TSLA Holders Q2'20 (Top 69)

This blog gives an overview of who the largest TSLA shareholders are as of the end of Q2'20, and how it changed compared to the end of Q1'20.

For the previous two installments please refer to:

A spreadsheet with the complete data can be downloaded here:

Top 69 TSLA Holders Q2'20

#1: Elon Musk

Type: Insider

Previous Rank: #1

Previous Shares: 38,658,670

Current Shares: 38,658,670

Change: 0%

Stake: 20.7%

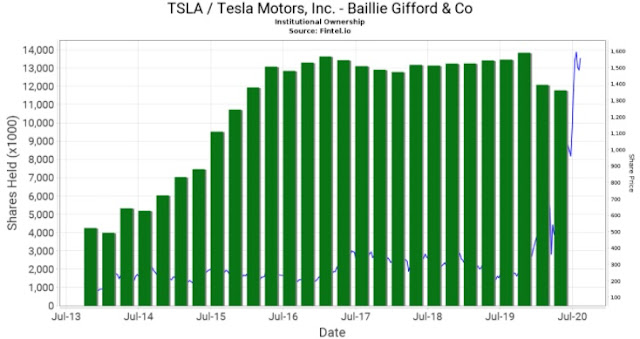

#2: Baillie Gifford

Type: Long Term Institutional Investor

Previous Rank: #2

Previous Shares: 12,076,416

Current Shares: 11,771,213

Change: -2.5%

Stake: 6.3%

Allocation: 9.69%

|

| https://fintel.io/so/us/tsla/baillie-gifford- |

I think we're about to find out in Q3 and Q4 whether Baillie has a limit to how much of its portfolio it can invest in a single stock. At the end of Q2 at a stock price of $1,079.81, 9.69% of Baillie's portfolio was invested in TSLA. Many funds have certain rules in place that they are not allowed to break, such as only being allowed to invest up to a certain percentage in a single stock. In the case of ARK, they are only allowed to invest up to 10% of each of their funds in a single stock.

The funds ARK is managing are mutual funds though, and Baillie is a very different investor than ARK, so it's not certain that Baillie has to sell off shares as TSLA becomes over 10% of its portfolio, but with TSLA's current stock price at over $1,600, TSLA makes up approximately 15% of Baillie's entire investment portfolio, so I wouldn't be surprised if Baillie will decrease its exposure to TSLA over time. If in 3 months we find out that Baillie has not sold off much during Q3 and TSLA is at 15% (or even 20% if the rally continues) of its overall portfolio, that'd be an insanely bullish sign towards Baillie's confidence in TSLA. But I think it's more likely than not, Baillie will have decreased its stake in Q3.

Baillie's second biggest investment is currently AMZN at 8.66% of its portfolio, with BABA coming in 3rd at 6.70%, and ILMN coming in 4th at 4.83%.

#3: Capital World Investors

Type: Long Term Institutional Investor

Previous Rank: #3

Previous Shares: 10,714,131

Current Shares: 10,678,093

Change: -0.3%

Stake: 5.7%

Allocation: 2.79%

|

| https://fintel.io/so/us/tsla/capital-world-investors |

#4: Vanguard Group Inc

Type: Long Term Institutional Investor

Previous Rank: #4

Previous Shares: 8,662,781

Current Shares: 8,852,837

Change: +2.2%

Stake: 4.8%

Allocation: 0.34%

|

| https://fintel.io/so/us/tsla/vanguard-group |

I think there's room for Vanguard to accumulate more TSLA shares over time, because compared to other large tech companies its stake in TSLA is actually quite low. Vanguard owns 10.26% of BRK.B, 8.64% of Visa, 8.17% of MSFT, 7.64% of FB, 7.41% of AAPL, and 6.46% of AMZN, compared to only 4.8% of TSLA.

