fund:

This fund offers investors a low-cost way to gain broad exposure to U.S. mid- and small-capitalization stocks in one fund. The fund invests in about 3,000 stocks, which span many different industries and account for about one-fourth of the market-cap of the U.S. stock market. One of the fund’s risks is its full exposure to the mid- and small-cap markets, which tend to be more volatile than the large-cap market. The fund is considered a complement to Vanguard 500 Index Fund. Together they provide exposure to the entire U.S. equity market.

The Dow Jones U.S. Completion Total Stock Market Index is an unmanaged index that represents all U.S. equity issues with readily available prices, excluding components of the S&P 500.

These index funds only hold stocks that are not in the S&P 500, so they will both sell their entire TSLA stake upon inclusion.

The other three TSLA shareholders that I've put into this category are:

- Jane Street Group, LLC

- D.E. Shaw & Co

- Discovery Value Fund

The Discovery Value Fund appears to belong to Price Waterhouse Coopers in Singapore:

|

| https://sec.report/CIK/0001750451 |

|

| https://sgpgrid.com/company-details/pricewaterhousecoopers-singapore-pte-ltd |

Each of these three TSLA shareholders has heavily traded around its TSLA position:

|

| https://fintel.io/so/us/tsla/discovery-value-fund |

|

| https://fintel.io/so/us/tsla/d-e-shaw |

|

| https://fintel.io/so/us/tsla/jane-street-group-llc |

Because of this, I think there is a good chance that these institutions will sell most, and perhaps even all, of their TSLA shares during a large run-up. Therefore, my model projects these shareholders to sell 100% of their TSLA shares during the inclusion:

7: Current TSLA sellers

The model assumes that, as the stock price runs-up, this group of shareholders will sell shares of TSLA, so that the percentage of their AUM in TSLA stays the exact same.

Important note: The selling pressure numbers in the "TSLA Demand" column, in this table and the ones from the next two sections, are calculated off of a certain input stock price, for which you want the model to calculate buying and selling pressure. I'll walk you through how to use the model in a later section, but for now it's important to note that these numbers vary depending on what stock price you put into the model.

ARK and Baillie Gifford are the best examples of this group, and are likely to follow this strategy very closely. Both ARK and Baillie Gifford are known to be massive TSLA bulls, but they both have limits on how large a percentage of their assets they can have invested in a single stock. For both ARK and Baillie this appears to be around 10%.

ARK Investment LLC comprises all the assets of all of ARK's funds, some of which do not hold TSLA, so the "% of AUM in TSLA" in this table for ARK is slightly below 10%.

Although it's unlikely that the other shareholders will follow this strategy quite as closely as ARK and Baillie, I've nonetheless put them in this group for the following reasons:

Vanguard International Growth Fund and JP Morgan Large Cap Growth Fund

TSLA is now the second largest position for both of these funds, and their % of AUM in TSLA is very close to that of their largest holdings. Furthermore, they both sold off a significant amount of their TSLA position in Q3'20. This signals that TSLA continues to be one of their highest conviction investments at this level, but it also means they don't want it to become an overly large percentage of their assets, and/or that they might have internal rules that prohibit single stocks from becoming too large a position. I think it's most likely that both these funds will continue to trim their TSLA stakes, so that it stays among their top holdings.

Nikko Asset Management Americas Inc and Whale Rock Capital Management LLC

Nikko is extremely similar to the two funds discussed above, in that TSLA has also reached what appears to be the limit of how much of the fund can be invested in any single stock holding. Looking at Nikko's history when it comes to TSLA, it appears extremely likely that this is exactly what's happening:

|

| https://fintel.io/so/us/tsla/nikko-asset-management-americas |

During the past five quarters, Nikko has consistently sold between 25% and 30% of its TSLA stake, in order to stop it from going too much above 5% of Nikko's total AUM. It seems likely that this will continue, and therefore I am confident in putting Nikko in this group.

Whale Rock seems very similar to Nikko, and really looks like it sold off the exact amount of TSLA it needed to to keep it below 5% of AUM in Q3.

Growth Fund of America, New Perspective Fund, and American Funds Insurance Series

All these funds are managed by CWI (Capital World Investors), Tesla's single largest shareholder (excl. Elon and Susquehanna Securities maker maker). This means that altogether CWI controlled 103,122,911 TSLA shares as of the end of Q3, which is 13.7% of the entire TSLA float. To say that CWI will play a very large role in TSLA's S&P 500 inclusion would be an understatement. CWI itself is in the next group of investors, but because understanding this investor is such important context to determining what will happen with these three funds it manages, here is a brief section with additional info on CWI.

Capital World Investors

|

| https://fintel.io/i/capital-world-investors |

As you can see, CWI first invested in TSLA in Q2'13, probably after Tesla's fantastic Q1'13 financial results. It then significantly added to the position during the second half of 2014, slightly increased and decreased its position throughout 2015 and 2016, and held almost exactly 3M shares throughout 2017.

Unlike Baillie Gifford, CWI appears to have never publicly commented on Tesla, but I did find this very interesting short clip from December of 2016, in which Craig Beacock, Vice President of CWI since 2007, comments on how AEVs (Autonomous EVs) will destroy oil growth.

|

| https://www.linkedin.com/in/craigbeacock/ |

The first 35 seconds of the clip are particularly interesting, because Craig makes it clear that, even back in 2016, he had a very deep understanding of what the future transportation market would look like. The two comments that really emphasize this to me are:

- "Most, if not all, autonomous cars will be electric."

