The Automotive Industry's Transition to AEVs: Which car manufacturers will survive the next decade?

Introduction

This will be a little bit of a different blog from my others, as it will not be as much about Tesla as it will be about the rest of the automotive industry and the challenges it will face over the next ten years.

I got the idea for this blog when I was thinking about the risks that people often associate with Tesla as a company. Many people say that Tesla will go bankrupt, won't be able to compete when competition arrives, can't make a profit, etc. In my opinion the only risks to Tesla not succeeding to at least some degree in the next decade are incredibly small percentage freak accidents, such as something happening to Elon, or an airplane crashing and destroying the entire Fremont factory. Barring something like that happening, even with mediocre execution in the next decade Tesla is set up to be one of, if not the, biggest player in the transportation industry in 2030 as I explained in my Tesla Investment Thesis.

Then I changed my point of view from Tesla to the rest of the automotive industry, and I soon realised that the challenges they are facing and the hurdles they have to overcome not to thrive, but to survive and to continue to exist are humongous in comparison. The risks to the automotive industry's survival are so large in fact, that I'd be surprised if more than a few car manufacturers survive the transition to Autonomous Electric Vehicles (AEVs). And they are so large that I'm very worried for certain economies like Japan, whose automotive industry accounts for 12% of GDP. In this blog I will lay out those challenges, and share my opinion on which car manufacturers are well positioned to survive the upcoming disruption, and which car manufacturers are already more-or-less dead in the water.

I've divided this blog into two sections. In the first part I will talk about the specific challenges that car manufacturers are facing. In the second part I will take a look at the twelve biggest car manufacturers, discuss how well positioned they are to deal with these challenges, and give them a rating for how likely I think they are to survive the next decade. I'm really happy with the result that is this blog, so I hope you enjoy reading it.

Part 1: Challenges

I've identified a total of twelve challenges that car manufacturers will face in the next decade as the world transitions from ICEVs (Internal Combustion Engine Vehicles) to AEVs. I've ranked these from least problematic to most problematic, although it might be more accurate to say that except for maybe the first few, I've ranked them from "How the hell are we going to solve this?" to "We're f*cked!".

Challenge #1: Fast Charging

Fast charging is undeniably an integral piece of the EV future. The vast majority of daily driving may be no problem for modern EVs on a single charge, but a car that can only drive a hundred or so miles from home before it has to turn around, is not a car that most people can rely on completely. It is therefore no surprise that the Supercharger network is often cited as one of the biggest advantages of buying a Tesla compared to another EV. The automotive industry would be wise to pay attention to this, and to have fast charging solutions in place for customers who want to be able to travel long distances.I don't think anybody is going to catch up to Tesla's Supercharger network's size any time soon though:

- Tesla currently has 1636 Supercharger stations with 14,497 Superchargers worldwide.

- IONITY currently has 150 fast charger stations with a total of about 600 chargers across the EU.

- Volkswagen's Electrify America is targeting 484 sites with 2,000 fast chargers by the end of 2019 in the USA.

Fortunately enough for traditional auto, there are 3rd party charging stations being built as well, but these don't compare to the Supercharger network in size either. Chargepoint may have 68,000 chargers, only 1,500 of them are fast chargers. EVGO is similar in that it only has about 1,200 fast chargers across 34 states in the USA. So it appears that as of right now, in terms of fast chargers Tesla has more than everybody else combined.

I do think there will eventually be enough fast charging infrastructure built out across the world that it won't be too big of a problem for the car manufacturers. You only need a certain amount of chargers after all, and the 2,000 chargers Volkswagen built through Electrify America only cost them 370M$, so the biggest manufacturers have more than enough funds to build out their own charging infrastructure in a worst case scenario.

Risk Level: "We should be fine one way or another." - VP of Charging Networks at large car manufacturer.