#5: BlackRock Inc

Type: Long Term Institutional Investor

Previous Rank: #5

Previous Shares: 7,213,587

Current Shares: 7,719,768

Change: +7.0%

Stake: 4.1%

Allocation: 0.33%

|

| https://fintel.io/so/us/tsla/blackrock |

Same story as with Vanguard. BlackRock owns 8.00% of BRK.B, 7.30% of Visa, 7.30% of JNJ, 6.80% of MSFT, 6.60% of FB, 6.30% of AAPL, and 5.40% of AAPL, compared to only 4.1% of TSLA.

#6: Growth Fund of America

Type: Mutual Fund

Previous Rank: #6

Previous Shares: 5,080,353

Current Shares: 5,145,353

Change: +1.3%

Stake: 2.8%

Allocation: 2.15%

This mutual fund is managed by #3 Capital World Investors.

#7: Fidelity

Type: Long Term Institutional Investor

Previous Rank: #7

Previous Shares: 4,615,556

Current Shares: 4,709,340

Change: +2.0%

Stake: 2.5%

Allocation: 0.56%

|

| https://fintel.io/so/us/tsla/fmr-llc |

#8: Vanguard Total Stock Market Index Fund

Type: Index Fund

Previous Rank: #9

Previous Shares: 4,229,383

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 0.30%

This is one of a few mutual funds that has not reported its holdings as of the end of Q2 yet, because reporting rules for mutual funds are a bit different. It's likely that its TSLA stake has increased slightly by 100-200k shares.

#9: Jennison Associates LLC

Type: Long Term Institutional Investor

Previous Rank: #8

Previous Shares: 4,320,630

Current Shares: 3,868,742

Change: -10.5%

Stake: 2.1%

Allocation: 3.78%

|

| https://fintel.io/so/us/tsla/jennison-associates-llc |

It looks like Jennison temporarily increased its TSLA stake during the COVID-19 dip in Q1, and has now slightly reduced its stake to about where it was at the end of Q4'19.

#10: New Perspective Fund

Type: Mutual Fund

Previous Rank: #10

Previous Shares: 3,377,612

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 2.23%

Another mutual fund that has not yet reported its holding as of the end of Q2. Its stake most likely stayed about the same during Q2.

This fund is also managed by #3 Capital World Investors.

#11: State Street Corp

Type: Long Term Institutional Investor

Previous Rank: #11

Previous Shares: 3,095,851

Current Shares: 3,167,130

Change: +2.3%

Stake: 1.7%

Allocation: 0.25%

|

| https://fintel.io/so/us/tsla/state-street |

You may have never heard of State Street Corp, but it's massive and has AUM of $1.4T. It's almost as large as the likes of Vanguard and BlackRock. Even more so than those two, I believe State Street Corp is quite underweight TSLA right now, and I expect its stake to continue to increase over time.

State Street Corp is the #3 largest investor in MSFT, #4 in AAPL, #3 in AMZN, #5 in FB, #3 in JNJ with a 5.77% stake, and #3 in BRK.B with a 5.66% stake. In all of these companies State Street Corp has about 50% to 70% the number of shares as Vanguard does, yet State Street Corp only has about one third the TSLA shares Vanguard does, and is only the #10 largest TSLA investor excluding Elon.

#12: Larry Ellison

Type: Insider

Previous Rank: #12

Previous Shares: 3,001,250

Current Shares: 3,001,250

Change: +0%

Stake: 1.6%

Allocation: ?

#13: JP Morgan Chase & CO

Type: Long Term Institutional Investor

Previous Rank: #13

Previous Shares: 2,816,285

Current Shares: 2,750,859

Change: -2.3%

Stake: 1.5%

Allocation: 0.57%

|

| https://fintel.io/so/us/tsla/jpmorgan-chase- |

#14: Vanguard International Growth Fund

Type: Mutual Fund

Previous Rank: #15

Previous Shares: 2,241,608

Current Shares: 2,241,608

Change: +0%

Stake: 1.2%

Allocation: 4.29%

#15: Vanguard Extended Marker Index Fund

Type: Index Fund

Previous Rank: #16

Previous Shares: 2,031,507

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 1.95%

This fund has not reported its holdings as of the end of Q2 yet.