- "Most autonomous cars will be managed in fleets. They're not going to be individually owned, they're going to be owned by, maybe it's Google, maybe it's Uber, maybe it's some yet unnamed company."

These things may be obvious today, especially to TSLA investors, but these comments were made four years ago, and Craig spoke these words with strong conviction.

The most interesting part about CWI's investment history in TSLA starts in 2018. This was the crisis year, at the start of which Tesla was struggling to ramp Model 3 production, FUD was rampant, and Elon lashed out at analysts during the first quarter's earnings call. In spite of all this, CWI doubled its TSLA stake during the first half of 2018. And even though the third quarter of 2018 was filled with drama from the Thai cave rescue and "funding secured" tweet, CWI had almost tripled its stake by the end of 2018.

To top it all off, CWI added another 1M (5M post-split) shares during the first half of 2019, in which TSLA sank to multi-year lows, and during which some of TSLA's biggest shareholders, Price T. Rowe and Fidelity, sold off 50% and 80% of their TSLA shares. CWI continued to add some shares in the quarters after, but in Q2 and Q3 of 2020 it slightly reduced its stake by 0.3% and 2.5%.

All in all, CWI appears to be one of Tesla's biggest bulls right now.

Back to the three funds CWI manages

As for the American Funds Insurance Series fund, I was already confident it belonged in this group when I started writing this blog, when it had not reported its Q3 holdings yet. Now that it has reported its Q3 holdings exactly in line with what I was expecting (trim to keep below 10% of AUM), I am even more confident that it will continue to do this going forward.

Although New Perspective Fund's TSLA position is less at 6.49% of its AUM, and in spite of it not selling any TSLA during Q3, I am nonetheless putting it in this category and assuming it will not let its TSLA stake grow any further, because its second largest position is so much smaller than its TSLA position at only 3.40% of its AUM. It seems like it doesn't have a 5% single stock allocation limit, and it certainly could be that the fund manager is comfortable letting TSLA increase to 10% of AUM, but in order to be a little more conservative, I've put it in this group.

As for Growth Fund of America, its largest holdings are:

|

| https://fintel.io/i/growth-fund-of-america-growth-fund-of-america-class-a |

Considering this fund increased its TSLA share-count by almost 4% in Q3'20, I'm actually going to assume the fund manager will let TSLA run up to 10% of AUM, and therefore I am putting it in the next group instead of this one.

Gilder Gagnon Howe & Co LLC

The last two are the most tricky ones. GGH (Gilder Gagnon Howe) has been a loyal and steady TSLA shareholder over the years, rarely making more than 20% adjustments to its stake:

|

| https://fintel.io/so/us/tsla/gilder-gagnon-howe-co-llc |

However, this is what GGH's portfolio currently looks like:

|

| https://fintel.io/i/gilder-gagnon-howe-co-llc |

TSLA is far and away its largest position.

Now, on one hand, GGH may simply be very bullish on TSLA, and be fine with TSLA making up a larger percentage of its AUM. It had ample opportunity to reduce its TSLA position in Q3, but only decided to sell 11.4% of it. GGH may be content with having six, or more, percent of its assets in TSLA.

On the other hand, it's totally possible that GGH made a short-term exception for TSLA, and usually does not allow a position to grow (much) above 3% of its AUM. If this is the case, it's likely that it'll significantly cut its TSLA position during any inclusion run-up.

We have no way of knowing for sure how GGH will play the inclusion, but I've decided to put it in this group and assume that it's more likely than not to keep 5% or 6% of its AUM in TSLA.

Ilmarinen Mutual Pension Insurance

This is the trickiest one:

|

| https://fintel.io/i/ilmarinen-mutual-pension-insurance |

|

| https://fintel.io/i/ilmarinen-mutual-pension-insurance |

Most signs point towards Ilmarinen probably holding onto a lot of its TSLA stake during a run-up:

- It's a pension fund, not a hedge fund. It's unlikely to buy a position in one quarter, only to sell it in the next.

- It doesn't seem to trade its large positions (MSFT, GOOGL).

- It only just bought TSLA in Q3'20. It must've thought TSLA was undervalued at $400 and $500.

However, TSLA is IMPI's largest single stock position at 5.89% of AUM, with #2 being MSFT at only 2.32% of AUM. This is rather strange, and makes me think it's more likely IMPI could divest from TSLA during a large run-up.

In the end, I've decided that the three points above outweigh this one point, so I've put it in this group, and the model assumes Ilmarinen will keep the % of its AUM in TSLA the same during an inclusion run-up.

8: Potential TSLA sellers

This group is similar to the previous "Current TSLA sellers" group, in that I've assumed that every investor in this group has an 'allocation limit' for individual stocks. Therefore, the model assumes that these shareholders will sell TSLA when it goes above this limit, to the extent that it does not exceed the limit.

About some of the shareholders in this group I believe it's very likely they will behave similar to this, or perhaps even are comfortable to let TSLA run up above the limit somewhat. However, there are also a number of, mostly smaller, shareholders that I am less confident about. After all, you never know when a fund manager decides TSLA is overvalued and decides to sell most, or all, of its position.