The countries that plan to ban the sale of ICEVs in 2030 are already starting to implement incentives similar to Norway. The Netherlands for example has a target of 200,000 EVs on the road in 2020 and 1 million in 2025, and is pushing for this with the help of incentives. The Irish government has set a target of 10% of all the vehicles on the road to be electric by 2020. Iceland has exempted EVs from sales tax up to ~50,000$. The list of countries pushing for EV adoption goes on and on.

But perhaps the biggest push comes from China. China wants at least a fifth of its car sales to be electric by 2025, and they have implemented yearly targets starting in 2019 that require automakers to amass NEV (New-Energy Vehicle) credits equivalent to 10 percent of annual sales. Many manufacturers will simply not be able to meet these targets, and therefore will have to buy credits or pay fines. And if the 2B$ that Fiat-Chrysler will be paying Tesla for EU credits are anything to go by, this is going to cost car manufacturers a hefty sum of money and reduce profit margins quite a bit.

The only thing that manufacturers can do about government regulations that encourage EV adoption is to actually transition to EVs in a timely manner. However, it looks like a number of them are not going to be able to transition in time and will therefore have no choice but to pay fines and see some of their customers buy heavily incentivized EVs instead.

Risk Level: "We're able to account for this in our budget, thanks to our strong V8 and Pickup sales." - CFO at large car manufacturer

Challenge #2: Regulations

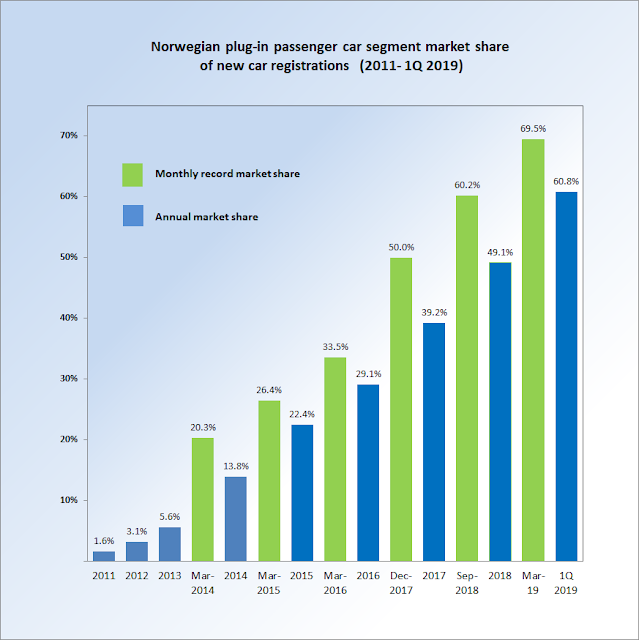

An ever increasing number of cities and countries plan to outright ban the sales of ICEVs. A lot of these targets may still be quite far away, but Norway is a clear example that these changes are not going to happen overnight. Norway has been pushing towards their 2025 goal of banning ICE vehicles for nearly a decade now, and recently EVs have reached a majority market share in the country. |

| https://en.wikipedia.org/wiki/Motor_vehicle |

The countries that plan to ban the sale of ICEVs in 2030 are already starting to implement incentives similar to Norway. The Netherlands for example has a target of 200,000 EVs on the road in 2020 and 1 million in 2025, and is pushing for this with the help of incentives. The Irish government has set a target of 10% of all the vehicles on the road to be electric by 2020. Iceland has exempted EVs from sales tax up to ~50,000$. The list of countries pushing for EV adoption goes on and on.

But perhaps the biggest push comes from China. China wants at least a fifth of its car sales to be electric by 2025, and they have implemented yearly targets starting in 2019 that require automakers to amass NEV (New-Energy Vehicle) credits equivalent to 10 percent of annual sales. Many manufacturers will simply not be able to meet these targets, and therefore will have to buy credits or pay fines. And if the 2B$ that Fiat-Chrysler will be paying Tesla for EU credits are anything to go by, this is going to cost car manufacturers a hefty sum of money and reduce profit margins quite a bit.