#16: Goldman Sachs Group Inc

Type: Short Term Trader & Long Term Institutional Investor

Previous Rank: #14

Previous Shares: 2,702,701

Current Shares: 1,988,491

Change: -26.4%

Stake: 1.1%

Allocation: 0.65%

|

| https://fintel.io/so/us/tsla/goldman-sachs-group |

Although Goldman Sachs has held onto at least 600-800k TSLA shares over the years, it continuously trades in and out of much larger TSLA positions.

#17: American Funds Insurance Series

Type: Mutual Fund

Previous Rank: #17

Previous Shares: 1,908,500

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 4.17%

This fund has not reported its holdings as of the end of Q2'20 yet. It is managed by #3 Capital World Investors.

It's possible that currently, with TSLA trading at nearly $2,000, this fund is selling off some TSLA shares, because if it's still holding onto the same number of shares as it was at the end of Q1, TSLA would currently be close to 10% of its assets, which isn't something funds like this often do. At the end of Q1, its largest investment was MSFT @ 6.45% of its portfolio.

It's interesting to note that this mutual fund only has an expense ratio of 0.36%. If I'm not mistaken, that's almost as low as a lot of index funds.

#18: Invesco QQQ Trust

Type: Index Fund

Previous Rank: #18

Previous Shares: 1,906,125

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 1.20%

This index fund has not yet reported its holdings as of the end of Q2, but its TSLA stake likely remained largely unchanged, perhaps up slightly. It's an index fund after all, so it only buys and sells shares when investors buy into and sell out of the fund.

#19: Bamco Inc

Type: Long Term Institutional Investor

Previous Rank: #19

Previous Shares: 1,615,174

Current Shares: 1,617,010

Change: +0.1%

Stake: 0.9%

Allocation: 6.31%

|

| https://fintel.io/so/us/tsla/bamco-inc-ny- |

TSLA is now Bamco's #1 holding @ 6.31% of its portfolio. Bamco isn't like most of the institutional investors in that all its top positions are large tech giants (AMZN, MSFT, AAPL, etc.):

|

| https://fintel.io/i/bamco-inc-ny- |

The only other company I've even heard off among Bamco's top holdings is Alibaba. The fact that this unusual investor with $27B under management is willing put $1.75B of it into TSLA is a large vote of confidence. However, I'd imagine that their stake, which is currently worth ~$3B and likely >10% of Bamco's portfolio, can't stay the same forever. I would not be surprised if Bamco is currently taking profits on TSLA.

#20: Nuveen Asset Management LLC

Type: Long Term Institutional Investor

Previous Rank: #22

Previous Shares: 1,454,953

Current Shares: 1,434,639

Change: -1.4%

Stake: 0.8%

Allocation: 0.63%

|

| https://fintel.io/so/us/tsla/nuveen-asset-management-llc |

Nuveen is relatively new to TSLA, but nonetheless a very large investor.

#21: Geode Capital LLC

Type: Long Term Institutional Investor

Previous Rank: #21

Previous Shares: 1,463,633

Current Shares: 1,421,631

Change: -2.9%

Stake: 0.8%

Allocation: 0.33%

|

| https://fintel.io/so/us/tsla/geode-capital-management-llc |

This is the first time since 2013, when Geode first invested in TSLA, that it has reduced its stake in the company during a quarter.

#22: Primecap Management Co

Type: Long Term Institutional Investor

Previous Rank: #20

Previous Shares: 1,545,630

Current Shares: 1,318,515

Change: -14.7%

Stake: 0.7%

Allocation: 1.22%

|

| https://fintel.io/so/us/tsla/primecap-management-co-ca- |

I'm slightly surprised that Primecap decided to sell 15% of its stake in TSLA during Q2, because it's still only at 1.22% of its overall portfolio. I wonder if it had anything to do with COVID-19, or whether they're just not as bullish on TSLA as some of the other investors on this list.

#23: Harbor Capital Appreciation Fund

Type: Mutual Fund

Previous Rank: #23

Previous Shares: 1,308,380

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 3.39%

This fund has not updated its holdings as of the end of Q2 yet.