To determine whether an investor belongs in this group, I've looked at a number of factors, including but not limited to: history of its TSLA stake, change to its TSLA position in Q3'20, and change to its non-TSLA positions in Q3'20. I'll quickly go over each shareholder in this group, explain why I believe it belongs in this group, and explain what I believe its allocation limit for TSLA is. It'd be useful to keep the model close as you read this, because there are a number of useful statistics in it about each shareholder:

Capital World Investors

We've already gone over CWI in detail in the previous section. I think it's certainly possible that CWI is bullish enough to let TSLA run-up to 6%, 7%, or maybe even 10% of its AUM, especially because all three mutual funds it manages have >5% of their AUM in TSLA. If CWI does let TSLA run up over 5%, then boy... we'll be in for a hell of a squeeze, but I think it's safer to assume CWI will keep TSLA at around 5% of its portfolio, similar to its second largest holding, MSFT.

Growth Fund of America

We also already went over this fund managed by CWI in the last section, where I mentioned that I believe it is most likely to let TSLA run up to 10% of its AUM.

Jennison Associates LLC

Jennison has been one of TSLA's biggest bulls since the early days:

|

| https://fintel.io/so/us/tsla/jennison-associates-llc |

I think Jennison is likely very similar to CWI, in that it's possible it's so bullish on TSLA that it'll let TSLA run up to 10% of its AUM, but I think it's safer to assume it will keep it under 7%, nearer to its largest and third largest holdings, AMZN and AAPL.

Bamco Inc

I didn't know before, but I just found out that Bamco Inc is the name of Ron Baron's company. I did know that the "Baron Partners Fund" belonged to him (and his partners), but I never realised Bamco Inc was the legal name of his firm.

Considering this, it's no surprise that Bamco sold less than 1% of its TSLA shares between Q4'18 and Q2'20. Similar to the Baron Partners Fund though, it sold off a little under 10% in Q3'20.

Bamco has 9.64% of its AUM in TSLA, while Bamco's second largest holding is CSGP at 5.22%. I was going to say that Bamco's allocation limit for TSLA is most likely 10%, but that there's a real chance that it might reduce its stake more in line with its other holdings to 5%, but now that I know Bamco is owned by Ron Baron, I'd say it's very likely that Bamco will keep its stake at at least 10% for the foreseeable future, and that there is some chance it'll let it grow well above 10%, like the Baron Partners Fund. I think the only question is whether Bamco's internal rules allow it to do so.

Either way, in the model I've assumed Bamco will sell TSLA to keep its AUM in TSLA at 10%

Harbor Capital Appreciation Fund

We don't have this fund's Q3'20 data yet. If this fund did not sell any TSLA during Q3'20, allocation at the end of the quarter was just under 10%. Considering its second largest holding is AMZN at 8.32%, I think it's a reasonable assumption that the fund will keep TSLA at 10%.

Vanguard Growth Index Fund

Similar story here. TSLA is at 1.94% allocation, whereas its #1 holding is AAPL at 10.81%. This fund kept its TSLA stake effectively the same in Q3, so I think it's safe to assume it'll let it run for now, up to a maximum of 10%, although this wouldn't be reached until a TSLA stock price of ~$2,000.

Primecap Management Co

Although this shareholder selling 19.9% of its TSLA shares in Q3'20 could indicate it doesn't want its TSLA allocation to grow, it has a solid, long-term TSLA investment track record, and it reduced its stake not just in TSLA, but in about 85% of its top holdings, during Q3'20:

|

| https://fintel.io/i/primecap-management-co-ca- |

This makes it more likely that its 19.9% sale in TSLA had less to do with its stance towards TSLA, and more to do with fund dynamics. Perhaps a sizeable amount of money was pulled out from the fund, or something along those lines. I think it's reasonable to assume that Primecap will let its TSLA allocation run up for the time being, to a maximum of 5%.

Sumitomo Mitsui Trust

Same story as Primecap:

|

| https://fintel.io/i/sumitomo-mitsui-trust-holdings |

Although Sumitomo sold TSLA, it sold a small percentage of nearly all of its holdings. Considering TSLA is still a relatively small portion of its portfolio, and considering that (minus BRK) Sumitomo is very similar to the "Index fund look-a-like" category, I think it's safe to put Sumitomo in this group, and assume it'll let its TSLA allocation run up to 5%.

Fidelity Blue Chip Growth Fund

We also don't have data about Q3 from this fund yet. I think this fund will most likely sell small amounts of TSLA and let its TSLA allocation increase at the same time. I think it should probably be in between this and the previous category, but for simplicity's sake I've put it in this one. I expect this to be slightly too optimistic.

Coatue Management LLC

This shareholder doubled its TSLA stake in Q3. Considering its #1 holding is PYPL at 7.01% of AUM, I think it's likely this investor's single stock limit is 10%, so this is what I've put in the model.

UBS Asset management Americas Inc

I think this investor just barely does not qualify for the "Index fund look-a-likes" group:

|

| https://fintel.io/i/ubs-asset-management-americas |

BRK is missing, and it's quite underweight GOOGL, JNJ, NFLX, and probably others. It's also somewhat underweight TSLA. I expect that UBS will let its TSLA stake at least run-up towards its allocation limit, which appears like it might be 5% or 6%. But it's also entirely possible that UBS will be a small net buyer of TSLA during the S&P inclusion process.

