Tesla's $1.8B Valuation Allowance: Could it mean FY 2019 GAAP profits and immediate S&P 500 inclusion?

FY 2019 GAAP profits through execution

Tesla's Q4'19 earnings that are coming up in a few days have been the most highly anticipated Tesla earnings in quite a while. There's a lot of hype around the surging stock price, and around the company in general due to high expectations for 2020. Besides improving fundamentals from the Giga 3 and Model Y ramps, many people are also very excited about the effect S&P 500 inclusion could have on the stock price. When Tesla is included in the S&P 500, a large number of funds tracking the S&P 500 index will be forced to buy Tesla stock. Some have estimated this could be as much as 15-20 million shares, based on studying what happened to Twitter when it was included in the S&P 500 in 2018 and its stock surged over 50%.The last requirement Tesla has to fulfill to be eligible for S&P 500 inclusion is to show TTM (Trailing Twelve Months) GAAP profits, which many people expect Tesla to hit some time in 2020, possibly as soon as Q1'20. Some people, however, have been theorizing whether it's possible for Tesla to be GAAP profitable in 2019, and be included in the S&P 500 shortly after Q4'19 earnings.

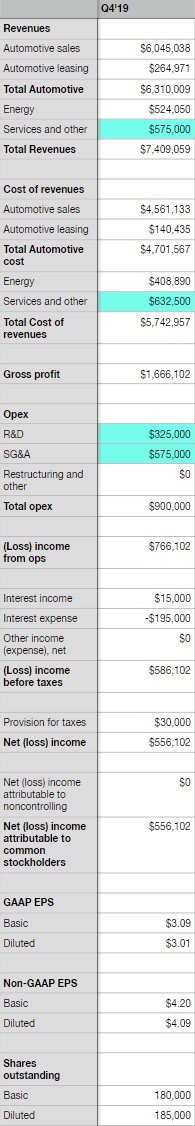

For this to happen, Tesla would have to show approximately $967M in GAAP profits in Q4'19. If you've read my Q4'19 Earnings Forecast blog, you might remember that I'm expecting $257M in GAAP profits, so Tesla would have to beat my forecast by $710M in order to be GAAP profitable for FY 2019. Even if I fill in the most bullish of bullish predictions in my model (30% Energy growth QoQ, similar cost reductions to the stellar Q3'19, etc.), I can only get to $556M in GAAP profits:

Therefore, I think it's safe to rule out FY 2019 GAAP profits through execution alone. I can't think of any realistic scenario in which Tesla's business on its own made Q4'19 so good that they've achieved GAAP profits for the entire year.

FY 2019 GAAP profits through the sale of options

One to two weeks ago, there was some discussion on the TMC Investor forum about the value of the call options Tesla bought on itself as part of a hedge against dilution from the convertible bonds it sold in the past. Here are links to a couple of excellent posts on the topic from users ReflexFunds and Fact Checking:

A simplified explanation of all this is as follows:

Tesla sold convertible bonds on a couple of occasions in the past to raise funds. These convertible bonds are basically debt that can be converted into stock if the SP is above a certain threshold upon expiration. To limit dilution in case this debt is converted into stock, Tesla bought call spread options alongside them. Fact Checking's theory is that Tesla could decide to sell the call spread options prematurely, and that the proceeds from these could end up on the income statement, cause FY 2019 to be GAAP profitable, and then subsequently lead to an early surprise S&P 500 inclusion.

Personally, I think this is highly unlikely to happen. Yes, Elon could potentially hurt the short sellers and cause a massive squeeze, but I don't see any other reason for Tesla to do this. S&P 500 inclusion will almost certainly happen in 2020 anyway, likely as soon as after Q1'20, and these call spread options were bought as hedges. If Tesla sold (part of) them at the end of 2019 when SP was ~$430, this would kind of defeat their purpose, and in my eyes be bad for the company and its shareholders in the long term.

Last but not least, nobody knows for certain whether the sale of these call spread options would be accounted for on the income statement. It's possible that they would be accounted for differently, and not lead to FY 2019 GAAP profits. Therefore, I think this theory is almost as unlikely as FY 2019 GAAP profits through execution. A bit more plausible, but I'd be really surprised if this happened, and I'd be concerned and I'd want to know more about why they decided to sell these options so prematurely.

