My TSLA Investment Strategy

Introduction

This post is a coming together of a couple of topics I've been wanting to write about:

- Some big options trades I made in the middle of January, but haven't had time to write about thus far.

- An update to my medium-term model for Tesla in 2020, 2021, and 2022, which I first shared in October of last year.

- My current investment strategy, because I think it could be a useful example for others to help them determine how to think about their investments.

This blog is divided into four sections:

One thing to keep in mind is that this blog is about my investment strategy, and not my investment portfolio. I will not be sharing what number of shares I own, nor exact position sizes, only my overall strategy when it comes to investing.

With that out of the way, let's get started.

1) Investment Strategy

Investing goals & the value of money

When starting something new, the first thing to ask yourself is what you are trying to accomplish. What are you trying to do? What are your goals? You might think that this isn't all that important in investing, because the goal will always be to make money, but this would be a grave error, and it would indicate an overly simplistic view of investing and money in general.

Different people value money vastly differently at different times and in different situations, depending on a number of factors. Setting aside scenarios where someone is falling from an airplane without a parachute, and is going to attach no value to money unless it's in the form of a Scrooge McDuck type swimming pool in the exact location he is set to make impact with the ground, there are still a number of other factors that influence how valuable money is to someone.

Far and away the most important one to be aware of as an investor is current level of wealth. Different folks will react differently to receiving a $100 gift:

- Someone who is flat broke and has $0 to his name is going to be immensely happy with $100, because it will allow him to survive and eat and drink for a few weeks.

- Someone who is struggling to make ends meet, is also going to be very happy with an extra $100, because it'll allow him to pay off some bills, or simply allow him some breathing room financially.

- A person with a low to medium income will be pleasantly surprised with $100, and might be able to surprise a significant other with a night out, or a child with a present, that they were not able to afford before.

- A high income person will likely still be somewhat happy, but probably won't do anything with it, and will probably have forgotten about it an hour later.

- A rich person might even be mad you wasted his time giving him $100, because he'd rather have spent it doing something else. Or he might be annoyed he now has to carry around a $100 bill, whereas he normally pays for everything with his credit card.

As you can see, generally the more wealthy a person is, the less value additional wealth has. Most people fall into one of these five categories in terms of how additional money impacts them:

- Survival. Someone who does not have enough money/resources to survive and provide for his most basic needs will be desperate to get more, because his life depends on it.

- Uncomfortable. People who barely have enough money to survive, and who constantly need to struggle to stay at this level and not drop back into the survival category, still value money extremely highly. And rightfully so, because an increase in wealth will drastically improve their quality of life.

- Comfortable. I suppose there are different levels of comfort for different people, but for simplicity's sake anyone who is able to comfortably support life's necessities (food, water, home, electricity, internet, clothes, etc.) falls into this category. More wealth still has value, but far less than before. More wealth will make a person in this category more comfortable, or possibly give them a chance at entering the next category.

- Freedom. Anyone who has not just enough money to live comfortably for the near future, but for the rest of their life, has achieved financial freedom. At this point, more money could still make one's lifestyle more comfortable, allow for a larger safety cushion in case unexpected things happen, or allow a person to spend more on luxury goods such as sports cars, yachts, etc., but even then there will be a point at which it becomes effectively impossible to spend all one's money within a lifetime. Eventually additional money has nearly zero additional value, no matter how rich one's tastes are, and how extravagant one's spending habits.

- Miscellaneous Goals. Some people might have other purposes for money beyond financial freedom and supporting their lifestyle indefinitely. Perhaps you grew up watching a certain sports team and it's your dream to own that team. Perhaps you've always wanted to go to the moon. Perhaps you've always wanted to write and direct a big budget movie. Perhaps you want to own a private island. Goals like this can be quite expensive and may require significantly more money than financial freedom.

Investing definitely doesn't deal with the first two of these categories. In developed countries, social security (in countries that have it), charities, and increasing one's income, can move a person up from category 1 or 2, to 3. Most investors either focus on increasing their level of comfort within category 3, or try to reach category 4. Some fortunate investors aim to increase their level of comfort in category 4, and some might be striving to accumulate enough wealth to achieve a goal from category 5.

Whichever category you fall into, it is extremely important as an investor to understand what your goals are and how important they are to you, in order to be able to form a solid investment strategy that works for you. Let me illustrate this with a couple of examples.

Imagine a 25 year old who grew up an orphan, and her passion and main goal in life are to be able to do full-time volunteer work with orphans and foster kids. She has calculated that she needs $1M in order to attain financial freedom and be able to dedicate full-time to this goal, and so her only investing goal is to accumulate $1M as swiftly and safely as possible. Considering she has a well-paying corporate job that would get her to $1M in savings in 10-15 years anyway, she doesn't want to take large risks, but simply wants to accelerate the time line. Any money made beyond $1M has almost no value to her.

A very different scenario would be that of a 45 year old who just sold his company for $40M. He has calculated that $20M is already more than enough to support a lifestyle that includes everything he and his family could ever desire. Therefore, half of the money he received from selling his company is of no value to him right now, but he does have a wild dream of owning his favorite soccer club, Manchester United, for which he has calculated he would need approximately $2B. Turning $20M into $2B is no easy feat, but since the $20M has practically no value to him anyway, he is willing to employ a more risky strategy to give him a better shot of achieving his goal before he is too old to enjoy it.

Lastly, imagine a 35 year old with a very high income job ($400k / year), but almost no savings to his name, because him and his wife like to live a very luxurious life style. He and his team have just received a $1M bonus each for helping their company ink a multi-billion dollar deal. Initially he considers buying him and his wife matching Lamborghini's, but he'd also like to move to a big mansion and own a yacht, which would all together set him back approximately $20M. He has little interest in achieving financial freedom, because he loves his job and it pays very well. He'd prefer not to lose his entire $1M bonus, because he'd really like to buy those two matching Lamborghini's, but it wouldn't be the end of the world either considering his high paying job, and he would like to try to save up $20M to be able to upgrade his life style to the next level.

These three people, have vastly different goals, and vastly different risk-profiles. The first 25 year old woman's main objective is capital preservation, because losing capital would delay her goal of financial freedom rather than make it come sooner. The second person is the complete opposite. He does not care whether he is likely to lose his money, likely to double it, or likely to 10x it. All he cares about is achieving an exactly 100x return within 10-15 years or so. No more, no less. The last person is a bit of a mix. He'd of course prefer not to lose any money, but it wouldn't be the end of the world either. He's also the only person from these three examples who doesn't have a (clearly defined) maximum target, and seems like he would always benefit from having more. Although some of the things he'd purchases if he made more than $20M might be less important to him, so achieving the $20M target might be a lot more important than the next $20M after that.

Hopefully these examples show that there's a lot more to investing than simply making money and maximizing returns. It's extremely important to understand your goals, how important they are to you, and how it influences how much value various amounts of money have to you. Before I talk about a few things you can do to help you further explore the answers to these questions, let's take a brief look at how one can go about calculating the amount one needs to achieve financial freedom, because it's very important to at least be aware of what this number is to you, and whether it is attainable or not.