Wells Fargo & Company

Wells Fargo has kept its TSLA stake quite steady over the past two years, it's quite underweight TSLA, and when one subtracts the ETFs from its portfolio, it also looks quite a bit like an "Index fund look-alike":

|

| https://fintel.io/i/wells-fargo-company-mn |

It's very possible that Wells Fargo will be a net buyer, like UBS, but the safe thing to do is to assume it'll simply let TSLA run up until an assumed allocation limit of 2.5%.

You might wonder why I chose an assumed limit here (and in some other places) below the % of AUM this investor has in its largest holding. That is because, just like ARK occasionally lets TSLA run slightly above 10% in its funds, it seems to me other investors do this too. Wells Fargo's actual allocation limit could be 3%, or 5%, but I think 2.5% is the safe assumption to make here. In this case it doesn't matter much though, because TSLA would only reach this limit at a stock price of ~$3,000.

Vanguard Primecap Fund

This fund also reduced its stake in not just TSLA, but most of its holdings, during Q3:

|

| https://fintel.io/i/vanguard-chester-funds-vanguard-primecap-fund-investor-shares |

Therefore, I think that the 5.3% reduction to its TSLA share-count during Q3 was likely coincidental, so I've assumed this fund will let TSLA run up to an allocation maximum of 5%.

Morgan Stanley

Morgan Stanley slightly increased its TSLA share-count in Q3, is underweight TSLA, and TLSA is nowhere near its top holdings, so I think it belongs in this group.

Allianz Asset Management

Allianz has been a significant buyer of TSLA during the two most recent quarters, but doesn't look like an index fund, so I think it's best to put it in this group.

Barclays Plc

Barclays has added 25% to its TSLA share-count this year. I think this is the best category to put it in. I must say though that it is slightly overweight TSLA compared to some of the other banks, so it's possible it could trim TSLA before it reaches the assumed allocation limit.

California Public Employees Retirement System

A not insignificant buyer of TSLA during recent quarters:

|

| https://fintel.io/so/us/tsla/california-public-employees-retirement-system |

I think it's most likely this shareholder will let its TSLA stake appreciate for the time being.

APG Asset Management N.V.

Not too dissimilar from the "Index fund look-a-likes":

|

| https://fintel.io/i/apg-asset-management |

If one also takes this investor's very steady track record as a TSLA investor into consideration, I think it's clear it belongs in this group.

Royal Bank of Canada

This bank is significantly underweight TSLA, and it added 60% to its TSLA share-count in Q3, so I think there could very well be more buying to come at inclusion time, but the conservative thing to do is put it in this category.

Vanguard Capital Opportunity Fund

Although this fund sold far more of TSLA than of its other holdings during Q3, it did reduce its stake in most of its holdings. My intuition says it's willing to let its TSLA portfolio allocation increase slightly further from here.

9: The misfits

The investors in this final group just don't quite fit into any of the other groups. This group contains investors that kind of look like an index fund, but are too overweight/underweight a few stocks to just assume they'll go equal-weight TSLA. This group also contains banks that look like they're overweight TSLA, so I find it too optimistic to assume they'll just let their TSLA stake run-up without selling, even though their % of AUM in TSLA is still quite low. And this group also contains a couple of other investors that just need a little bit of special treatment in terms of modelling their behaviour. For the investors in this group, the model assumes that, in addition to a single stock allocation limit, they will either increase or decrease their TSLA share-count by some percentage during the S&P 500 inclusion.

Fidelity

|

| https://fintel.io/i/fmr-llc |

Fidelity is one of the world's largest money managers, and it resembles the index fund look-a-likes quite a lot. So much so that I wouldn't blame somebody for wanting to put it in that group for modeling purposes. Even I initially put Fidelity in the "Index fund look-a-likes" group, but I've changed my mind, because Fidelity is clearly over- and underweight a number of stocks. It's significantly underweight names like BRK, JNJ, and PG, and it's significantly overweight stocks such as NVDA, CRM, and REGN.

Furthermore, Fidelity sold off a whopping 33.7% of its TSLA stake in Q3. One would assume Fidelity wouldn't have been so stupid as to sell off these shares if it needed them when TSLA is included in the S&P 500, but Fidelity owned 25M (pre-split) shares of TSLA a few years ago, and it was stupid enough to sell off 80% of these before TSLA went on the run of a lifetime, so I wouldn't put this type of screw-up past Fidelity.

My guess is that part of Fidelity's assets are indexed to the S&P 500, and another part is benchmarked to it. I think it's more likely than not that Fidelity will be a net buyer of TSLA throughout the inclusion, but I also think it's more likely than not that they will still end up underweight.

The model predicts that Fidelity will increase its TSLA share-count by 20%, and then lets it run up to an assumed maximum of 5%.

Goldman Sachs Group Inc

|

| https://fintel.io/i/goldman-sachs-group |

GS is somewhat the opposite of Fidelity, in that it is currently overweight TSLA. Moreover, a rollercoaster has nothing on Goldman's history as a TSLA shareholder:

|

| https://fintel.io/so/us/tsla/goldman-sachs-group |

GS did add 18.6% to its TSLA position in Q3, but I'm nonetheless quite nervous about the future of GS's TSLA position, and I think the Q3 increase might've just been an S&P inclusion play. I've therefore modelled that GS will reduce its TSLA share-count by 60% during the inclusion, and after that keep it below 2% of AUM.