#24: JP Morgan Large Cap Growth Fund

Type: Mutual Fund

Previous Rank: #26

Previous Shares: 1,222,300

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 3.84%

This fund has also not updated its holdings as of the end of Q2 yet.

#25: Renaissance LLC

Type: Algorithm Hedge Fund

Previous Rank: #37

Previous Shares: 767,506

Current Shares: 1,106,906

Change: +44.2%

Stake: 0.6%

Allocation: 1.03%

This is unlikely to be a long term investment.

#26: Baron Partners Fund

Type: Long Term Institutional Investor

Previous Rank: #28

Previous Shares: 1,100,000

Current Shares: 1,100,000

Change: +0%

Stake: 0.6%

Allocation: 20.37%

20.37% of the fund into a single stock, woow. This means that TSLA at $1,900 is currently swiftly approaching 50% of the Baron Partners Fund. That is pretty wild, and Ron Baron recently went on CNBC to say that he would like to buy more TSLA @ $1,000, so it'll be fun to see how big a portion of the fund TSLA will make up in the future.

Here are the full holdings of Ron Baron's fund:

|

| https://fintel.io/i/baron-select-funds |

You can see Baron also has a little over 5% of the fund invested in SpaceX.

#27: Vanguard Growth Index Fund

Type: Index Fund

Previous Rank: #29

Previous Shares: 1,093,753

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 0.64%

This fund has not reported its holdings as of the end of Q2 yet. Because it's an index fund, its TSLA stake likely remained largely unchanged.

#28: Fidelity Blue Chip Growth Fund

Type: Mutual Fund

Previous Rank: #33

Previous Shares: 1,037,117

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 2.72%

This fund also has not reported its holdings as of the end of Q2 yet.

#29: Northern Trust Corp

Type: Long Term Institutional Investor

Previous Rank: #31

Previous Shares: 955,673

Current Shares: 1,001,949

Change: +4.8%

Stake: 0.5%

Allocation: 0.26%

|

| https://fintel.io/so/us/tsla/northern-trust |

#30: Sumitomo Mitsui Trust

Type: Long Term Institutional Investor

Previous Rank: #27

Previous Shares: 1,131,376

Current Shares: 984,202

Change: +13.0%

Stake: 0.5%

Allocation: 0.75%

|

| https://fintel.io/so/us/tsla/sumitomo-mitsui-trust-holdings |

Looking at this entire list, it's surprising to see how bad many of the largest money managers are at timing the market. However, Sumitomo did a great job loading the boat on TSLA during Q3 last year. Since then, it has slowly lowered its exposure the stock, but it's still on board with nearly 1M shares.

#31: Vanguard U.S. Growth Fund

Type: Mutual Fund

Previous Rank: #30

Previous Shares: 1,067,153

Current Shares: 910,066

Change: -14.7%

Stake: 0.5%

Allocation: 2.39%

#32: Norges Bank

Type: Long Term Institutional Investor

Previous Rank: #24

Previous Shares: 855,769

Current Shares: ?

Change: ?

Stake: ?

Allocation: ?

I'm not sure what is up with Norges Bank, but the last correct 13F it filed was for Q4'19. It filed empty 13Fs in Q2'19 and Q3'19, as well as in Q1'20 and Q2'20. It did file amendments to the Q1'20 and Q2'20 ones that were not empty, but they were full of its outdated positions from 12 months prior.

So yeah... not sure what's up with that.

#33: Legal & General Group PLC

Type: Long Term Institutional Investor

Previous Rank: #36

Previous Shares: 774,042

Current Shares: 799,242

Change: +0.7%

Stake: 0.4%

Allocation: 0.42%

|

| https://fintel.io/so/us/tsla/legal-general-group |

#34: Fidelity Growth Company Fund

Type: Mutual Fund

Previous Rank: #34

Previous Shares: 792,506

Current Shares: 782,589

Change: -1.3%

Stake: 0.5%

Allocation: 1.37%

#35: Citigroup Inc

Type: Institutional Investor & TSLA Market Maker?

