TSLA Options: Are Call Spreads the Future?

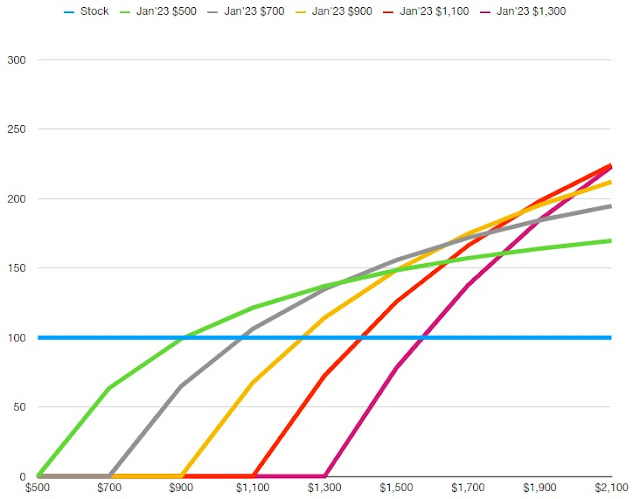

I'm going to keep this post very brief. I may have finished my MBA, but there are a lot of things in my life that I'd like to spend time on that are not Tesla and investing. Nonetheless, I'd like to take some time to share this research I've done over the past week into Tesla options. More specifically, research into Tesla call option spreads. I've never been a huge fan of them in the past, because I've always calculated my options returns in # of shares. I still plan to be fully invested in TSLA for the foreseeable future as I explained in detail in My Tesla Investment Thesis 3 , so any deviation in investment strategy from owning 100% TSLA common stock, I need to compare to that strategy, so I need to calculate the return on option trades in # of shares. I've talked about this in more detail in My TSLA Investment Strategy , but for the purpose of this post you need to know that a large run-up in the stock beyond the shorted call option means your trade...