FY 2019 GAAP profits through a valuation allowance release

Last weekend there was a post on the TMC Investor forum by user The Accountant pointing out a very interesting detail from Tesla's finances, that also could in theory affect Q4'19 financials enough to lead to FY 2019 GAAP profits. The Accountant pointed out that Tesla has a $1.8B valuation allowance on its balance sheet that, if (partially) released in Q4'19, would be more than enough to push Tesla over the $967M in GAAP profits it needs in Q4'19 to make FY 2019 GAAP profitable and qualify for S&P 500 inclusion.

If you've never heard of VA (valuation allowance) before, I don't blame you. It's a pretty obscure accounting tool, and I had never heard of it before either when I read the post. But after spending most of last weekend researching this subject, I now have a solid understanding of what it is, and of how it affects Tesla and its chances of S&P 500 inclusion as early as February or March. This post is meant to be a brief(-ish) summary of all of the research that was done on TMC last weekend (including my own), and of what impact it could have on TSLA.

What is a valuation allowance?

A valuation allowance is a balance sheet item used to discount another balance sheet item or multiple balance sheet items, to account for unknown factors. The $1.8B valuation allowance on Tesla's balance sheet that we are talking about is used to discount Tesla's DTAs (Deferred Tax Assets) to account for the unknown.

In simpler words, Tesla has been losing money for most of its history, and it can put these losses on its balance sheet and use them in the future to weigh against profits. Further simplified, if a company loses $1B in year one, and then profits $3B in year two, it will only have to pay taxes over $2B, because it can subtract the $1B in losses first. DTAs are a little bit more complicated than this, but in essence this is what they are.

The uncertainty here, and the reason we need to account for a VA, is that being able to use these DTAs in the future depends entirely on being able to profit in the future. From an accounting standpoint, an otherwise healthy company that's always been profitable but books a loss in a single year due to a global crisis or something of that nature, should be expected to return to profits in the following year, and therefore can safely account these DTAs on their balance sheet expecting to be able to use these in the near future. A company that has never shown a yearly profit, however, from an accounting standpoint cannot account for these DTAs and claim to expect to be able to use them in the future. They would only have future projections to base these claims on, and little to no "objectively verifiable evidence". Therefore, companies in this situation are required to account for a "valuation allowance" on their balance sheet that discounts DTAs that they are "more likely than not" unable to use in the future.

An example of this is Uber:

|

| https://www.sec.gov/Archives/edgar/data/1543151/000119312519103850/d647752ds1.htm |

As you can see, in 2018 Uber had a total of $2.24B in DTAs on its balance sheet, but it accounted for a $1.29B VA to discount DTAs it predicts (from an accounting standpoint) are "more likely than not" not fully realizable. Their total DTAs that they expect to be able to use in the future therefore are $947M.

In their SEC filing, Uber stated the following about their DTAs:

Based on available evidence, management believes it is not more-likely-than-not that the net U.S., Singapore, India, and Netherlands deferred tax assets will be fully realizable. In these jurisdictions, the Company has recorded a valuation allowance against net deferred tax assets. The Company regularly reviews the deferred tax assets for recoverability based on historical taxable income, projected future taxable income, the expected timing of the reversals of existing taxable temporary differences and tax planning strategies by jurisdiction. The Company’s judgment regarding future profitability may change due to many factors, including future market conditions and the ability to successfully execute the business plans and/or tax planning strategies. Should there be a change in the ability to recover deferred tax assets, the Company’s income tax provision would increase or decrease in the period in which the assessment is changed. The Company had a valuation allowance against net deferred tax assets of $1.1 billion and $1.3 billion as of December 31, 2017 and 2018, respectively. In 2018, the change in valuation allowance was primarily attributable to an increase in U.S. state deferred tax assets resulting from the loss from operations and U.S. federal and state tax credits generated during the year.

How does a reduction in VA impact the income statement?

You might've noticed this part on Tesla's income statement:

The "provision for taxes" portion of the income statement is where a company accounts for taxes. Part of the taxes it accounts for in this section are future taxes in the form of DTAs and DTLs (Deferred Tax Liabilities). Just like a company might not have to pay all of its suppliers until after the quarter ends, and it might not receive payments for everything it sold in the quarter until after the quarter ends, it might also not have to pay for, or receive benefits from, taxes that should be accounted for in a certain quarter.