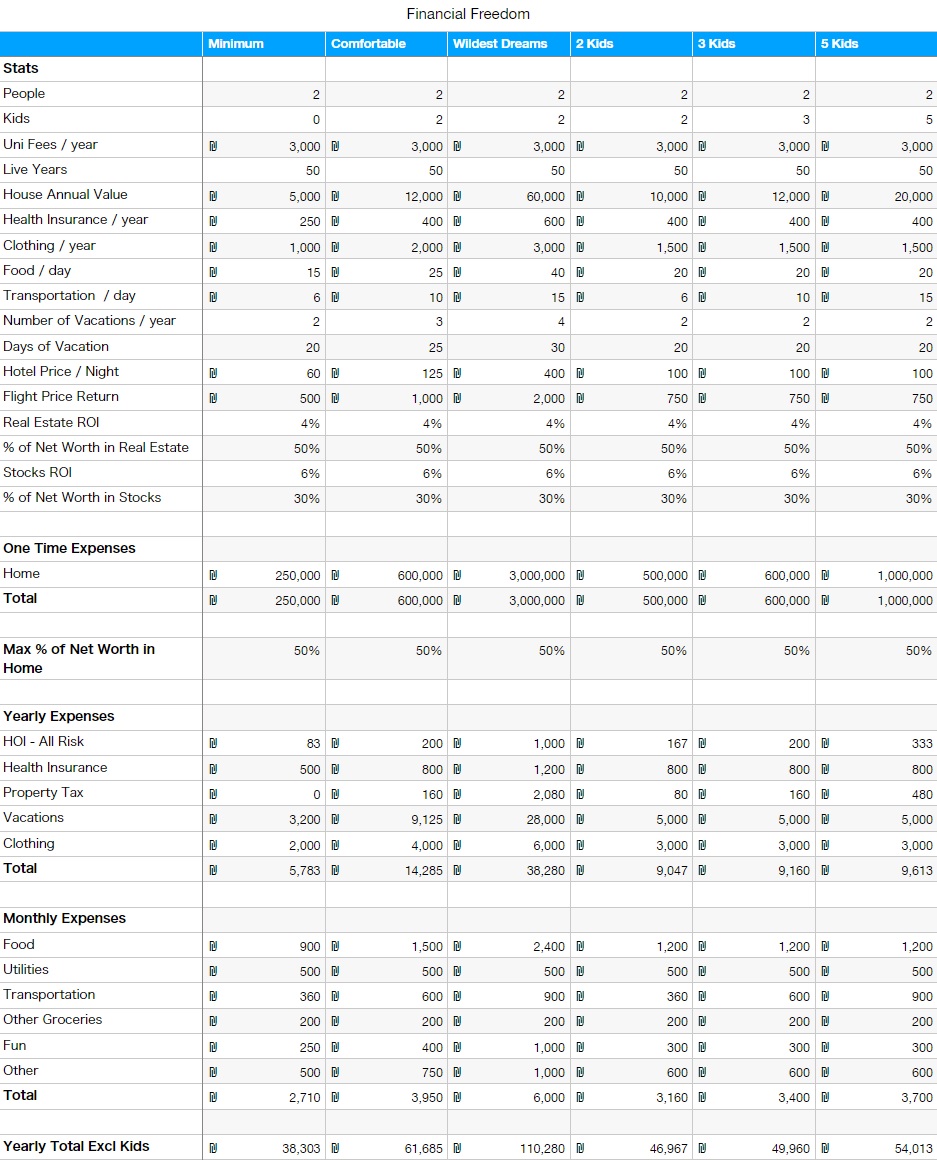

The paper-clip like symbol is supposedly the symbol for the Israelian currency, but I've used it to indicate whatever your local currency is, be it USD, EUR, or something else. You can then get the total amount of USD needed, by entering the exchange rate in "Your Currency to USD".

Let's say you're in your early thirties, you have $100k to your name that you're looking to invest, you've determined that you need a minimum of $4M to achieve financial freedom, and you have almost no use for any money beyond $10M, because you don't have crazy rich tastes nor other big goals.

Although spreading your investments out will significantly lower your risk of losing it all, any form of investment carries some risk with it, so an initial important thing to find out is how important that $100k is to you. In order to find out, you could ask yourself questions such as:

Imagine a 25 year old who grew up an orphan, and her passion and main goal in life are to be able to do full-time volunteer work with orphans and foster kids. She has calculated that she needs $1M in order to attain financial freedom and be able to dedicate full-time to this goal, and so her only investing goal is to accumulate $1M as swiftly and safely as possible. Considering she has a well-paying corporate job that would get her to $1M in savings in 10-15 years anyway, she doesn't want to take large risks, but simply wants to accelerate the time line. Any money made beyond $1M has almost no value to her.

A very different scenario would be that of a 45 year old who just sold his company for $40M. He has calculated that $20M is already more than enough to support a lifestyle that includes everything he and his family could ever desire. Therefore, half of the money he received from selling his company is of no value to him right now, but he does have a wild dream of owning his favorite soccer club, Manchester United, for which he has calculated he would need approximately $2B. Turning $20M into $2B is no easy feat, but since the $20M has practically no value to him anyway, he is willing to employ a more risky strategy to give him a better shot of achieving his goal before he is too old to enjoy it.

Lastly, imagine a 35 year old with a very high income job ($400k / year), but almost no savings to his name, because him and his wife like to live a very luxurious life style. He and his team have just received a $1M bonus each for helping their company ink a multi-billion dollar deal. Initially he considers buying him and his wife matching Lamborghini's, but he'd also like to move to a big mansion and own a yacht, which would all together set him back approximately $20M. He has little interest in achieving financial freedom, because he loves his job and it pays very well. He'd prefer not to lose his entire $1M bonus, because he'd really like to buy those two matching Lamborghini's, but it wouldn't be the end of the world either considering his high paying job, and he would like to try to save up $20M to be able to upgrade his life style to the next level.

These three people, have vastly different goals, and vastly different risk-profiles. The first 25 year old woman's main objective is capital preservation, because losing capital would delay her goal of financial freedom rather than make it come sooner. The second person is the complete opposite. He does not care whether he is likely to lose his money, likely to double it, or likely to 10x it. All he cares about is achieving an exactly 100x return within 10-15 years or so. No more, no less. The last person is a bit of a mix. He'd of course prefer not to lose any money, but it wouldn't be the end of the world either. He's also the only person from these three examples who doesn't have a (clearly defined) maximum target, and seems like he would always benefit from having more. Although some of the things he'd purchases if he made more than $20M might be less important to him, so achieving the $20M target might be a lot more important than the next $20M after that.

Hopefully these examples show that there's a lot more to investing than simply making money and maximizing returns. It's extremely important to understand your goals, how important they are to you, and how it influences how much value various amounts of money have to you. Before I talk about a few things you can do to help you further explore the answers to these questions, let's take a brief look at how one can go about calculating the amount one needs to achieve financial freedom, because it's very important to at least be aware of what this number is to you, and whether it is attainable or not.

How to calculate the amount of money you need to achieve financial freedom

In order to do this you're going to need:- An idea of what kind of life style you want. If you don't mind living very frugally, you might not need that much.

- To know how many people you want to support. Do you want to support your husband/wife, your children, and perhaps even your parents?

- A detailed list of all expenses related to your desired life style.

- Some spreadsheet skills to put it all together.

Here's an example:

You can download this spreadsheet here:

This is the format that I used for my own calculations, although the numbers and scenarios are different. I just entered those as examples, but I don't know exactly how many pieces of art you'd like to own, and how often you'd like to make it rain at the local strip club, so you'll have to adjust this one or create one for yourself to find out how much money you would need to attain financial freedom.

Anyway, you can see that this example has a couple of different scenarios. The first three are an example of how one might calculate how much would be needed for three different levels of comfort of financial freedom, and the last three are examples of what kind of influence extra children would have on these numbers.

You can see that the model accounts for vacations, health insurance, home owner's insurance, clothing, food, transportation, children, children's university fees, and a lot more. Again, you'll have to create your own, because different countries have different costs for education, different property taxes, etc. etc.

This model assumes you buy a home and pay it off, because this is something I'd personally prefer to do over getting a mortgage. It then calculates yearly expenses, and how much money would be needed to generate enough passive income to cover these yearly expenses indefinitely. I tend to try to err on the side of caution with models like this, and I've also factored in a safety margin of 20%.

The paper-clip like symbol is supposedly the symbol for the Israelian currency, but I've used it to indicate whatever your local currency is, be it USD, EUR, or something else. You can then get the total amount of USD needed, by entering the exchange rate in "Your Currency to USD".

How to determine the value of money to yourself

Now that you know how much you'd need to achieve financial freedom, and hopefully also any other goals you might want to achieve, we can revisit the question of how valuable various amounts of money are to you. The best way I know of to do so, as well as get a feel for my willingness to take on risks, is to engage in a series of thought exercises.Let's say you're in your early thirties, you have $100k to your name that you're looking to invest, you've determined that you need a minimum of $4M to achieve financial freedom, and you have almost no use for any money beyond $10M, because you don't have crazy rich tastes nor other big goals.

Although spreading your investments out will significantly lower your risk of losing it all, any form of investment carries some risk with it, so an initial important thing to find out is how important that $100k is to you. In order to find out, you could ask yourself questions such as:

- If I were offered the opportunity to bet the $100k with a 50% chance of losing it, and a 50% of ending up with $250k, would I take it?

- If I were offered the opportunity to bet the $100k with a 50% chance of winning, what kind of odds would I need for me to take that bet?

- If I were offered the opportunity to bet the $100k with a chance of ending up with $250k, what would the probability of winning the bet have to be for me to take that bet?