The only thing that manufacturers can do about government regulations that encourage EV adoption is to actually transition to EVs in a timely manner. However, it looks like a number of them are not going to be able to transition in time and will therefore have no choice but to pay fines and see some of their customers buy heavily incentivized EVs instead.

Risk Level: "We're able to account for this in our budget, thanks to our strong V8 and Pickup sales." - CFO at large car manufacturer

Challenge #3: Software

Being good at making software is becoming a more and more important part of building cars, both in terms of making the machine work and in terms of user experience. Especially once passengers no longer have to use their attention to drive the vehicle, the importance of in-car entertainment will grow immensely. All of this brings numerous challenges for the automotive industry.First and foremost, traditional car manufacturers are not good at making software. Volkswagen currently develops less than 10% of the software in its vehicles, and outsources the rest. This is very problematic according to a Volkswagen manager:

"The main burden today is the interconnectedness of hardware and software in the car. Just one example: currently, up to 70 control units operating with software from 200 different suppliers must be networked in vehicles of the Volkswagen brand. We devote a large part of our energy to technical integration and rely very much on the developments of third parties. This is not a good model for the future. We need to be the ones who develop the software."

Another problem is software recalls. There is an ever growing amount of automotive recalls due to faulty software each year, and although this would easily be fixed by implementing OTA (Over-The-Air) Software Updates like Tesla first introduced in the Model S in 2012, so far very few models of traditional car manufacturers are able to receive OTA updates. Maybe this has something to do with the fact that many dealer franchise laws require software updates to be handled by dealerships.

Still, the obvious solution is to build in-house expertise in software development. This will likely take some time, but it is not an impossible task. However, I think certain car manufacturers will have an easier time doing this than others. It's easy for Tesla to attract the best of the best talent in software development, evident by the 500,000 job applications they received in 2017, and the fact that it's ranked as one of the top 5 companies where people want to work in the USA.

|

| https://twitter.com/FutureJurvetson/status/705925529388453888 |

I suspect that for German car manufacturers this also should not be too difficult to accomplish over time. Germany is very proud of its car industry after all. But for companies such as GM and Ford, I foresee a lot more difficulties. They have to compete for talent with the likes of Facebook, Alphabet, Amazon, Tesla, Apple, and a ton of other companies that I think the best of the best would prefer to work at over GM and Ford.

Risk Level: "We'll catch up, just give us a few years." - Head of HR at large car manufacturer.

Challenge #4: Workers & Unions

In 10 years there might be more software jobs available in the automotive industry, but there will definitely be less jobs available in other divisions such as manufacturing. Electrification is the number one concern for auto workers and their unions, as they fear it will drastically change the job landscape. According to a recent Bloomberg article, Ford has estimated that producing EVs will require 30% fewer hours of labor and 50% less factory floor space. A study about EV production in Europe found that assembling an electric motor and battery took 40% fewer hours compared to an ICE and transmission. And Deloitte has estimated that the market for legacy powertrain components such as mufflers, fuel tanks, and transmissions could shrink by as much as 20% by 2025. Furthermore, a large portion of EV components are being produced abroad in Korea and China, compared to the ICEs and transmissions that are often produced locally. Workers are understandably scared of this future, which leads to strikes such as the 2019 GM Strike.The problem for car manufacturers here is that they won't switch to EVs overnight, and they will still need to profitably run their ICE business for many years before they can terminate them completely. During this transition period they need good relationships with their workers to sustain their ICE business, and they'll also need workers to manufacture their future EVs. Large parts of the workforce will have to be retrained and will have to undergo a mindset switch, while they fear future unemployment. That's a recipe for unrest, and can hurt car manufacturers a fair bit. It was estimated that GM lost up to 100M$ per day during the more than a month long union strike.

I don't think any of these pose an existential risk to the car manufacturers, because the workers and unions won't benefit from bankrupting their own employers, but it'll definitely be a cause for concern during the transition period. Car manufacturers need to watch this situation closely, carefully manage relationships with their workers and unions, and cooperate with them to create a plan for the future.