Let's go back to the example of a company that loses $1B in year one and profits $3B in year two. Assuming a 10% tax rate, this company would account for a $100M tax benefit in year one, showing up as a -$100M provision for taxes on that year's income statement, and an addition of $100M to its NOLs (Net Operating Loss Carry Forwards) on the balance sheet (NOLs are a form of DTAs). In year two, this company would account for a $300M tax payment, showing up as a +$300M provision for taxes on that year's income statement that is subtracted from its overall profits, and it would pay for this with $200M in cash and by using the $100M in NOLs on its balance sheet from the previous year.

I hope you're able to follow all of this so far, because now we'll talk about the part we're really interested in: how a reduction in VA impacts the income statement.

When a company like Tesla, that has thus far been unprofitable, and from an accounting standpoint cannot be sure if it will be able to use DTAs in the future, records a loss, it won't impact the income statement in the same way as it did in the previous example. If you look at Tesla's income statements of the past, you'll notice that it has almost always accounted for income taxes it has to pay, in spite of almost always losing money:

The main reason for this is that Tesla has been unable to account for DTAs on their income statement, because it has thus far been unable to prove with "objectively verifiable evidence" that it will be able to use them in the future. It has therefore discounted them with a VA, and they have not really shown up on the income statement. However, when Tesla (and other companies in similar positions) start to turn the corner on profitability, and are suddenly able to say from an accounting standpoint that it is "more likely than not" that they will be able to use DTAs in the future, they will reduce the VA and account for these now "more likely than not" realizable future tax benefits all at the same time. The most recent example of this happening with a big company is Twitter in Q3'18:

|

| https://s22.q4cdn.com/826641620/files/doc_financials/2018/q3/Q3-2018-Shareholder-Letter.pdf |

As you can see, Twitter reduced their valuation allowance by ~$700M in Q3'18, and as a result made an otherwise marginally profitable quarter ($87M) hugely profitable ($789M).

Of course this doesn't really mean Twitter made some huge profits that quarter, and it's not like the stock 10x'ed overnight, because nothing materially changed about the business. The only thing is that Twitter's accountants and auditors felt like there was enough "objectively verifiable evidence" to determine that Twitter was "more likely than not" going to be profitable enough in the future to make use of the DTAs on their balance sheet.

So then why are people talking about this with regards to Tesla? That's because in Q4'19 specifically, a large boost like this to Tesla's income statement would be enough to make Tesla's FY 2019 GAAP profitable, which in turn would all but guarantee S&P 500 inclusion. As we've discussed, this would lead to the forced buying of a large number of shares by S&P 500 index funds, and this would definitely boost SP significantly, and possibly squeeze out a lot of the shorts.

So how likely is this to happen?

To determine this, I did two case studies on the VA reductions of unprofitable companies that turned profitable:

The Amazon case study, unfortunately enough does not bode well for Tesla. The main issue is that a lot of the VA from Amazon's balance sheet did not make its way to the income statement for some reason. Details in Amazon's SEC filings on what exactly happened are a bit scarce.

The Twitter case study, however, bodes a lot better. The vast majority of Twitter's $1B VA made its way onto the income statement in a single quarter, so considering Tesla has a $1.8B VA and it only needs a ~$700M boost to its Q4'19 financials for FY 2019 GAAP profitability, if there is a reduction in Tesla's VA in Q4'19, it would really surprise me if it was not enough to be included into the S&P 500.

|

| https://ir.tesla.com/static-files/15df7636-8cd8-4b18-989b-4badeeda806c |

So then the only question that remains is, will Tesla reduce its VA in Q4'19, or will it not? Based on this podcast, it sounds like it needs to be more than 50% likely you can claim DTAs, "objectively verifiable evidence" outweighs projections, it's not an exact science, and a lot of judgement is involved. Nobody outside of Tesla's finance department is able to do anything but guess as to what will happen. This is how I feel about things:

It think it is possible because:

- Tesla is turning the corner on profitability. With Q4'19, it'll have been GAAP profitable for four out of the last six quarters.