The answers to these questions will likely depend on your level of income. If you're making $1M per year, you would most likely happily take the first one, but someone working minimum wage would likely need much higher odds and/or a higher chance of winning in order to take that bet. Here is another example:

If I were offered the choice between these investment opportunities that would play out over 20 years until I'm in my early fifties, which would I choose?

- An effectively 0% chance of losing my investment, a 5% chance of ending up with $100k, an 80% chance of ending up with $500k, a 15% chance of ending up with $4M, and an effectively 0% chance of ending up with $10M or more.

- A 1% chance of losing my investment, a 9% chance of ending up with $100k, a 50% chance of ending up with $500k, a 35% chance of ending up with $4M, and a 5% chance of ending up with $10M.

- A 5% chance of losing my investment, a 15% chance of ending up with $100k, a 15% chance of ending up with $500k, a 55% chance of ending up with $4M, and a 10% chance of ending up with $10M.

- A 15% chance of losing my investment, a 15% chance of ending up with $100k, a 10% chance of ending up with $500k, a 20% chance of ending up with $4M, and a 40% chance of ending up with $10M.

One last example of a type of question you could ask yourself is this:

- If I were offered the opportunity to bet the $100k with a 90% chance of losing it, and a 10% chance of ending up with $10M, would I take it?

- What chance of winning would I need to bet the full $100k with a potential 100x pay off?

- With a chance of winning of only 10%, what is the maximum amount I would be willing to bet? Would I bet $1k to win $100k? $10k to win $1M?

All of these types of questions can help shed light on how valuable various amounts of money are to you, how important certain goals are to you, and how much risk you'd be willing to take in order to reach them.

How big of an impact would financial freedom have on your life and happiness? How important is it to you to own luxury goods like sports cars, a second house, a private jet, etc? Having a firm grasp of all of these is fundamental in order to achieve personal success as an investor, and to be able to create a personalized, effective investment strategy.

How big of an impact would financial freedom have on your life and happiness? How important is it to you to own luxury goods like sports cars, a second house, a private jet, etc? Having a firm grasp of all of these is fundamental in order to achieve personal success as an investor, and to be able to create a personalized, effective investment strategy.

Realism filter

But before you can build an investment strategy, there is one final thing you have to do: put your goals through a realism filter.

If your goal is to be the richest person on the planet, I wish you good luck, because you're going to need it. Likewise, if you're 70 years old, have $100k to your name and have never invested in your life, have a terminal illness with only 1 year left to live, and your goal is to turn that $100k into $23M so you can buy each of your 23 grandchildren a $1M house as a parting gift, once again I wish you good luck, because it's just not a very realistic goal.

Being too conservative with your goals, and dismissing goals as impossible too easily is also a mistake. This amazing Wait But Why article about what makes Elon Musk special does an amazing job of explaining how Elon doesn't limit his goals by what is commonly thought of as impossible. In investing specifically, compound interest can be very powerful, so don't be too quick to dismiss a goal as impossible:

If your goal is to be the richest person on the planet, I wish you good luck, because you're going to need it. Likewise, if you're 70 years old, have $100k to your name and have never invested in your life, have a terminal illness with only 1 year left to live, and your goal is to turn that $100k into $23M so you can buy each of your 23 grandchildren a $1M house as a parting gift, once again I wish you good luck, because it's just not a very realistic goal.

Being too conservative with your goals, and dismissing goals as impossible too easily is also a mistake. This amazing Wait But Why article about what makes Elon Musk special does an amazing job of explaining how Elon doesn't limit his goals by what is commonly thought of as impossible. In investing specifically, compound interest can be very powerful, so don't be too quick to dismiss a goal as impossible:

Finding the right balance between confidence and self-doubt, and between optimism and skepticism is in my opinion one of the hardest skills in life to master, but it's important to get at least decent at it to be successful as an investor. Not just for goal setting, but more importantly to come to the right conclusion about investment opportunities, and to not get detached from reality.

Building a strategy

The final thing to do is to build a strategy with an expected ROI and a risk profile that make sense to you. Generally the higher the expected ROI, the higher the risk and/or the higher the variance. Low risk high reward investments should in theory not exist or at least be extremely rare, but *spoiler alert* they do exist and are absolutely awesome.

In the example of the 25 year old, who simply wants to save up $1M as safely as possible, and not risk delaying her financial freedom, a fairly safe strategy makes sense. If she expects it will take her about 10 years to reach her goal, it could still make sense to invest in some individual growth stocks early on, because these are likely to pay off over a 10 year period, but the closer she gets to her goal of $1M, the less risk she'll want to take. When she's at $900k in savings, a 5% yearly return that's 90% likely to be between 3% and 7% is much more desirable than a 6.5% return that's 90% likely to be between -5% and 18%, especially because she also has her income to help her save up the final $100k. So she might want to limit her exposure to individual stocks, and move more money into things like ETFs and bonds, and hold a larger % of her money in just cash.

The example of the 45 year old who has no value for his $20M unless he can turn it into $2B within a 10-15 year period, requires a vastly different strategy. It's incredibly difficult to reliably 100x your money investing, especially in just 10-15 years. TSLA @ $180 in June of 2019 had a very good chance of doing it, but that was a once in a lifetime opportunity in my opinion. For the most part, to give himself a chance of achieving his $2B target, this person would have to take on a lot more risk. He could do so by using margin, by leveraging up through derivatives, or by making more speculative shorter term trades. What would work best for him depends on his personal knowledge and skill set, and also on the specific investment opportunities available to him at the time. Success is far from guaranteed, but he is okay with the higher risk, because losing the $20M would not impact his life anyway.

The final example of the 35 year old who wants to turn his $1M bonus into $20M in let's say 15 years, would be a bit of a mixture between the two previous examples. A 20x return on investment in 15 years would still be a hell of a feat to accomplish, and not an easy task. It certainly cannot be accomplished by investing in low-risk assets such ETFs, and the person would have to be a very good investors and achieve a just north of 20% annual ROI investing in individual stocks, or take on slightly more risk through leverage here and there. His exact strategy should depend on the opportunities available to him, and on how big a difference something like $5M-10M vs $20M is to him. He'd likely be best off working on his investing skills, investing in a handful of individual companies that he's highly confident in, hope the companies do well enough for him to reach $20M, and just be happy with less than $20M if his investments don't work out as well as he'd hoped.

You might've noticed that the opportunities available at any given time will (unsurprisingly) also impact investment strategy. So now it's time to look at how I've built my own strategy given my goals and the opportunities available to me at this time.

2) TSLA Stock

My Goals

My main investment goal is financial freedom. I'm not someone who wants to live a luxurious life style. I rarely buy anything unless I actually need it. The only thing I could see myself spending a lot of money on, when the time comes, is a nice home to live in. Financial freedom, which I see as freedom in how I choose to spend my time, is the most important thing to me. Although I can probably find ways to do the things I want to do and make money from them, it'll be easier when I can just focus on doing the things I want to do without worrying about generating an income from them.Beyond a minimum level of financial freedom, money quickly loses value to me in terms of my personal life and spending. I have no interest in sports cars, yachts, private planes, etc. and little interest in living a more luxurious life style in terms of expensive dinners every day, and going on vacations to expensive resorts every month. The only thing I would spend more money on, if I have the opportunity, is a larger, nicer home. But even with that, I am likely overestimating how much of a difference it will make in my long term happiness.

The only real value I have for money beyond a minimum level of financial freedom lies in some of my miscellaneous goals. They're a bit different from the examples I gave earlier. I don't want to get into specifics here, because it's quite off-topic, and if you get me started on one of them in particular, I could easily write 100+ pages about just that. But for the purpose of this blog, let's just say that I think something along the lines of 50-100x the amount I need for financial freedom, would likely be very useful for some of these goals.

Current Opportunities Opportunity

Although I have done some amount of research into a couple of other investment opportunities (a few ARK companies, Uber, SolarCity (in 2015), etc.), maybe I should talk about opportunity instead of opportunities, because TSLA stock is so perfect, I'm doubtful that there's anything better out there.

TSLA's extraordinary risk-reward profile makes for quite a unique situation, and so I've built my investment strategy around it. But before I tell you exactly what role TSLA stock fulfills in my investment strategy, let's take a look at what makes it so unique.