JP Morgan Chase & Co

|

| https://fintel.io/i/jpmorgan-chase- |

Compared to other banks, JPM is also overweight TSLA, but not as overweight as it is MA, TXN, NEE, and various other stocks.

|

| https://fintel.io/so/us/tsla/jpmorgan-chase- |

It also doesn't have the smoothest history of TSLA ownership, but not quite as rollercoaster-like as Goldman, and it's been a lot more steady over the past twelve months.

This is honestly a very tough one, and this is almost guess work. I've gone with a sale of 25% of its stake and an allocation limit of 2%.

Citigroup Inc

|

| https://fintel.io/i/citigroup |

This is another tough one to guess. Citi is also a bank that speculates on loads of options, and that is somewhat overweight TSLA compared to other big names.

It also has this very shaky track record as a TSLA shareholder:

|

| https://fintel.io/so/us/tsla/citigroup |

I've therefore assumed something similar to Goldman Sachs, and modeled that Citi will sell 60% during the inclusion.

Fidelity Growth Company Fund

|

| https://fintel.io/i/fidelity-mt-vernon-street-trust-fidelity-growth-company-fund |

On one hand, it looks like TSLA has significant runway within this fund, but on the other hand the fund sold off 23.2% of its TSLA stake during Q3'20. I don't see any reason why TSLA can't be among this fund's top holdings, but I also think it's possible the fund will sell off bits and pieces as the stock runs up, so I've modelled in a sale of 20% upon inclusion.

Deutsche Bank

|

| https://fintel.io/i/deutsche-bank-ag- |

Deutsche Bank is clearly too dissimilar from the "Index fund look-a-likes" to put in the same category, but it's not totally dissimilar.

DB is underweight TSLA compared to some of its holdings, but equal-weight and overweight compared to others. If not for the fact that DB has traded around its TSLA position in the past, I'd have modelled DB to keep its TSLA share-count the same throughout inclusion, but because it's frequently bought and sold TSLA in the past, and because it has sold TSLA in recent quarters, I'm expecting DB will sell part of its TSLA stake during S&P inclusion and run-up.

Price T Rowe

|

| https://fintel.io/i/price-t-rowe-associates-inc-md- |

PTR (Price T Rowe) is very similar to Fidelity. It's also one of the world's biggest asset managers with total AUM of almost $1T. It is also, just like Fidelity, similar to the "Index fund look-a-likes", but not quite similar enough to be included in that category. And finally, also just like Fidelity, it is

significantly underweight TSLA.

The argument against PTR buying a lot of TSLA during inclusion is that it's just as underweight BRK and PG, and almost as underweight JNJ, as it is TSLA. The main argument for PTR buying a lot of TSLA is that it was one of the biggest buyers during TWTR's S&P 500 inclusion:

|

| https://fintel.io/so/us/twtr?d=2018-06-30 |

PTR almost quadrupled its TWTR stake during Q2'18, and I think this argument weighs a little heavier, so I'm modelling PTR tripling its TSLA stake during S&P inclusion, which would still leave it significantly underweight TSLA. For PTR to go equal-weight TSLA compared to AAPL would require it to 5x its position, and to go equal-weight TSLA compared to AMZN would require it to ~14x its position.

American Century Companies Inc

|

| https://fintel.io/i/american-century-companies |

This shareholder appears to have quite a reasonable TSLA allocation, especially compared to some of its overweight investments (MA, V, CRM, TXM, etc.). However, it also reduced its TSLA stake by 50% so far this year, 40% of which came during Q1, and 10% of which came during the most recent Q3. I think there's a very real possibility it'll continue to lower its TSLA weighting, so I'm modelling that American Century Companies will sell off 25% of its stake during inclusion.

Fidelity OTC Portfolio

We don't know this fund's Q3 movements yet. It's a very new TSLA investor:

These were its top holdings as of the end of Q2:

|

| https://fintel.io/i/fidelity-securities-fund-fidelity-otc-portfolio |

On one hand, TSLA definitely has room to run up within this fund's portfolio, because it has around 40% of its portfolio allocated to its top 5 investments, none of which are TSLA. It's also quite likely this fund further reduced its TSLA stake in Q3.

However, it's overweight TSLA compared to most of its investments, and it was a seller during Q2, so to err on the side of caution, I'm assuming it'll sell off 25% of its Q2 share-count (likely more of its currently unknown Q3 share-count) during inclusion.

Ultra Fund

This fund is very similar to Fidelity's OTC Portfolio, and we also don't know this fund's Q3 holdings yet. TSLA is nowhere near this fund's top holding yet, but it's been selling steady chunks of its TSLA shares, between 20% and 25%, for the past year:

|

| https://fintel.io/so/us/tsla/american-century-mutual-funds-inc-ultra-fund-investor-class |

Therefore, I've made the same assumption for Ultra Fund as I did for Fidelity's OTC Portfolio. I've assumed that it'll sell off 25% of its Q2 share-count (likely more of its currently unknown Q3 share-count) during inclusion.