Previous Rank: #32

Previous Shares: 993,814

Current Shares: 740,750

Change: -25.5%

Stake: 0.4%

Allocation: 0.82%

|

| https://fintel.io/so/us/tsla/citigroup |

Considering the amount of TSLA options Citigroup has reported in its 13F filings over the years, I think it's likely that Citigroup is a TSLA market maker:

|

| https://fintel.io/so/us/tsla/citigroup |

These positions could be both long and short, and are currently worth $1B (calls) and $1.3B (puts). Citigroup's TSLA shares could be an investment, but could just as easily be purely for delta hedging purposes.

#36: ARK Investment LLC

Type: Mutual Funds

Previous Rank: #44

Previous Shares: 596,649

Current Shares: 712,348

Change: +19.4%

Stake: 0.4%

Allocation: 8.27%

|

| https://fintel.io/so/us/tsla/ark-investment-management |

I believe this is the aggregate number of TSLA shares ARK owns across its mutual funds.

|

| https://fintel.io/i/ark-investment-management |

ARK's total AUM (Assets Under Management) more than doubled in Q2'20 to nearly $10B!!! Well deserved if you ask me. TSLA alone should've already added nearly another $1B to that so far in Q3'20.

#37: Fidelity Extended Market Index Fund

Type: Index Fund

Previous Rank: #38

Previous Shares: 699,703

Current Shares: 700,424

Change: +0.1%

Stake: 0.4%

Allocation: 2.39%

#38: Bank of New York Mellon Corp

Type: Long Term Institutional Investor

Previous Rank: #40

Previous Shares: 652,243

Current Shares: 684,105

Change: +4.9%

Stake: 0.4%

Allocation: 0.20%

|

| https://fintel.io/so/us/tsla/bank-of-new-york-mellon |

#39: Vanguard Primecap Fund

Type: Mutual Fund

Previous Rank: #42

Previous Shares: 625,000

Current Shares: ?

Change: ?

Stake: ?

Allocation: 0.61%

This fund has not reported its holdings as of the end of Q2 yet.

#40: Whale Rock Capital Management LLC

Type: New Institutional Investor

Previous Rank: #43

Previous Shares: 604,748

Current Shares: 613,300

Change: +1.4%

Stake: 0.3%

Allocation: 5.28%

|

| https://fintel.io/so/us/tsla/whale-rock-capital-management-llc |

Although Whale Rock has only recently (re-)invested in TSLA, it seems to have very high conviction considering TSLA is currently its 3rd largest holding at 5.28% of its portfolio. I would be shocked if it has not sold off a significant amount of shares over the past month and a half during the run-up to $1,900, because its stake at the end of Q2 would now be worth >10% of its portfolio.

#41: Wells Fargo & Company

Type: Long Term Institutional Investor

Previous Rank: #41

Previous Shares: 629,171

Current Shares: 607,935

Change: +3.5%

Stake: 0.3%

Allocation: 0.19%

|

| https://fintel.io/so/us/tsla/wells-fargo-company-mn |

#42: Swiss National Bank

Type: Long Term Institutional Investor

Previous Rank: #49

Previous Shares: 524,653

Current Shares: 583,353

Change: +11.2%

Stake: 0.3%

Allocation: 0.53%

|

| https://fintel.io/so/us/tsla/swiss-national-bank |

#43: UBS Asset Management Americans Inc

Type: Long Term Institutional Investor

Previous Rank: #46

Previous Shares: 546,668

Current Shares: 552,841

Change: +1.1%

Stake: 0.3%

Allocation: 0.36%

|

| https://fintel.io/so/us/tsla/ubs-asset-management-americas |

#44: Price T Rowe

Type: Institutional Investor that doesn't know what it's doing

Previous Rank: Did not make the list

Previous Shares: 323,702

Current Shares: 545,442

Change: +68.5%

Stake: 0.3%

Allocation: 0.07%

|

| https://fintel.io/so/us/tsla/price-t-rowe-associates-inc-md- |

Once upon a time, there was an investor who owned a future gold mine, but then he went and sold it for pennies on the dollar. This investor's name is Price T Rowe, and instead of over 17M TSLA shares, today worth over $30B, he only owns ~500k TSLA shares, worth less than $1B.