TSLA's Downside Risk

First, let's take a look at TSLA's downside risk in May/June of 2019 @ ~$200, when I decided to effectively go "all-in" on TSLA. With ~180M shares outstanding at a SP of ~$200, Tesla was valued at approximately $36B. What would Tesla have to do to deserve this valuation beyond any reasonable doubt?

|

| https://teslainvestor.blogspot.com/2019/10/tesla-in-2020-2021-my-bet-on-tsla-jan22.html?m=1 |

In this table from this blog from October 2019, I listed the EBIT multiples from various automotive companies at the time. As you can see, they ranged from 5 at the low end for Fiat to 13 at the high end for Nissan. So let's say that an EBIT multiple of 10 was a fair value for an automotive company. To reach that at the SP of $200 at the time, Tesla would have to do $3.6B in EBIT per 12 months.

At the time, Tesla had just done -$300M in EBIT over the past 4 quarters, so quite a bit off from +$3.6B:

However, Tesla was in the process of building out extra M3 production in Shanghai, and would soon launch the MY. In the same blog from October 2019, I showed that if Tesla could manage to ramp production to 10k M3 per quarter (7k Fremont + 3k Shanghai) and 7k MY per quarter, it'd achieve an EBIT of ~$1B per quarter, which would be more than $3.6B over a 12 month period, and therefore enough to deserve a $36B valuation and $200 SP, even if it never grew any further.

So what were the risks to Tesla achieving less than this? In my opinion, <1% freak accidents. The Shanghai factory was progressing very rapidly at the time, ramping M3 in Shanghai should not have been a huge problem considering Tesla was already producing it in Fremont, and the MY was going to be very similar to the M3, so that also seemed like a low risk production ramp.

So the risks in my opinion were freak accidents that stopped Tesla from achieving 10k M3/week and 7k MY/week. I saw these risks as incredibly unlikely natural catastrophes destroying the Fremont factory (earthquake, meteor), or perhaps some sort of terrorist/TSLAQ attack on the Fremont factory or Palo Alto HQ.

Barring something crazy like this, I foresaw no risks to Tesla achieving this goal, and therefore I saw almost zero downside risk to TSLA stock @ $200 in May/June of 2019.

So what about TSLA today @ $800? Today there are about 200M shares outstanding, mostly due to the CEO compensation package, and therefore TSLA is valued at $160B at a SP of $800. This time let's say Tesla would need a 15x EBIT multiple to deserve this valuation beyond any doubt, because as we all know Tesla isn't just a car company, and the market also seems to have woken up to that fact.

15x EBIT is still lower than all of the big tech companies (APPL 20x, GOOGL 25x, MSFT 35x, AMZN 85x), but we want to know what Tesla needs to achieve to deserve that $160B valuation, if it never grew any further after that. At 15x EBIT, that would be ~$10B of EBIT per 12 months, so $2.5B of EBIT per quarter.

I'm going to get into some more detailed financial models in the next section of this blog, but for now I'll say that 10k M3 per week, and 15k MY per week should do the trick. You might point out that this is only about 33% more than the 10k M3 + 7k MY from before that is supposed to achieve $1B EBIT per quarter, but those calculations were before Tesla's amazing Q3'19, in which it showed much reduced OPEX and much increased operating margins. 10k M3 + 15k MY per week should lead to approximately $2.5B in EBIT per quarter, at which Tesla would definitely deserve its $160B valuation and $800 SP.

So what are the risks to Tesla achieving this? Tesla is already able to produce 10k M3 per week, and about 3k M3/MY per week. By the end of 2021 or at the latest by early 2022, when Shanghai's phase 2 is operational and Berlin is starting to produce some MY, Tesla should be at this target of 10k M3 + 15k MY per week. In my opinion the risks to Tesla achieving this are even lower than the risks were to Tesla deserving its $200 SP a year ago, because:

- Even if something catastrophic happens to one of Tesla's factories, it has at least one other, and soon 2-3 others (Berlin + Texas).

- Tesla has proven that it's learned from the initial M3 ramp up, and that it's capable of rapidly ramping up production at an overseas factory.

- Tesla has already started producing and delivering some amount of MYs, further reducing any risks that were associated with the ramp up of that new product.

In my opinion, the main downside risk to Tesla right now, is something extremely unlikely and catastrophic happening to its Palo Alto HQ, where most of its talent is located. I firmly believe that as of right now Tesla's most valuable asset is its talented employees.

In summary, I saw extremely low risk in TSLA @ $200 a year ago, and I see even less long term risk in TSLA @ $800 today.

TSLA's Upside Potential

If you'd like to understand Tesla's long term potential better, and you haven't yet read these two blog posts, I highly recommend you do so:

In essence, I'd be highly surprised to see Tesla be worth much less than $2T by 2030, for a SP of ~$10,000. Going out to 2030, there is obviously somewhat more execution risk than with Tesla deserving its current SP of $800, but this does not require Tesla to create regulatory approved, "safer than a human" FSD. Production of 10M EVs at an ASP of $40,000 would be $400B in revenue. At 30% gross margins and 15% operating margins, that would be an EBIT of $60B, and require a 33x EBIT multiple to achieve a $2T market cap.

If Tesla is also able to create "safer than a human" FSD and gain regulatory approval, the sky is pretty much the limit, and I would not be surprised to see a $10T+ valuation and a SP of $50,000 to $60,000. Although it's a bit difficult to predict with precision that far out into the future, if I was forced to give a TSLA 2030 price target, as of this writing I would probably put it at around $5T, and a SP of $20,000 to $25,000.

This is why I think TSLA stock @ $180 in June of 2019 could turn out to be a 100x investment over a 10-15 year period.

My TSLA Stock Investment Strategy

So, TSLA stock in my opinion is an investment with incredibly low downside risk at current prices, and incredibly high upside potential over the next decade. Possibly as much as 100x upside counting from a year ago, and still likely at least 10x upside from today's price.

I've been fortunate enough to have been able to accumulate a number of TSLA shares that, although there is some execution risk, I believe are highly likely to appreciate enough for me to achieve financial freedom by 2030, even in a bear case where Tesla does not solve FSD.

Considering the fact that financial freedom is my most important investment goal, I plan to not touch these 'core shares', unless things materially change about TSLA stock as an investment. Even if I were a god-tier trader (which I am not), and knew with 60-70% certainty which way the stock would move in the short term, I would not touch these shares. As is, I believe it's highly likely these shares will allow me to achieve my main investment goal, but if I do anything but hold them, I risk jeopardizing my main investment goal, so I don't.

TSLA stock may be the part of my investment strategy that will hopefully allow me to achieve my most important investment goal, it is not the only part of my strategy. Even if TSLA had stayed at $200 for much longer, I'm not sure I would've been able to grab up enough shares to reach some of my miscellaneous goals. I would've needed to buy at least ~10x the number of shares I needed for financial freedom, and then had to hope Tesla solved FSD and did much better than my 2030 bear case.

Fortunately enough, I decided to get into TSLA options a year ago. Although I probably deserve some credit for realising it was very good timing to get into TSLA options, I must say the timing was probably quite lucky as well, because any TSLA bull, who got into options a year ago, should've done quite well over the past 12 months.

Either way, I believe I've had quite good reasoning for all of my big options trades. I talked about some of these in my blog post in October of 2019. In this blog post, I will also talk about when I decide to buy options, how I decide the amount I want to buy, how I calculate potential ROI for these trades, how I compare different strategies to each other, and how it fits into my overall investment strategy.

But before we get into that, I'm first going to update my medium term TSLA financial models, so that we're aware of what TSLA's medium term future looks like, and so that we have ample data and predictions to base options decisions on.

3) Tesla in 2020, 2021, and 2022

In this section of the blog I'll walk through a bear and a bull model for Tesla for the next 2.5 years. I'll walk through each part of the model step by step. These parts are as follows:

Let's talk about Shanghai first, because I believe it's the easiest one to predict. Tesla stated in their latest ER that production capacity will reach 200k M3 per year soon, and this report states that there will be a stress test in July with eventual production of 5k per week. This is what my sales forecasts are based on, and they are nearly the same in my bull and bear cases.

- Energy

- Automotive

- Income Statement

- Summary

Here are links to the models:

These models also contain a "Cash Flows" and a "Balance Sheet" tab. The Balance Sheet tab is only there for past data. I neither know how to predict future changes to the balance sheet, nor do I see it as particularly useful.

As for the "Cash Flows" tab, I do have some predictions, but I will not be discussing these, because I think it's far too hard to accurately predict detailed future cash flows. You can predict a few things such as Cap Ex, but other things such as changes to operating assets and liabilities are incredibly difficult to predict far into the future even for people inside Tesla's finance department, and effectively impossible to predict for an outsider..