This fund is managed by American Century Companies Inc.

Stock Account Class R1

|

| https://fintel.io/i/college-retirement-equities-fund-stock-account-class-r1 |

This fund looks like it's at least benchmarked to the S&P 500, because it's holdings are fairly similar to it. It's pretty close to equal-weight TSLA compared to AAPL, MSFT, V, and NVDA.

It was a big buyer of TSLA in Q4'19 and Q1'20, but a small seller in Q2'20 and Q3'20. I've modelled a reduction in this fund's TSLA share-count of 20%, which I think would be very conservative at a stock price of $600, but probably too bullish at a stock price of $1,000.

Credit Suisse

CS looks quite similar to a lot of the banks from earlier in this section (JPM, Citigroup, Deutsche Bank). Minus some options positions, some ETFS, and a few heavily overweight stocks, it looks somewhat like an index fund look-a-like:

|

| https://fintel.io/i/credit-suisse-ag- |

It looks fairly equal-weight TSLA at the moment, however, its history as a TSLA shareholder is the definition of a rollercoaster:

|

| https://fintel.io/so/us/tsla/credit-suisse-ag- |

Furthermore, it decreased its TSLA stake by about 50% in Q3. Credit Suisse's current TSLA share-count is almost at its lowest level since mid-2015 (after accounting for the split). One could make an argument that CS is currently more or less equal-weight TSLA, and that the rollercoaster peaks were simply CS making a short-term bet on TSLA by going heavily overweight. In this case, perhaps CS's TSLA share-count will not go much lower than it is now. This is just a theory though, and by no means fact.

In the end, I decided to model CS reducing its TSLA stake by another 20%, which would bring it to a level only seen a few times, in mid-2015 and mid-2014.

BNP Paribas Arbitrage

|

| https://fintel.io/so/us/tsla/bnp-paribas-arbitrage |

BNP is quite overweight TSLA compared to some of its other top holdings, and it has heavily traded around its TSLA position almost every single quarter. So, although BNP already reduced its share-count a fair bit in the two most recent quarters, I wouldn't be surprised to see them cut it further. I've modelled a 50% reduction, which would put BNP's TSLA share at its second lowest point since BNP first bought TSLA, and at its lowest point since Q2'14.

Mitsubishi UFJ Trust & Banking Corp

|

| https://fintel.io/i/mitsubishi-ufj-trust-banking |

This Japanese bank may be overweight TSLA, it's not nearly as overweight TSLA as it is other stocks, such as NEE, JD, and D. It seems totally plausible that it'll remain overweight TSLA throughout the S&P inclusion and any accompanying stock price run-up. However, it sold 15% of its TSLA shares in both Q1 and Q2, and a staggering 40% in Q3, so I've modelled in a 40% reduction in its TSLA share count, which would mean it'll still be slightly overweight TSLA compared to AAPL and MSFT. This is likely too conservative for a stock price of $600, but it feels pretty accurate if TSLA shoots up to $800-900 or so.

HSBC Holdings Plc

|

| https://fintel.io/i/hsbc-holdings |

|

| https://fintel.io/so/us/tsla/hsbc-holdings |

HSBC seems like a toned down version of some of the other banks we saw earlier. It looks slightly more like an "Index fund look-a-like" than the likes of Citigroup and Goldman, and it has traded around its TSLA position less, although it has nonetheless frequently increased and decreased its share-count.

For all of 2019 and 2020, HSBC has been a large buyer of TSLA, except for Q3'20, during which it reduced its share-count by 16%. It's currently slightly overweight TSLA, so I've modelled, what I believe to be a reasonable, 25% reduction in HSBC's TSLA share-count.

Fidelity Advisor Growth Opportunities Fund

This fund sold TSLA in Q3 in spite of using cash to buy more shares in 90% of its holdings:

|

| https://fintel.io/i/fidelity-advisor-series-i-fidelity-advisor-growth-opportunities-fund-class-a |

It's also pretty overweight TSLA (although not just TSLA), and it sold quite a large chunk of its TSLA shares in Q3 (34%). If TSLA runs up, I'd expect this to continue, so I've modelled a reduction of 35% in this fund's TSLA shares.

Growth Account Class R1

This fund looks very similar to the previously discussed Stock Account Class R1, and it's managed by

the same company. The only difference is that it sold TSLA more aggressively in Q3, to the tune of almost 40% of its holdings, so I've modelled in a large sell-off for this fund during the inclusion as well. It's only a little overweight TSLA though, and much more overweight names like NVDA and INTU, so my -40% could turn out to be too conservative of a projection.

JPMorgan Growth Advantage Fund

This fund is quite overweight TSLA, but it could very well stay that way because it's a growth fund. It's also more overweight a few other stocks than it is TSLA. It has reduced its TSLA share-count by 10%, 10%, and 20% respectively in the past three quarters, so I think modelling a 30% reduction during S&P inclusion is very much on the conservative side. I've also kept the TSLA allocation limit conservative at 5% of AUM, so the model predicts the fund will sell more TSLA if the stock price runs up to above $850 or so.

10: The prediction model

First, let's do a quick recap of the eight groups we've talked about.

Overview of the eight groups

- Boring people. These current shareholders will not sell anything no matter what. Maybe there's a small chance Larry Ellison or the Baron Partners Fund will sell some shares, but for the most part these investors are 100% neither buying nor selling.

