TSLA Options: Are Call Spreads the Future?

I'm going to keep this post very brief. I may have finished my MBA, but there are a lot of things in my life that I'd like to spend time on that are not Tesla and investing.

Nonetheless, I'd like to take some time to share this research I've done over the past week into Tesla options. More specifically, research into Tesla call option spreads.

I've never been a huge fan of them in the past, because I've always calculated my options returns in # of shares. I still plan to be fully invested in TSLA for the foreseeable future as I explained in detail in My Tesla Investment Thesis 3, so any deviation in investment strategy from owning 100% TSLA common stock, I need to compare to that strategy, so I need to calculate the return on option trades in # of shares. I've talked about this in more detail in My TSLA Investment Strategy, but for the purpose of this post you need to know that a large run-up in the stock beyond the shorted call option means your trade's returns suffer a lot.

There are some other subtle downsides that I'll cover in more detail later, but let me share with you some numbers first.

TSLA 2023 Forecast

Although some of my past predictions have turned out quite accurate:

Prediction in Sep'19 for Q2 or Q3 2021: 225k deliveries, $13B revenue, ~$1B EBIT

Actual: 200-250k deliveries, $10-12B revenue, $1.3-2B EBIT

Prediction in May'20 for Q4'21: $1.75-3.1B EBIT

Actual: $2B in Q3'21, on track to be $2-3B in Q4'21

The following may or may not be as accurate. I think there's less detailed information available than a few years ago, because Tesla has shared less details with investors since the end of 2019, and I also have not followed Tesla as closely this year, so I may have missed some information.

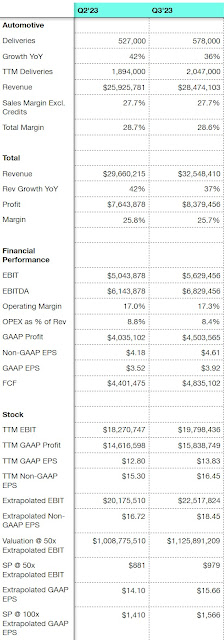

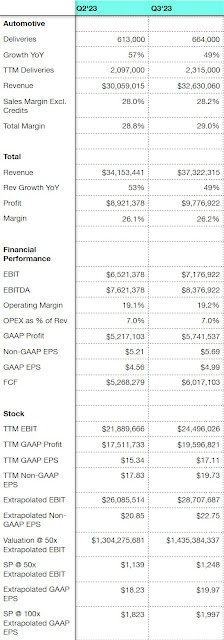

Regardless, this is about where I expect Tesla will end up in the 2nd half of 2023:

Mid case model:

Bear case:

Bull case:

Bear case

TSLA Options Comparison

Option Spreads Analysis Spreadsheet:

You can play around with this spreadsheet yourself. You should only have to edit the highlighted fields. This is a similar spreadsheet to the one I shared in My TSLA Investment Strategy blog post. You can find more details about how it works there.

I think the best way to look at this data is by comparing naked calls with a spread that has a similar breakeven point. For example, the $600 call and the $900 spread both more or less break even at a stock price of $1,200.

$900-2,475 spread:

Lose all @ <$900

Breakeven @ $1,200

Max profit 150% @ $2,500

Still profit 70% @ $3,600

$600 naked call:

Lose all @ <$600

Breakeven @ $1,200

Profit 70% @ $4,000

One more example is the $1,100 call and the $1,400 spread that both break even at a stock price of $1,600.

$1,400-2,475 spread:

Lose all @ <$1,400

Breakeven @ $1,600

Max profit 230% @ $2,500

Still profit 130% @ $3,700

$1,100 naked call:

Lose all @ <$1,100

Breakeven @ $1,600

Profit 130% @ $4,000

Below their breakeven points, the naked calls outperform the spreads, because the drop off of the spread is much steeper. However, as long as at least the break even point is reached, the spreads vastly outperform the naked calls, unless the stock goes completely parabolic.

Even if you expect the stock to go to $3,000 by late 2023, even though you lose some money shorting the $2,475 call, putting the premium from that short into a larger number of overall contracts allow the spreads to outperform the naked calls.

Spreads Downsides

Conclusion

- Omicron

- Inflation

- FED rate hikes

- Changes to QE

- China weakness

- On-going semiconductor shortage and other supply chain issues

- Some Tesla specific execution risks due to new technologies (4680s, castings, structural batteries, Cybertruck, Semi)

Nice analysis Frank. I have thought that spreads are the way to go as well with rising earnings limiting Tesla's downside risk and the stock not likely to go 3x or more in a year.