If you're not particularly interested in the detailed reasoning behind all the assumptions in these models, feel free to skip over them, but I'd highly recommend checking out the final "Summary" section at least, because it'll give you an interesting high-level overview of what I'm forecasting.

Before we begin, here are a few final notes:

Before we begin, here are a few final notes:

- COVID-19 brings with it a little bit more uncertainty. Although I don't believe we'll see a 2nd round of lock downs, there is a slightly higher chance of crazy, unforeseen stuff happening.

- I don't believe we'll see demand for autos severely impacted in the wake of COVID-19, but even if it is, I doubt Tesla will see much of an impact. Tesla definitely won't be able to fulfill Model Y demand for the next few years, even if there is a 50% reduction in demand. I also believe China demand is far in excess of what Shanghai can produce in the near term, and they could always export to APAC. M3 production in Fremont seems like it will be lowered from 7k/week to 5k/week to accommodate for MY, and Tesla was demand constrained before COVID-19, so I also doubt they'll see demand constraints there. In my opinion, the only place where a drop in global auto demand would impact Tesla is MS+X sales.

- 2022 is a little bit tricky to predict accurately. It's not too difficult to forecast 2021, because we know the plans for Shanghai, we have a decent idea when initial production in Berlin will start, and we know when the Cybertruck is supposed to launch. However, 2022 is more uncertain, so it's more likely I'm off to some degree for 2022.

1) Energy

Bear

Bull

Energy Storage

Bear

Bull

This is incredibly tricky to forecast. I have no doubt there is enough demand for >100% YoY growth for the next few years, but it's not Tesla's main focus, and it's always a question of whether Tesla has access to enough spare batteries or not. I've modeled 2-3x growth in the 3 years from Q4'19 to Q4'22, steady margins, and a small reduction in price, but I could see things pan out much better, if Tesla has enough available talent and batteries to dedicate to its Energy Storage business.

Fortunately enough, it's a relatively small part of Tesla's business (for now), so it doesn't impact the overall model very much if I turn out to be very wrong.

Regular Solar Sales & Leases

Bear

Bull

This is pretty much the same as energy storage in that it is difficult to accurately predict, because Tesla has revamped its entire solar business since the SolarCity acquisition, and because there is less information/data available to base predictions on. Fortunately enough, this is a similarly small part of Tesla's overall business, so it doesn't impact the overall accuracy of the model all that much.

What I've modeled is for solar leases to stay steady, like they more-or-less have over the past few years, and for solar sales to approximately double from Q4'19 to Q4'22.

Solar Roof

Bear

Bull

There is a lot more information regarding Solar Roof plans to base our predictions on, partly thanks to my Say.com question, that was answered during the last conference call, about Solar Roof installation capacity. It appears as if COVID-19 has thrown a temporary wrench in Tesla's Solar Roof plans, but that Elon expects to reach an installation capacity of 1k/week by early 2021, perhaps as soon as by the end of this year.

My bear model projects Tesla to hit 1k/week by Q3'21, and 1.5k/week by Q4'22, with a margin of 17.5% . My bull model projects Tesla to hit 1k/week by Q2'21, and 2k/week by Q4'22, with a margin of 20%. As a result, I expect that the Solar Roof will make up approximately 50% of Tesla's energy business, with 1/3 going to storage, and 1/6 going to regular solar.

2) Automotive

Bear

Bull

I've separated the financials for M3 and MY sales by factory, because vehicles built in Fremont will have much lower margins, and perhaps also slightly lower ASPs associated with them. If Tesla ever stops producing in Fremont altogether, perhaps I'll be able to consolidate some of those numbers, but doing so right now I believe would lower the accuracy of this model.

MS+X

Bear

Bull

In my bear case, I'm projecting slightly weaker sales in 2020 in the wake of COVID-19, and a return to 2019 sales levels starting in 2021. In my bull case, I'm projecting a slight bump in Model S and X sales due to the Plaid Powertrain introduction that is set to happen later this year. In this case I am projecting a bump to 20k/quarter with some seasonality.

I certainly think the Plaid Powertrain could provide a larger boost, and get us back to 2018 levels of 20-25k/quarter. However, there's too much uncertainty at this time, and I'm not comfortable modeling this out. I'd rather err on the side of caution, and update the model if the Plaid Powertrain introduction does indeed boost MS+X sales back to 20-25k/quarter.

M3

Bear

Bull

Let's talk about Shanghai first, because I believe it's the easiest one to predict. Tesla stated in their latest ER that production capacity will reach 200k M3 per year soon, and this report states that there will be a stress test in July with eventual production of 5k per week. This is what my sales forecasts are based on, and they are nearly the same in my bull and bear cases.

In terms of Shanghai margins, judging from Tesla.com the M3s coming out of Shanghai are currently being sold for $2k more than the ones coming out of Fremont. I've factored in small future price reductions in both scenarios. All indications and official statements point to the M3 being cheaper to produce in Shanghai than in Fremont. Exactly by how much is anybody's guess, but I've estimated 2.5% to 6.25% cheaper COGS compared to Fremont. The result is 3% to 6.5% higher margin in Shanghai than in Fremont.

Made in Fremont M3 sales are a bit uncertain. Until Q1'20 ER, I expected that Fremont would stay at 7k M3 per week, and ramp up to an additional 7k MY per week. However, in Q1'20 ER Tesla once again listed M3 and MY production together, just like in Q4'19 ER, and it stated that "Model 3/ Model Y installed capacity in Fremont will extend to 500,000 in 2020". There are a couple of possible explanations as to what is going on:

- Tesla is under promising, and will actually manage to install more than 500k per year capacity in Fremont by the end of the year.

- Tesla is done with Fremont. They will only ramp to 3k MY per week, and will build out any additional production capacity at other factories. I don't think they want to limit themselves to 3k MY per week, unless they can really get final assembly online in Texas by the end of the year, but that just seems so impossibly fast that I'm not counting on this being the case.

- Tesla is going to reduce M3 production in Fremont to 5k per week, and build out MY production of 5k per week as well.

For now, I'm going to assume #3 is the case. This seems most likely to me, although it's something to keep an eye on, because this assumption could prove to be incorrect. Therefore, I've modeled out 65k M3 per quarter (5k per week) from Fremont. I've kept margins the same to what I believe they've been like for the past few quarters. There could be some cost savings from larger economies of scale thanks to the launch of the MY, but I'll model those in if/when they actually happen.

Made in Berlin M3 sales are the most difficult to predict. Elon recently stated on Twitter that he expects MY deliveries to start in Switzerland a year from now, after Berlin starts production. Groundbreaking also seems imminent, which means that production could start around Q1/Q2 of 2021 if things progress just as fast as in Shanghai.

However, Tesla has stated that Berlin will begin producing MY first. This means that either Tesla is initially going to sell the MY at insane margins in Europe as to not cannibalize the M3, which will still suffer from shipping costs and import fees, and/or it is going start producing M3 in Berlin not long after it starts producing MY. I could be wrong, because we've had no official word yet, but I'm predicting M3 production in Berlin to start in Q2'22 in the bear case, and in Q4'21 in the bull case.

As for margins, I'd expect these to be similar in Berlin and Shanghai. Some costs such as labor might be slightly more expensive in Berlin, but learnings from Shanghai should lead to slight cost savings, so I'm guessing those will even each other out.

MY

Bear

Bull

Shanghai and Berlin are fairly straightforward in terms of ramps, ASPs, and margins. ASPs look to be $3k higher than the M3, and COGS could be cheaper than the M3 according to Sandy Munro. However, I've been slightly conservative and projected MY COGS to be the same as M3 in the bull case, and ~2.5% higher in the bear case. With regards to production start in Berlin, I've assumed Q4'21 in the bear case, and Q2'21 in the bull case.

Shanghai could go beyond 5k MY per week capacity, but I've chosen not to model this. Berlin I believe will definitely go beyond 5k MY per week, due to its much larger size. The bull case has MY production in Berlin going up to 7k MY per week, but I could see it reaching 10k per week in 2023.

Fremont and Texas are trickier due to the aforementioned uncertainties. Tesla has talked multiple times about having separate MY production for the east coast, so I think it's fairly safe to assume this will happen, and it's just a question of when.

Electrek posted an article based an anonymous source claiming final assembly for MY in Texas will come online by the end of 2020. Electrek's sources have been correct sometimes, but have also been incorrect just as often (MS+X Refresh), so I'd take this report with a grain of salt. The end of this year seems impossibly quick. In the bull case I've predicted production start of MY in Texas around the same time the Cybertruck is supposed to launch (second half of 2021), and in the bear case not until the first half of 2022.