- Index funds that file 13F. These are the index funds that will clearly go equal-weight TSLA. This category is also pretty much set-in-stone, and I doubt reality will deviate more than a few percentage points from this prediction.

- Index fund look-a-likes. These institutions that look a lot like index funds should also follow the model fairly closely, because I excluded any institutions that had too many anomalies from this category. However, I'd expect reality to differ slightly more from the prediction for this category than the previous one, but not by a large amount.

- Market makers. Although I'm pretty confident that the 58.2% of TDHI number for Susquehanna + Citadel will prove to be reasonably accurate, the "% delta hedged by other MMs" is more of a guess, and the model allows you to input your own. Another factor here is the constantly changing TDHI. The TSLA demand from MMs is not constant, but it is an important factor to pay attention too when looking at TSLA's S&P 500 inclusion.

- TSLA haters. This is also a fairly straightforward category. The three speculators may not quite sell 100% of their shares, so this number will likely turn out to be a little bit too bearish, but the assumption that all investors in this category will sell 100% of their TSLA shares should prove to be fairly accurate.

- Current TSLA sellers. This is the group of investors whom I've projected will keep their % of AUM in TSLA exactly the same. This is where we're staring to get more into the realm of estimations. Some within this group will likely behave very similar to the model's projections, but probably at least one will deviate from it. How exactly CWI manages its two funds in this category could also have a big impact on the number.

- Potential TSLA sellers. I've projected that these investors will let their TSLA positions appreciate for now, but that they will starting selling once their positions reach their assumed allocation limits, in order to keep them below that limits. I think these are also pretty reasonable projections to go off of, especially because we have a good idea of whom the biggest investors in this group are. However, if Jennison and/or CWI decide to let their TSLA stakes run further than I've anticipated, these numbers could turn out to be far too bearish.

- The misfits. These are the investors that are too hard to place into any other category, so in addition to assuming a single stock allocation limit, we've also assumed they will either increase or decrease their TSLA stake by some percentage during the S&P inclusion. This category is for sure the most error prone. A few of the estimations in this category are even almost guesses. The only saving grace is that these are, for the most part, somewhat smaller investors, so inaccuracies in this category are likely to have less of an overall impact on the model than inaccuracies in other categories.

Before I explain to you how to use this model, let me address a concern some of you will undoubtedly have at this point, which is the absence of retail investors.

I have not included retail investors, because there are too many difficult assumptions one has to make, in order to estimate how retail investors as a whole will play the S&P inclusion. The first one of these is the total number of shares owned by retails. My guess is around 100M, but this is a guess that could easily be off by 30%+. This is in contrast to all of the other investors in this model, of whom we either know the exact share count, or have a pretty good approximation (market makers).

Second, we don't know how retail investors' ownership has changed in the past, and assumptions made as to how current retail investors will play the inclusion are also quite difficult and error-prone. Lastly, although it's unlikely to be a huge amount, we also don't know how many new retail investors will decide to jump aboard the TSLA rocket during inclusion, and add to total retail ownership.

So because of all of this, and because TSLA retail investors are unlikely to play too big a role during the next two weeks, I've omitted them from this model. However, I'd assume that if TSLA were to get really squeezy, say $1,000+, that retails will start selling in some fashion, so it's likely that at least a couple of million shares could be freed up from retails. Everybody has a selling point after all.

How to use the prediction model

And now we've finally arrived at where we can talk about about how to actually use this mega complicated model. I hope you're still with me!

As mentioned, the model calculates buying pressure and selling pressure from the most influential actors during TSLA's S&P 500 inclusion. The buying pressure is relatively constant regardless of the stock price, because most buyers buy to be equal-weight TSLA. The dollar amount they'll need to do so may change as TSLA fluctuates, but the amount of shares they need to buy barely does.

The selling pressure, however, is naturally heavily dependent on the stock price. At $450 and $500, unsurprisingly not much sellers seemed to show up, but if TSLA somehow got to $1,000,000, even I'd be rushing to dump all my shares as fast as I can. More realistically, even at $1,000 there will naturally be more selling pressure than at $500.

Therefore, the model allows you to input a certain stock price, then calculates buying pressure and selling pressure at that stock price as per its assumptions, and finally outputs a "Total TSLA Demand", indicating whether buying pressure outpaces selling pressure or vice versa, and to what extent. On top of a stock price to make its predictions for, the model also needs you to put in the current SPY price (google "SPY stock"), and allows you to input your estimations for "Other MM Hedge %" and "TDHI increase":

These fields are in green, and the model requires these inputs, especially the "End SP" (stock price for which you want it to make its predictions), in order to function well.

The model also has a number of fields in red and yellow:

The red fields are for four funds that have not reported their Q3 holdings yet.

The yellow fields are fields that I've filled in as per the assumptions I laid out in this post, but you are free to change them if you disagree with them. The model will automatically change its calculations based off of different inputs in the yellow fields.

Finally, it's time to look at the output of the model:

At the very bottom of the model, you will see this summary of TSLA demand coming from each category, and a "Total TSLA Demand" field summarizing them.

Limitations of this prediction model

Now, before I get into the final section, show you some scenarios, and share my thoughts with you, it's important to talk about the limitations and shortcomings of this model, because it is not perfect, and it can not be used to predict with absolute certainty what will happen.