They must've been real happy in Q2'19, when TSLA was $180, that they sold off most of their stake in Q4'18 for $3xx. Well... they must be f*cking crying now over at Price T Rowe. This is exactly why the phrase "you can't go wrong with taking profits" is stupid, because you can do very wrong by taking profits. Price T Rowe missed out on $29B+ by taking profits.

#45: Credit Suisse

Type: Long Term Institutional Investor

Previous Rank: #57

Previous Shares: 433,351

Current Shares: 533,933

Change: +23.2%

Stake: 0.3%

Allocation: 0.41%

|

| https://fintel.io/so/us/tsla/credit-suisse-ag- |

#46: Gilder Gagnon Howe & Co LLC

Type: Long Term Institutional Investor

Previous Rank: #47

Previous Shares: 540,757

Current Shares: 519,846

Change: -3.9%

Stake: 0.3%

Allocation: 4.39%

|

| https://fintel.io/so/us/tsla/gilder-gagnon-howe-co-llc |

TSLA is this investor's #1 position at 4.39% of its portfolio. I think it's likely that Gilder is currently taking profits, because at $1,900 TSLA is approaching 10% of its portfolio and is about double its 2nd largest position.

#47: Deutsche Bank

Type: Short Term Trading Institutional Investor

Previous Rank: Did not make the list

Previous Shares: 376,486

Current Shares: 502,234

Change: +33.4%

Stake: 0.3%

Allocation: 0.41%

|

| https://fintel.io/so/us/tsla/deutsche-bank-ag- |

#48: Morgan Stanley

Type: Long Term Institutional Investor

Previous Rank: #39

Previous Shares: 668,668

Current Shares: 482,077

Change: -27.9%

Stake: 0.3%

Allocation: 0.12%

|

| https://fintel.io/so/us/tsla/morgan-stanley |

Not a high conviction shareholder.

#49: iShares Russell 1000 Growth ETF

Type: Index Fund

Previous Rank: #53

Previous Shares: 469,907

Current Shares: ?

Change: ?

Stake: ?

Allocation: 0.56%

This fund hasn't reported its holdings as of the end of Q2 yet, but it's unlikely to have changed much, because it's an index fund.

#50: American Century Companies Inc

Type: Long Term Institutional Investor

Previous Rank: #54

Previous Shares: 465,449

Current Shares: 462,080

Change: -0.7%

Stake: 0.2%

Allocation: 0.47%

|

| https://fintel.io/so/us/tsla/american-century-companies |

#51: Mitsubishi UFJ Trust & Banking Corp

Type: Long Term Institutional Investor

Previous Rank: #52

Previous Shares: 485,250

Current Shares: 444,807

Change: -8.3%

Stake: 0.2%

Allocation: 1.06%

|

| https://fintel.io/so/us/tsla/mitsubishi-ufj-trust-banking |

#52: Fidelity OTC Portfolio

Type: Mutual Fund

Previous Rank: Did not make the list

Previous Shares: 439,307

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 1.66%

#53: D.E. Shaw & CO

Type: Algorithm Hedge Fund

Previous Rank: Did not make the list

Previous Shares: 14,909

Current Shares: 432,637

Change: +2,801.9%

Stake: 0.2%

Allocation: 0.56%

Not unlike Renaissance, this is an algorithm based hedge fund focused on short term trading. Its algorithm must've seen something at the end of Q2 that indicated a large rise in the stock price was imminent.

#54: Growth Account Class R1

Type: Mutual Fund

Previous Rank: #58

Previous Shares: 404,276

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 0.90%

This fund has not reported its holdings as of the end of Q2 yet.

#55: Barclays PLC

Type: TSLA Market Maker?

Previous Rank: Did not make the list

Previous Shares: 320,465

Current Shares: 400,439

Change: +25.0%

Stake: 0.2%

Allocation: 0.33%

|

| https://fintel.io/so/us/tsla/barclays |

|

| https://fintel.io/so/us/tsla/barclays |

Considering this holder's out-sized options holdings worth $775M (calls) and $1.4B (puts), which are far larger than its stock holdings, I'm going to assume that Barclays is acting as a TSLA market maker, and that at least some portion of its stock holdings are for delta hedging purposes.