At the same time production starts in Texas, I have Fremont dropping production slightly, because I'm not sure there is enough demand in NA to support production of 10k MY per week. Perhaps if Tesla expands to a few new markets in South America, and/or continues shipping MY to Australia and some APAC regions from Fremont.

Cybertruck

Bear

Bull

This is one of a couple of areas where the bull model is still conservative. I have it ramping up to 5k per week over 4 quarters by Q3'22. Due to the completely different nature of the vehicle, I think it's important to be slightly conservative. A lot more things could go wrong here than with the introduction of the MY. Tesla could certainly nail it, and reach 5k per week by the start of 2022, and 10k per week in late 2022, but I've chosen not to model this, even in the bull case.

The ASP of the Cybertruck should be very similar to the M3. Margins are also difficult to estimate for now, but I've gone with 20% and 25% in the bear an bull cases respectively.

Semi

The Tesla Semi is notably absent from my model. I am aware that it is currently set to go into production in 2021, but it was also supposed to go into production in 2019 and 2020, we've received very little information surrounding the state of the program, and Tesla has stated it will most likely use initial production itself rather than selling it to customers. Therefore, I've decided to exclude the Semi from these projections, although I am quite hopeful that we will finally see it go into production, if not in 2021, at least in 2022.

Credits

Bear

Bull

These are also difficult to estimate, but I believe the $300k per quarter in the bear model, and the $300k per quarter going up to $500k per quarter by 2022 in the bull model, are both reasonably conservative.

The Q1'20 10-Q stated that none of the $350M credit sales in Q1'20 were from the deferred credits balance, so that means all of these credits sales are likely recurring. It could be that credits sales are currently limited by sales numbers, in which case credits sales will go up as Tesla sells more cars. However, it's also possible that in the next 2.5 years a few auto manufacturers will go bankrupt, and others will manage to sell EVs in larger volumes, hurting Tesla's credit sales in some way.

Leasing

Bear

Bull

I'm very happy with the way my leasing model has performed since I first created it in October. So far it appears to be quite accurate. The bull and bear models are nearly the same.

Demand

Before we move on to the next part, the Income Statement, let's do some calculations on whether there will be enough demand to support some of the high-level sales predictions I've made for the M3 and MY. I've projected M3 sales of 700-750k units per year, and MY sales of 800k-1,000k per year by the end of 2022.

We know that the M3 sells ~45k per quarter in the US:

|

| https://insideevs.com/news/343998/monthly-plug-in-ev-sales-scorecard/ |

According to this table, the M3's competition sells the following numbers in the USA:

- Mercedes C-Class: ~50k units per year

- BMW 3-Series: ~50k units per year

- Audi A4: ~25k to 35k units per year

According to this table, the same competitors sell the following numbers in China:

- Mercedes C-Class: ~150k units per year

- BMW 3-Series: ~110k to 130k units per year

- Audi A4: ~170k units per year

According to this table, the same competitors sell the following numbers in Europe:

- Mercedes C-Class: ~150k units per year

- BMW 3-Series: ~110k to 125k units per year

- Audi A4: ~100k to 110k units per year

It appears that luxury vehicles like the M3, sell approximately 2x to 3x the numbers in EU and China compared to the US. That means that Tesla could see demand for M3 in US + China + EU as high as 5-7 * 180k = 900k to 1.26M per year, if the M3's success in the US will translate to similar success in China + EU, now that local production will bring down prices to the same level as the US made variant.

So my projection for 700-750k M3 per year seems quite reasonable, especially considering the 900k to 1.26M excludes sales in other countries such as APAC, Canada, etc., and even if the MY and/or Cybertruck severely cannibalize the M3 and cause a 30-50% reduction in demand, the M3 should still see global demand of at least 700-750k per year.

As for the MY, we don't know yet the exact demand in any market, but we can try to make some estimates based on what Tesla was able to achieve with the M3. Let's start by trying to estimate the demand for the MY in the USA. Currently the M3 sells ~45k per quarter, in a 95k per quarter market, for 50% market share. However, according to this table, this same market sold only ~70k vehicles per quarter in the first half of 2017 before the M3's arrival.

This is what the Midsize SUV market looked like in 2019:

|

| https://www.goodcarbadcar.net/2020-us-midsize-luxury-suv-sales-figures/ |

Sales for all of 2019 were 635,223, so that's an average of ~160k per quarter. If the MY will do the same thing to the Midsize SUV market as the M3 did to the Midsize Sedan market, it will grow the total market by 30% (70k to 95k = ~30%) from 160k per quarter to 210k per quarter, and take 50% market share of this market, and sell 105k units per quarter in the USA.

The comparison of MY competitors in the USA and abroad is as follows:

According to this table, the MY's competition sells the following numbers in the USA:

- Mercedes GLC-Class: ~70k units per year

- BMW X3: ~60k to 70k units per year

- Audi Q5: ~70k units per year

According to this table, the same competitors sell the following numbers in China:

- Mercedes GLC-Class: ~120k to 140k units per year

- BMW X3: ~120k units per year

- Audi Q5: ~125k to 135k units per year

According to this table, the same competitors sell the following numbers in Europe:

- Mercedes GLC-Class: ~80k to 95k units per year

- BMW X3: ~60k to 80k units per year

- Audi Q5: ~60k to 70k units per year

It appears that luxury SUVs sell similar numbers in the EU compared to the USA, and approximately 2x the numbers in China. By this logic, global MY demand could be approximately 4x MY demand in the USA of 105k, for a total global demand of 420k per quarter, excluding non-US America, APAC, etc. This would come out to demand of 1.68M vehicles per year, and it would seem as if there'll be more than sufficient demand for MY globally to support the 800k-1,000k yearly production I forecasted, even if the M3 numbers on which these MY numbers are based, turn out to be pre-MY cannibalization numbers.

I understand that this is a far from perfect method for forecasting MY demand, but I believe it's the best way to look at it that we have. It could turn out to be off by a lot, but we have a large margin for error (800k-1,000k modeled vs 1.68M projected demand), so I do not expect a lack of demand will make my model turn out to be incorrect.

3) Income Statement

Bear

Bull

This is fairly simple, because I've already made most of the predictions in the two previous parts. There are only 4 predictions left to make:

- I'm assuming Services & Other will drop slightly as a percentage of automotive revenues, but eventually stabilize at 7% to 8%. In the bear case, I'm not expecting the margin will improve very much, and have it stay steady around -12.5%. In the bull case, I'm projecting slightly more margin improvement to -7.5%.

- OPEX should reduce as a percentage of overall revenues as per Tesla's guidance and common sense, but I do expect significant OPEX increases over the next few years. I have SG&A flatten out at 6.75% in the bull case, and at 8% in the bear case, resulting in 16.6% and 10% operating margins respectively.

- Taxes are incredibly difficult to predict. I think it's a given that Tesla will start to pay a lot more taxes as it starts to book significant profits over the next few years, but we have no past data to help us determine what % of EBT will go towards taxes. Some other large companies (APPL, AMZN, etc.) appear to fluctuate and go as low as 15% and as high as 33% at different points in time. For Tesla, I've modeled in 20% in the bull case, and 25% in the bear case.

- Shares Outstanding aka dilution, I've modeled at about 6M shares per year, simply because that's what dilution has been like for the past few years, excluding capital raises. This one is also quite difficult to predict accurately though.

4) Summary

Bear

Bull

Now with all of the predictions out of the way, let's take a look at a high level overview of what I've forecasted, and do some final checks on whether these numbers are reasonable.

Energy

Bear

Bull

Comparing numbers from the 4th quarter of 2019, to those of 2020, 2021, and 2022, we can see I've projected revenue growth of 45%, 42%, and 40% YoY in the bear case, and 59%, 65%, and 46% in the bull case. These seems quite reasonable to me, and conservative if anything considering the introduction of the much more expensive Solar Roof product. As I've said, I believe demand is there to grow much faster, but I think Tesla Energy will be limited by the amount of talent and batteries available to help it scale.

In terms of margin, I've projected a change from 11.7% in Q4'19 (but 21.9% in Q3'19) to 18-20% by the end of Q4'22. This is probably too low, but it's in a large part due to unknowns about the new Solar Roof product's margins, and me not wanting to predict high margins for a product that we simply don't know the margins of.