First of all, although, as we talked about, the estimations for some groups should turn out to be extremely accurate, the estimations for others will turn out less accurate. The estimations for a few investors are almost pure guesses.

Another shortcoming is the fact that the model models investors to behave linearly. It projects some investors will linearly sell off their TSLA stake to stay under their allocation limits. Take ARK for example. As of this writing, TSLA is trading at $585, yet I've seen people with access to ARK's trading notifications post on TMC that ARK has not sold any TSLA yet since the inclusion announcement. This means TSLA now likely makes up well over 10% of multiple of its funds. Due to internal rules, ARK is not allowed to keep >10% in any single stock (for long), so it will have to sell off TSLA at some point, but it appears to be doing so in a non-linear fashion. Considering we've seen such low volume, in spite of the stock price running up to $600, I think it's highly likely that others, such as Baillie, and perhaps CWI (if it wants to keep TSLA under 5% of AUM that is), are employing similar strategies. All of this means that the model likely overestimates selling pressure at lower stock prices, and possibly underestimates it at higher prices.

This underestimating selling pressure at higher stock prices is further amplified by the fact that everybody has his price. I have a (pretty high) TSLA stock price at which I'd divest a little bit from TSLA, and a (very high) TSLA stock price at which I'd divest from TSLA completely. Every single investor and fund manager is the same. Although it is true that TSLA has amazing long-term potential, and this contributes to retail investors being loyal to the stock, and long-term institutional investors having very high price targets, there will be points at which some institutions will aggressively divest from TSLA. I think this will happen before a $1T valuation is reached in some fashion, and you will soon see that it has to in order to reach an equilibrium, but it will happen in an even larger fashion at some point past a $1T valuation. I'd think that enough big investors are willing to divest significantly before things get really crazy and we get to a valuation of multiple trillions.

The model could also turn out to be too bearish in some ways. For example, I could've missed some "index fund look-a-likes" that are heavily underweight TSLA, and whose TSLA position is too small to show up in my TSLA Holders database. Them buying in to become equal-weight TSLA could be something the model is not accounting for. One could also look at the buying pressure excl. MMs from my model, which is ~105.8M, or 113.4M when including Fidelity and Price T Rowe, and conclude that this could be on the low side. Based on the numbers shared publicly by the S&P, it's not even quite enough to cover pure-index fund buying, let alone buying from benchmarked funds.

One last area in which the model is lacking is that it (obviously) doesn't account for all TSLA investors. Although this model factors in movements of the 80 or so largest current TSLA shareholders with individual share-counts of 1M+, it doesn't factor in the movements of all the smaller shareholders with <1M shares. These will be less impactful, but this could still add up to millions of shares worth of selling pressure that the model does not account for.

I'd say that these are the main caveats to the model, but I nonetheless think it is a very useful tool to gain deeper insights into how the TSLA float might transform throughout TSLA's inclusion into the S&P 500.

Finally, in case there are any people who are skeptical about this entire method, and who don't believe one can predict investor behaviour in this way at all, I'd like to point out that some big investors don't have much of a choice.

Especially the largest "index fund look-alikes" really don't have much of a choice. They are managing trillions of dollars, so they can't be too picky. Vanguard and Blackrock together are almost 20% of the entire US stock market. Especially when it comes to the largest companies, it's not really feasible for them to decide stocks like AAPL, MSFT, AMZN, FB, GOOGL, and TSLA are overvalued and not invest in them, because it'd required them to stash $100B+ in other, smaller stocks, which is easier said than done.

Size also works against TSLA's largest shareholders in a slightly different way. For some of TSLA's largest shareholders, like CWI, it's not really possible to decide TSLA is suddenly overvalued at $800B, and to dump their entire stake. An investor like CWI simply owns too large a percentage of the TSLA float, so they have to plan their moves long in advance, and they have to buy and sell stakes over multiple quarters. If they don't, they'll tank the stock when they try to sell it all, or they'll pump the stock too much when they buy in.

CWI (with all its mutual funds too) is an extreme example, but it holds true to a lesser degree for somewhat smaller investors. This is why these investors, unless they are desperate for some reason, usually accumulate and sell off over multiple quarters. This doesn't make them totally predictable, but it does make it a little bit easier to predict how the larger shareholders will navigate this S&P inclusion, unless really crazy things transpire of course.

11: My personal view

Let's start by running through some scenarios, and let's begin by looking at the current TSLA stock price of $585 without any influence from the options market:

The model predicts that at this stock price of $585 and no influence from the options market, there will still be Total TSLA Demand of 40.1M shares. In other words, buying pressure will outpace selling pressure by 40.1M shares, and so the stock will likely need to go higher before an equilibrium can be reached.

When one includes delta hedging, the gap between buying and selling pressure is even more severe:

This is with the increase in TDHI from the end of Q3 of ~31M to as of this writing (Monday 30th before market open), and an "other MM hedge %" of 10%, which I think is probably conservative.

All in all, I think it's safe to say an equilibrium is unlikely to be reached at $585, even if my model turns out to be quite inaccurate. I think a deficit of 61.4M shares is unlikely to be compensated for by mistakes in my model and a few large investors selling much more than I've estimated.