ReplyDeleteHave you thought about the difference between call spreads and bullish put spreads? They have the same outcomes when using the same strike prices as the call spreads. Put spreads will generate you cash upfront which you could use to leverage more contracts out of. Call spreads allow you to potentially benefit from lower tax rates on the long leg (if held over a year).

It looks like the cost is similar, but not exactly the same. Seems to me the same strike put spreads are ~5% more expensive.

DeletePersonally I do not use any margin, so there is no benefit to me of having the cash. I'd just have all the cash (+ some more to cover entire spread) sitting in my account in case I turn out to be wrong.

Great analysis and thanks for sharing Frank... The 1900/2100 Jan 2024 bull call spread right now costs ~$1800 and is worth $20,000 at expiration for ~10x return on $ invested... Not a sure bet, but I like those odds...

ReplyDeleteJust don't forget to calculate your returns in # of shares. The stock would also go up by a lot if you're right, so your actual return is more like ~4x if the stock is exactly at $2,100 upon expiration, or ~3x if the stock is $3k, or ~2.5x if the stock is $3,500.

DeleteThanks a lot, Frank. This is very useful. I have always calculated the profit in $$$, but instead I should have done it in TSLA shares as unit, just like you did. As in the long run, TSLA should go much higher. So, the most important is to get more shares. But one thing you may need to consider, is that when you sell the spread, likely you need to pay tax, right? Then, that eats a significant % of the shares. So, maybe it is easier just to hold TSLA shares?

ReplyDeleteI live in Singapore, which has 0 capital gains taxes (excl. real estate speculation).

DeleteIf I had to pay taxes both over the stock sale, and then again over the spread sale, I don't think these'd be worth it anymore. I'd just sit back, relax, and hold common stock.

Happy new year so what would see Tesla stock price range be for 2022?

ReplyDeleteYes I am also interested what your latest price range is for 2022, much appreciated!

DeleteHappy new year!

DeleteI haven't thought about this at all, because for me there isn't much point in doing so.

I'd guess TSLA will probably do alright, assuming Berlin/Austin/CyberTruck/Semi ramps all go decently. However, there's quite a bit of macro uncertainty in the short term.

I'd be surprised if we drop below $600 at any point, and I'd also be surprised if we exceed $3,000. That's a crazy range, but there's just a lot of uncertainty and it's difficult to accurately predict the short term.

Hi Frank, thanks for the price range. Is it ok if I put 1800 as base case? I would love to include your price target on my collection: https://telsapricetargets.com

DeleteIt is just for fun of course.

Thanks!

Steven

It's not really a price target as much as it is a price range, but I'm okay with you adding it to the list on your website.

DeleteDank Frank!

DeleteI really enjoy your blog - hope all is well! Kind of disappointing the stock is flat from late Jan 2021, but I know the stock was flat for 5 years, about 2014-2019, so it can happen. Just curious, are you still bullish on TSLA? I am, but the market sure doesn't seem to agree with me, which is fine, but would be nice to have some confirmation, as I am pretty much done accumulating, with the exception of some deep in the money calls (mostly '24) which would certainly do better with a price runup.

ReplyDeleteHey, thanks!

DeleteAll is well, but I'm spending most of my time on non-Tesla things these days. Nothing has changed from my 3rd Tesla Investment Thesis and I myself am still fully invested.

I don't think anything like 2020 will ever happen again over that short of a time period, but I expoect a similar rise over the next ~10 years.

It has been flat since Jan'21, but that's partly due to TSLA getting ahead of itself at the end of 2020 due to the S&P inclusion. And partly due to the macro change from low interest rates to high interest rates, which has cratered stock market valuations across the board, not just Tesla's.

Thanks so much for the reply! Glad to hear all is well!

DeleteYes, makes sense, S&P inclusion overshot and tough macro environment huge contributors to the flatness of the stock price.

I agree about 202, with the only exception, is maybe if FSD is solved and the realization happens suddenly. I know it may not happen; therefore, my investment analysis only relies on vehicle sales, and if it does happen, probably more likely being a slow realization, having the march of 9's slowly come about. Just nice to have almost a free call option on the possibility!

Thanks again for sharing all your knowledge! So many investors have benefited!

I share similar sentiment to you when it comes to FSD. I feel like Wall Street won't fully grasp it until profits start rolling in from an operational robotaxi service. It may however contribute slightly as the software gets more and more impressive. I know it'll happen one day, but it's more like a free call option in the next 1-2 years.

DeleteYou're welcome! I'm happy to hear that :)