Automotive

Bear

Bull

The increase from today's ~100k deliveries per quarter to 460-540k per quarter might seem crazy, but keep in mind Tesla already has production capacity for ~172.5k per quarter online as of today (22.5k S+X, 100k 3+Y Fremont, 50k 3 Shanghai. On an annualized growth rate, that is only 45-55% annual growth, and pretty much exactly what Tesla is forecasting.

Yearly deliveries predicted by these models are as follows:

- 2020: 495k to 545k

- 2021: 960k to 1.12M

- 2022: 1.47M to 1.92M

The last thing to look at here is gross margin. "Total Margin" includes credits sales and automotive leasing, the "Sales Margin Excl. Credits" is the margin strictly from new car sales, which was right around 20% at the end of 2019. This is certainly going to increase as more and more of Tesla's production will come from new factories with much higher margins. Besides cost savings from lessons learned, the ramping of M3 production capacity at Fremont was particularly inefficient compared to future product ramp ups:

|

| https://ir.tesla.com/static-files/b2218d34-fbee-4f1f-ac95-050eb29dd42f |

In the bear case, I've projected gross margins to increase to 21.6% from the aforementioned 20%, and in the bull case, I've projected them to increase to 26.1%.

Financial Performance

Bear

Bull

The most important things to look at here, to check if my predictions are sensible, are OPEX and operating margin. OPEX has been around 15% of revenue in recent quarters, but Tesla has guided that this will go down, which makes total sense if you think about it. The R&D portion of Tesla's OPEX I believe is currently limited by the amount of available talent. I base this on some comments Elon has made in recent interviews (Air Force, Third Row) and on recent earnings calls. This is likely why Elon has talked about establishing overseas R&D centers; to take advantage of talent in different geographical locations. This scarcity of available talent, I believe will limit the growth of R&D spending.

As for the SG&A portion of OPEX, I do believe this will start to grow again significantly as Zach mentioned on Q4'19 ER, but large parts of SG&A expenses, like for example retail stores, are not going to grow as quickly as Tesla's revenue. Most of the increases in Tesla's expenses associated with revenue growth are production/factory costs, which go into costs of revenues on the income statement, and not into OPEX.

By the end of 2022, I've forecasted OPEX to decrease to 10.4% of revenue in the bear case, and 8.9% in the bull case, for operating margins of 16.6% and 10% respectively. That bull case of 16.6% operating margin might be a bit of a stretch, and would certainly send the stock flying, but 10% should be very doable, and I'd be very surprised with and disappointed in anything less than 10%.

Stock

Bear

Bull

Here you can find a couple of useful high level statistics. Even the ones from the bear case would be received extremely positively, and would certainly send the stock much, much higher than current levels. I'll use these and go into more detail into them in the next section of this blog.

4) TSLA Options

Now that we have some predictions for what the next few years for Tesla will look like, I can explain the second part of my investment strategy, TSLA options, which, if things go well, will hopefully allow me to achieve some of my miscellaneous goals.

My TSLA Options Strategy

As mentioned, I use TSLA options to give me a much better chance at reaching my miscellaneous goals, which would otherwise be nearly impossible to achieve. In order to do so I am willing to take on slightly more risk, but I am by no means completely indifferent like the person from the example of the 45 year old trying to turn $20M into $2B to buy Manchester United.

This is partly because I am much younger, and I realise that my life, my investment goals, and the world as a whole could very well differ in 10 years from what they are now. It is also partly because I don't need a clearly defined amount of money for my goals, like the example of the person who wants to buy Manchester United. One hundred times the amount I need for financial freedom, or more, would certainly be very helpful, but 10-20x might also get me quite far. It's not entirely set in stone yet.

To achieve these goals, it would of course be helpful if TSLA does better than my bear case for 2030 of about $1.5T to $2T, and achieves a market cap of ~$5T, or even $10T. However, I can't influence that, so what I try to do is take advantage of periods where I think TSLA SP is low compared to where I project fundamentals will be at 1 to 2 years in the future, by buying TSLA Call Options with expirations 1 to 2 years in the future.

How I go about this is a multi-step process:

- Create detailed financial projections for TSLA for the next few years, like the ones I shared in the previous section.

- Look at where TSLA SP could be in 1 to 2 years. Usually I use an EBIT multiple for this.

- Build in a margin of error for both my predictions and the timeline of them happening.

- Look at the risk reward profile of various call options on the market.

- Consider my overall portfolio, whether certain options fit in it, and if so how large a position I want to open.

Let's walk through these step by step.

1) Create Financial Projections

We've already done this in the previous section.

2) Make SP Predictions

To do this, I personally like to use EBIT as a valuation metric. Revenue just doesn't tell the whole story, and omits far too much crucial information. Bottom line earnings is too hard to accurately forecast, because it's earnings after taxes. EBITDA I've never been a fan of, and also suffers from DA being rather hard to forecast. EBIT is perfect in my opinion, because it's very similar to bottom line earnings, and it is also relatively easy to forecast and make predictions for.

Choosing an appropriate EBIT multiple for what I think the market will value TSLA at is much more difficult. Looking at competitors' EBIT multiples is pretty much useless in the case of TSLA, and looking at historic valuations is also not super useful, because Tesla has only just started posting EBIT profits. There's no exact science, but I like to use a combination of my feeling for how the market currently values Tesla, and by looking at EBIT multiples of various other companies.

|

| Data from Macrotrends.net, numbers in millions, growth is annualized |

As you can see, in today's market it's uncommon for a large tech company to be valued at anything less than 20-25x EBIT, even if that company is growing very slowly, and a lot of the ones that are growing rapidly at 20-40% CAGR are valued at ~30-50x EBIT.

Although I'm not an expert on Netflix nor Amazon, I'd imagine that their EBIT multiples are inflated partially because investors expect there is a lot of room for improvement in the operating margin of those companies. Due to the nature of Amazon's business, I doubt it's possible for them to achieve Facebook levels of operating margin, but I'd imagine it could be possible for them to double it to 10%. Netflix, as a largely software/online service company, I could also see them achieving a much higher operating margin than 13% in the future.

Going back to Tesla, considering how rapidly it is growing and how early it is still is, I think an EBIT multiple of 50x is very reasonable, and quite possibly conservative. Even in my bull case for 2022, Tesla's yearly production rate will only be ~2M units, which is far below long term potential of at least 10M units per year, perhaps as high as 20M+ units per year. If one wants to be extra conservative, perhaps one could use an EBIT multiple of 40x, but I personally think 50x is more than reasonable at this point in time, especially now that the market seems to have begun to realise Tesla's long term potential a little bit.

Taking this EBIT multiple, I prefer to apply it to an extrapolated EBIT rather than a TTM (Trailing Twelve Months) EBIT. Tesla is growing so rapidly that at most points in time, financials from a few quarters ago are already outdated. Although there is some seasonality, I think multiplying the most recent quarter's EBIT by 4 to get an 'extrapolated EBIT', and applying the 50x EBIT multiple to that number, is the best way to value Tesla.

The extrapolated EBIT numbers and stock prices @ 50x EBIT from the bear and bull models are:

Bear EBIT:

Q4'20 - $4.8B

Q4'21 - $7.0B

Q4'22 - $10.2B

Bear SP:

Q4'20 - $1,185

Q4'21 - $1,702

Q4'22 - $2,384

Bull EBIT:

Q4'20 - $6.7B

Q4'21 - $12.4B

Q4'22 - $18.9B

Bull SP:

Q4'20 - $1,663

Q4'21 - $3,005

Q4'22 - $4,438

3) Account for a Margin of Error

Next let's apply a bit of common sense to these numbers. I'd say that the SP of $1,185 after Q4'20 in the bear scenario is actually far too conservative. If things really play out as the model predicts, those numbers would lead to a much higher SP than $1,185, because even those bear financials are far better than anybody is expecting. It would undoubtedly lead to much more than a 30% increase in SP from today's levels.

On the other hand, I could be wrong about some of my assumptions, something unforeseen could delay things, and/or other factors such as macro-economics could keep the SP down. However, I still think a SP of at least $1,200-1,400+ by mid-2021 is quite a safe bet, especially considering S&P 500 inclusion will also almost certainly happen between now and then.

From 2021 and onwards, there is a larger disparity between the bear and bull cases, mostly due to the big difference in operating margins. Although I do truly believe the bear case to be on the conservative side, there is a real chance I'm off by some degree, and/or some things progress slower than expected. Nonetheless, I think a SP of $1,500+ by mid-2022 is a very safe bet, and I think it's much more likely we'll approach $2,000, perhaps even exceed it by quite a bit.