Risk Level: "We are aware of the situation, and taking steps to ensure a smooth transition." - Person in charge of Worker & Union Relationships at large car manufacturer.

Challenge #5: Lack of value add

Besides the design and assembly of vehicles, traditional car manufacturers are experts at building ICEs and in some cases also transmissions. An EV has neither an ICE nor a transmission, so the EVs sold by car manufacturers thus far may have been designed and assembled by them, the manufacturing of nearly all of the parts has been outsourced. This may just be because none of these EVs have been serious attempts at making a high-volume mass market EV, and Volkswagen did recently start experimenting with battery cell production, but they are the exception. Most car companies seem to have little or no interest in making any of the things that will replace the engine, transmission, and powertrain of ICEVs.Hyundai plots mass-market EV for India, plans to invest in battery manufacturing:

"When we introduce our mass-market EV in India, it will be based on the localisation of the battery. So our long-term roadmap is to invest in a battery manufacturing plant in the country," Kim told Autocar Professional on the sidelines of the Kona launch in New Delhi.Nissan finally sells its battery cell manufacturing division:

“We are pleased to have secured a definitive agreement with Envision, a leading global company in the field of sustainable energy. The transaction will enable Nissan to concentrate on developing and producing market-leading electric vehicles"Talking about a long-term road map and selling a battery cell manufacturing division don't sound like companies that want to invest in these crucial new technologies. It seems to me that some are moving too slow, will be too late to develop the expertise in-house, and will have no other option than to buy the components from companies like LG Chem and perhaps Volkswagen. Other companies simply seem content to do it this way, and don't seem to mind being reduced to auto design, development, and assembly.

Not all car companies have to be as vertically integrated as Tesla to survive and thrive in the EV future, but it is a fact of capitalism that if you add less value to a product, you will walk away with smaller profits.

Risk Level:

"We're working on it." - COOs of some automotive companies

"Widespread EV adoption is still very far out, so this is not very high on our to-do-list at the moment." - COOs of other automotive companies

Challenge #6: Car Manufacturers are not incentivized to go all-in on EVs

I was recently re-watching the Tesla Model X reveal on YouTube, and I found Elon's attitude towards other car manufacturers back then very interesting. It seems like at that point in time Elon felt like the other car manufacturers would most certainly jump on board of the EV train, and come out with strong competing models. The early signs were there. GM created the Volt, Nissan created the Leaf, and Daimler and Toyota invested in Tesla and bought some of its products to create their own EVs/Hybrids. It's almost like they thought: "Let's grab a piece of this EV pie, and buy ourselves some insurance in case it's a success.".

But then they did a 180. Daimler and Toyota sold their stakes in Tesla, Nissan did not create a follow up to the Leaf, and although GM created a follow up, the Bolt, it was a compliance car that lost them money. It's almost like somebody suddenly realised that EVs could completely destroy the ICE business, and so instead of participating in the revolution, it seems like they tried to be as quiet as they could in the hopes that it would just go away. I'm not sure if this was the automotive industry's doing, or if the oil industry somehow orchestrated it, but it has now put the automotive industry in a precarious position and has left them in a struggle to survive.

As of 2019 it seems like part of the industry (most importantly Volkswagen) has become aware of the situation and has done another 180, because they realise they will absolutely cease to exist if they don't change course and start to become an EV manufacturer. Big shout-out to Volkswagen's CEO Herbert Diess who seems to realise this, and appears to be steering the company in the right direction.

On the other hand, there are still many car manufacturers who are not serious (enough) about EVs, most likely due to the fact that they have to destroy their own business, and make obsolete many of their core competencies such as the internal combustion engine. In the case of Toyota, it would even require them to bankrupt a large number of their subsidiaries, because it owns many of its own suppliers, a large number of which would likely not survive the transition to electrification.

Needless to say, car manufacturers would really prefer that none of this happens. It's kinda like they're Bambi. They're about to be crushed by a giant burning tree, and the only way to survive is to jump off a giant cliff. You really really don't want to jump off the cliff, but it's the only way to survive.