#56: Charles Schwab Investment Management

Type: Long Term Institutional Investor

Previous Rank: Did not make the list

Previous Shares: 385,312

Current Shares: 398,451

Change: +3.4%

Stake: 0.2%

Allocation: 0.21%

|

| https://fintel.io/so/us/tsla/schwab-charles-investment-management |

Charles Schwab is now the only holder in this list that has never decreased its TSLA position during a quarter. It's as if their brokerage doesn't have a functioning sell button.

#57: Vanguard Capital Opportunity Fund

Type: Mutual Fund

Previous Rank: Did not make the list

Previous Shares: 393,566

Current Shares: ?

Change: ?

Stake: ?

Allocation: 1.52%

This fund has not yet reported its holdings as of the end of Q2.

#58: Stock Account Class R1

Type: Mutual Fund

Previous Rank: Did not make the list

Previous Shares: 391,762

Current Shares: ?

Change: ?

Stake: ?

Allocation: 0.23%

This fund has also not yet reported its holdings as of the end of Q2.

#59: Bank of America

Type: Short Term Trader & Long Term Institutional Investor

Previous Rank: Did not make the list

Previous Shares: 377,963

Current Shares: 389,525

Change: +3.1%

Stake: 0.2%

Allocation: 0.06%

|

| https://fintel.io/so/us/tsla/bank-of-america-corp-de- |

#60: Ultra Fund

Type: Mutual Fund

Previous Rank: #50

Previous Shares: 373,073

Current Shares: ?

Change: ?

Stake: ?

Allocation EoQ1: 2.27%

#61: Nikko Asset Management Americans Inc

Type: Long Term Institutional Investor

Previous Rank: #51

Previous Shares: 493,589

Current Shares: 365,628

Change: -25.9%

Stake: 0.2%

Allocation: 5.15%

|

| https://fintel.io/so/us/tsla/nikko-asset-management-americas |

I'd almost call this investor a short-term trader, if not for the fact that TSLA is the 2nd largest holding of this modest $7.5B fund at 5.15% of its portfolio. Although SQ is its biggest holding at 8.14%, I assume that the main reason Nikko has sold off TSLA over the past few quarters is that it does not want TSLA to become too large of a position.

#62: New York State Retirement Fund

Type: Long Term Institutional Investor

Previous Rank: Did not make the list

Previous Shares: 363,911

Current Shares: 359,098

Change: -1.3%

Stake: 0.2%

Allocation: 0.49%

|

| https://fintel.io/so/us/tsla/new-york-state-common-retirement-fund |

#63: Fidelity Advisor Growth Opportunities Fund

Type: Mutual Fund

Previous Rank: Did not make the list

Previous Shares: 200,676

Current Shares: 358,076

Change: +78.4%

Stake: 0.2%

Allocation: 2.48%

#64: Allianz Asset Management

Type: Very Bad Institutional Investor

Previous Rank: Did not make the list

Previous Shares: 258,153

Current Shares: 355,094

Change: +37.6%

Stake: 0.2%

Allocation: 0.44%

|

| https://fintel.io/so/us/tsla/allianz-asset-management |

This investor seems to buy high and sell low. It loaded the boat in late 2013 after the run up to $100+. It bought a bunch in Q1'19, only to sell most of it back in Q2'19 at the ~$200 lows. And it then sold even more in Q4'19 right before the run up to $900+. Whoever is in charge at Allianz should probably be fired and replaced by a sleeping monkey.

#65: California Public Employee Retirement System

Type: Long Term Institutional Investor

Previous Rank: Did not make the list

Previous Shares: 296,298

Current Shares: 330,530

Change: +18.3%

Stake: 0.2%

Allocation: 0.35%

|

| https://fintel.io/so/us/tsla/california-public-employees-retirement-system |

#66: JP Morgan Growth Advantage Fund

Type: Mutual Fund

Previous Rank: Did not make the list

Previous Shares: 315,400

Current Shares: ?