The further you predict into the future, the higher the likelihood you're off, but looking at my projections, I'd be shocked if TSLA does not achieve a SP of at least $2,000+ some time in 2023, and I think a SP of $3,000+ is much more likely.

Again, I'm erring on the side of caution here. I could easily make a case for a SP well in excess of $5,000 by 2023, especially considering none of these predictions factor in significant developments on the autonomy front. But even without that, although I'd say it's <50% likely that the financials from my bull scenario will become a reality, I think it's >50% likely that TSLA will be valued at >50x EBIT by the market, so I think a case can definitely be made for $5,000+ some time in 2023.

4) The Risk Reward of Call Options

There are no call options for 2023 yet. Jan'23 options should come out in mid-September most likely, but there are call options available for trading up to Jun'22, so I could potentially use my predictions of $1,200-1,400+ by mid-2021 and closing in on $2,000 by mid-22 to make some bets on call options, if the risk/reward is good enough.

These are the current Jun'21 and Jun'22 Call Options Chains:

Jun'21

|

| https://www.barchart.com/stocks/quotes/TSLA/options?expiration=2021-06-18-m&moneyness=allRows |

Jun'22  |

| https://www.barchart.com/stocks/quotes/TSLA/options?expiration=2022-06-17-m&moneyness=allRows |

You might be tempted to look at the Jun'22 chain, see that the $1,000 call option is for sale for ~$225, calculate that you would make a little over 4x your money if TSLA goes to $2,000 by then, and jump at the opportunity to open a position. However, this would be a humongous mistake. If your job paid you 9$ per hour, and I offered you a job that made $8 per hour, or a job that made $100 per hour, but at the end of every year you'd have a 90% chance of not getting paid a dime, you wouldn't take neither of those offers either.

For every options trade, you can't just look at whether the trade will be profitable or not, it has to be more profitable than investing in the underlying stock, especially in the case of TSLA, because the underlying stock is such a safe, high potential upside investment over the next decade. Therefore, one must calculate every options trade in number of shares, rather than in monetary value, gained or lost.

Applying this to the Jun'22 $1,000 call option, gives us a cost of about 28 shares ($22.5k option cost divided by current SP of $800), and if the SP reaches $2,000, a pay off of 50 shares (($2,000 - $1,000) * 100 = $100,000 profit on option, which is 50 shares at a SP of $2,000). Turning 28 shares into 50 shares is a return of less than 2x in terms of shares, compared to the more than 4x return in terms of monetary value.

Let's do this comparison between calculating option ROI in dollars and number of shares one more time more slowly:

An options trade calculated in dollars

- Buy a Jun'22 $1,000 call option for $22,500.

- If upon expiration the SP is $2,000, the option will be worth $2,000 minus $1,000 times 100 = $100,000.

- Profit is $100,000 minus the $22,500 initially paid for the option, so $77,500.

- ROI is $77,500 / $22,500 = 344%.

An options trade calculated in number of shares

- Buy a Jun'22 $1,000 call option for $22,500. $22,500 is currently worth $22,500 / $800 = ~28 shares.

- If upon expiration the SP is $2,000, the option will be worth $2,000 minus $1,000 times 100 = $100,000. This $100,000 is equal to exactly 50 shares at a SP of $2,000, because $2,000 * 50 = $100,000.

- Profit is 50 shares minus 28 shares, so 22 shares.

- ROI is 22 / 28 = 79%.

You can see that there is a huge difference.

Now that we know how to evaluate options trades, let's compare a number of Jun'22 call options, and see if any look attractive at current prices.

This table calculates the returns of a number of Jun'22 call options at strike prices ranging from $500 to $1,800 in number of shares, based on a 100 shares investment of $80,000. Most people will likely find this table confusing, so I've also created the following graph, which should be much easier to interpret:

Obviously 100 shares worth of TSLA stock will always be worth 100 shares, but you can see that different options will be worth different amounts of shares at different stock prices upon expiration. The $500 options will be worth no more than ~150 shares (based on 100 shares / $80k investment), even if the SP goes up to $3,000, whereas the $1,500s and $1,800s have the potential to be worth over 300 shares in the same scenario.

Looking at this graph, I actually believe that none of the Jun'22 options are great from a risk/reward standpoint at this point in time, at least for me personally. They're okay, but I usually prefer to look for at least 2x, preferably 3x returns on an options trade, because of the higher risk associated with them. In this case, even if I'm right that TSLA should at least come close to $2,000 by mid-2022, none of these options will even return 2 times my investment, and only the two riskiest ones can return 3x or more, and only if SP goes all the way up to $3,000+, which is far from certain. On the other hand, if I somehow end up being wrong about some things, I could lose my entire investment, whereas the stock is in my opinion extremely safe.

Fortunately enough, I was able to buy the options I currently hold at much lower prices. I'll talk a little more about those later, but if I held no options at all today, I'd probably be interested in buying some Jun'22s, perhaps a mixture of calls at a low strike price less than $1,000, some in between $1,250 and $1,500, and a few speculative ones at $1,800. However, the risk reward profile isn't looking super attractive to me right now, so I'd buy a lot less than I was fortunate enough to be able to buy at better prices.

Before we move on, let's also do a quick comparison between some of the Jun'21 call options.

These options look a lot more attractive to me at the moment, although SP will likely not be as high in mid-2021 as it will be in mid-2022, so even these Jun'21s require quite a lot of things to go right to return more than 2x. To gain more than 3x, would require a much higher EBIT multiple than 50x, and/or a pretty big boost from S&P 500 inclusion. I think these are both possible by mid-2021, so that's why I think Jun'21s are slightly more attractive than Jun'22s right now, but still option premiums are high, and these are far from no-brainer investments.

Like I said, I'm already pretty happy with my current options portfolio, but I will keep an eye on these Jun'21s and perhaps buy a few around the $1,400 strike price, if a good deal presents itself.

One last thing before we move on, is something that is good to have a mental image of, namely the value of a particular option in number of shares as the SP moves up and down.

Because a call option is a contract to buy 100 shares at a certain price, the option can never be worth more than 100 shares, and as the SP goes to infinity, the value of the option will approach 100 shares. Realising this, and knowing that the value of an option is:

- 25 shares when the SP is 33% higher than the strike price

- 33 shares when the SP is 50% higher than the strike price

- 50 shares when the SP is double the strike price

- 67 shares when the SP is triple the strike price

- 75 shares when the SP is quadruple the strike price

5) Fitting Options into a Portfolio

Just like we compared the value of various options in numbers of shares at different stock prices, we can also compare the value of different portfolios at different stock prices.

If you're interested in taking a more detailed look at the various tables and graphs presented for options/portfolio comparisons in these sections, please check out this document:

The following table + graph, as well as the ones from the last section are in this spreadsheet.

This graph compares 6 different portfolios from "Lev 0" to "Lev 100", named after what percentage of the portfolio is leveraged into call options. You can see the composition of each portfolio in the table above. They are comprised of a mixture of stock, and Jun'21 and Jun'22 options at various strike prices.

I've found that creating tables and graphs like this can be extremely useful in getting a feel for how much leverage I am taking on, to see how much of my portfolio I am allocating to a certain instrument, and to see potential gains and losses in various scenarios. These are a few of many factors I weigh in my ultimate decision on what options trades to make. They're a final check of sorts before going ahead with a trade.

My Past Options Trades

Trade #1: Jan'22 $400s

I already posted about one of my first big options trades back in October, when I opened a position in Jan'22 $400s. My reasoning at the time, which I explained in that blog post, was that even if sentiment around Tesla remained quite negative, I simply saw no way TSLA would not at least go above $400 by Jan'22 off of Giga Shanghai and Model Y ramp ups.

Trade #2: Jan'22 $500s

Around the end of November, a lot of things had changed in just two months:- Shanghai was progressing more rapidly than most people had expected.

- There were a lot of signs that the Model Y was way ahead of schedule, and that start of production was imminent.

- Tesla's Q3'19 ER was one the best in its history, showing massive gross margin improvements, a ton of cost reductions across the board, and a large operating margin improvement.

After I reran all the numbers, I came to the conclusion that, even if negative sentiment around Tesla would continue, a SP of $600 was now likely the minimum we would see by Jan'22. I also thought there was a lot of potential for a much higher SP of $800 to $1,200, strictly based off of fundamentals.