- Looking forward, almost everybody is expecting Tesla to be profitable going forward on a yearly basis. Tesla's internal finance people are likely projecting the same.

- Tesla's current large order backlog could help convince auditors and serve as "objectively verifiable evidence".

- Elon hates the short sellers, and I'm sure he would love squeezing them if at all possible.

I think it is ultimately not super likely because:

- Tesla has never had a GAAP profitable year.

- "Objectively verifiable evidence" outweighs future projections. Tesla's past shows losses, Tesla's future shows profits. The past weighs more heavily from an accounting standpoint.

- Twitter reduced its VA two quarters after its S&P 500 inclusion. This indicates Tesla might not release their VA until around Q3'20.

- S&P 500 inclusion is pretty much guaranteed to happen in 2020 anyway, so Tesla doesn't have to jump through hoops to get it this quarter.

Conclusion

I'm really looking forward to TSLA's Q4'19 earnings this Wednesday, because it will be exciting regardless of what happens. There is some chance of a big surprise in the form of a VA release causing FY 2019 GAAP profits and leading to S&P 500 inclusion, but personally I'd put the chances at somewhere in between 10-20%. The arguments against it happening outweigh the ones for, in my opinion.

I think you might've forgotten to figure in revenue from the carbon credits that they've been selling to Ford, GM, and Daimler Fiat. IIRC, those account for over a billion in gross revenue, so you're most bullish prediction could be as pretty reasonable.

ReplyDeleteAndy,

DeleteI do account for credit sales in my model under the Automotive section, but I did not post that in this blog. You can take a look at how I account for them in my Q4 Earnings Forecast blog. For the model with the most bullish numbers that I posted in this blog, I actually doubled the credit sales to $200M from the $100M I predicted in my Q4 Earnings Forecast blog.

I don't know where you're getting the "over a billion" in credit sales number, but it is incorrect. Tesla sold $100-150M in credits per quarter in the first three quarters of 2019. It's possible that in 2020 they will sell $1B+ in credits for the full year because of the FCA deal, but the details of this deal have not been made public, so we'll have to wait and see.

This comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteHave you taken into account the FCA deal of €2 billion? And its effect on future profits (FY 2020)?

ReplyDeleteValuation Allowance is basically the difference in depreciation charged by the company and the least chargeable depreciation under tax laws.

For example: The company takes useful life of an asset as 5 years even though tax laws allow for 15 years of useful life. The additional depreciation charged can go towards Valuation Allowance.

My presumption would be that in such cases, if the company goes for re-evaluation of assets by a chartered engineer & it is more than the residual value as per the useful life criteria allowed by tax laws, the company can appropriate the valuation allowance of that asset towards profits.

I don't think you correctly understand what a valuation allowance is, nor the nature of the $1.8B valuation allowance on Tesla's balance sheet.

DeleteThe FCA deal is a good point though. This could serve as a piece of "objectively verifiable evidence" to explain to the auditors why Tesla will be profitable going forward.

And I am sure that many of the robots which had become defunct in 2018 because of over-automation (and had to be thus written off) have been re-purposed for the new line and have suddenly become useful and may be re-evaluated and the valuation allowance for them added to P&L account.

ReplyDeleteAnd I am also quite sure that Elon Musk would like Tesla to be included in S&P 500 as soon as possible, not because of any 'short squeeze' but, he can then raise funds at will for all the expansion plans he has in mind.

ReplyDeleteI don't think you're aware of what great of a financial position Tesla is in at the moment. Considering their current cash position of ~$6B, their current cash flows, as well as their future cash flows after Giga Shanghai and Model Y have fully ramped, I think there is very little chance Tesla will need to raise money again.

DeleteAnother item which shows up in valuation allowance is income received but not earned. Mostly, FSD package payments. Tesla can always recognise part of that income & the tax paid on it.

ReplyDeleteVinod,

DeleteIt seems like you don't correctly understand what a valuation allowance is. It's a really complex and obscure accounting tool, that's very difficult to correctly understand.

If you want to understand, I suggest you reread the blog, or perhaps find some other explanations/examples through Google. Here is a link to another explanation:

https://www.accountingtools.com/articles/deferred-tax-asset-valuation-allowance.html