Change: ?

Stake: ?

Allocation: 2.01%

This fund has not yet reported its holdings as of the end of Q2.

#67: HSBC Holdings PLC

Type: TSLA Market Maker?

Previous Rank: Did not make the list

Previous Shares: 173,052

Current Shares: 314,855

Change: +81.9%

Stake: 0.2%

Allocation: 0.65%

|

| https://fintel.io/so/us/tsla/hsbc-holdings |

I think there is a good chance that HSBC is a TSLA market maker, considering its options positions are larger than its stock holdings.

#68: Coatue Management LLC

Type: Short Term Trading Institutional Investor

Previous Rank: #48

Previous Shares: 534,770

Current Shares: 309,877

Change: -42.1%

Stake: 0.2%

Allocation: 2.94%

#69: BNP Paribas Arbitrage

Type: Short Term Trading Institutional Investor

Previous Rank: #56

Previous Shares: 445,932

Current Shares: 302,567

Change: -32.1%

Stake: 0.2%

Allocation: 0.49%

Overview & Conclusion

- Smaller institutional investors.

- Retail investors.

- Other sources, such as market makers who don't have to file 13F like Citadel.

All in all, the float looks quite contracted to me at the end of Q2'20, so I'm not surprised the stock has performed so well thus far in Q3. I'm really really curious to see what the monstrous buying of 26M+ shares upon TSLA's inclusion into the S&P 500 will do to the stock. I think there could be fireworks. I wrote an entire blog about this topic recently in case you're interested:

A final observation I want to share is that extremely little changed in the top 20 during Q2. Even though the stock price rose by ~150%, there were only a few minor movements among the top 20. However, with TSLA approaching very large percentages of the portfolio of a couple of large investors, including TSLA's largest non-Elon investor, Baillie Gifford, I'm not so sure this will still be the case after Q3.

Thanks for the valuable research and info.

ReplyDeleteI think it brings some light as to who were selling so much shares when the Q2 earning report is out on 24th July, and continued bear trend for into early Aug. (which doesn't make sense and caused me some calls)

Goldman Sachs, Morgan Stanley, Nikko Asset Management and some of these bank market makers like Citigroup / HSBC etc could have just hold the stocks, but they didn't. They will pay with losses for their early selling of positions and lack of foresight with all the catalyst going into S&P, Battery day, Deliveries etc in October.

Well they still hold so much positions so I guess it still weren't matter.

Cheers again! More people should see your blog man!

Thanks eonridr!!

DeleteDon't forget to keep in mind that these positions are as of the end of Q2, meaning as of the end of June. Although we can speculate about a few entities who have likely sold since then, because TSLA was such a large percentage of their portfolio already at the end of June @ $800, we won't know for sure who's bought and who's sold until 3 months from now. These shareholders will be required to report their holdings as of the end of September by mid November to the SEC through 13F Filings.

Thanks for Clarifying Frank, I know these are the end of June, but it is still a telling tale of their direction for this stock. And I speculate that they did that in July and may continue to be their general direction that they will take going forward. (Unless they finally understood TSLA better)

DeleteIndeed, you're right, we'll see their positions after 3 months! =D

By the way Frank, Isn't Tencent holding 5% of the stakes in Tesla?

DeleteRefer to this article back in 2017, and also with the recent collaboration they are doing, I believe they are still one of the biggest holders isn't it?

https://www.cnbc.com/2017/03/28/messaging-app-parent-tencent-takes-stake-in-tesla.html

They no longer have a 5% stake, that's for sure. If they had, Tencent would've filed a 13G again in 2019 and 2020, which it did not do.

DeleteTencent is not an institutional investment manager, so it is not required to file a 13F like the companies on this list. Therefore, it could still have a stake in TSLA that is smaller than 5%, but we have no way of knowing this. Just like other companies, such as Apple or Amazon or Alibaba could all theoretically have a stake in TSLA smaller than 5%.