Another reason why car manufacturers have been so hesitant to 'jump off the cliff' is that until recently it has appeared difficult, if not impossible, to make a profit selling EVs. Tesla has showed that there is at least some amount of demand for EVs since 2012, but they've only just started showing semi-consistent profits since the second half of 2018. Meanwhile, many of the EV programs from traditional car manufacturers would not have made money if not for regulatory credits. Part of the cause for this is that it's hard to make money on a relatively cheap car such as the Chevy Bolt, unless you produce it in large numbers. GM sold 23,297 units in 2017 and 18,019 units in 2018, but to achieve low costs (and therefore lower prices and higher demand) they would have to produce 10 times that amount. But that would be a much larger investment, and pose a much larger financial risk to the company.

And therein lies the crux of the issue. Car manufacturers need to 'jump off the cliff' and go all-in on EVs, thereby destroying their own business, and many of its own core competencies. They've been incentivized for the longest time to do nothing, and hope the EV revolution goes away, but at this point it is really do or die for the automotive industry. Volkswagen appears to be showing that where there is a will there is a way, but it remains to be seen how many others can not make the jump, or will simply make the jump too late.

Risk Level:

"We can do it!" - CEOs of some automotive companies

"Please go away, and let us die in peace." - CEOs of other automotive companies

Challenge #7: Suppliers

Following Tesla and to a lesser extent the general automotive industry over the past 4 years, my worries for car manufacturers are not a recent thing. What is relatively new, however, is my worry for automotive suppliers, which started a few months ago when I listened to Autoline After Hours #471: The Auto Industry On The Eve Of Destruction.

Judging by the title this may seem like a Tesla fan club discussing how Tesla is going to rule the industry, but nothing could be further from the truth. The hosts are people who have been working in the automotive media for decades, and the guest is an automotive consultant who has worked in the automotive industry for decades as well. Nonetheless, especially the consultant paints a bleak picture of the future for many car manufacturers as well as automotive suppliers.

From 31:25 to 32:25 and from 34:25 to 36:50 the consultant talks about how the largest Tier 1 suppliers are already starting to shift the direction of their business by getting rid of some assets and developing new lines of business. Suppliers that are somewhat smaller (100-500M$ companies) though, according to him are going to see their businesses shrink drastically or even disappear entirely, and he doesn't see a way for many of these companies to survive the transition to EVs.

The problem this poses to car manufacturers is that just like they still need strong relationships with their workers and unions to support their ICE business during the transition to EVs, they also still need reliable suppliers for some time to be able to run their ICE business. If a number of their suppliers start going out of business left and right, this also creates problems for the car manufacturers themselves. Furthermore, it appears that for Toyota suppliers going out of business would be even worse, because Toyota apparently owns most of its suppliers. I've been unable to find out if this is also the case for other manufacturers, so for now I'm going to assume that Toyota is somewhat of an exception in this regard.

But this is just one part of the supplier issues car manufacturers will be facing throughout the transition from ICEVs to EVs. There won't just be suppliers going out of business on the ICEV side, there will also be suppliers struggling to scale as fast as the manufacturers need on the EV side. The consultant clearly emphasizes this point from 37:30 to 38:05, and I'm not surprised he foresees this happening, because Tesla has had similar issues with suppliers:

But this is just one part of the supplier issues car manufacturers will be facing throughout the transition from ICEVs to EVs. There won't just be suppliers going out of business on the ICEV side, there will also be suppliers struggling to scale as fast as the manufacturers need on the EV side. The consultant clearly emphasizes this point from 37:30 to 38:05, and I'm not surprised he foresees this happening, because Tesla has had similar issues with suppliers:

- Hoerbiger failed to deliver a hydraulic system for the Model X's Falcon Wing doors.

- A supplier really dropped the ball in developing a piece of software crucial in the Model 3's battery module production line.

- Panasonic's supply of battery cells has been a bottleneck for Model 3 production.

I don't know enough about this topic to know how easy or hard it will be for the auto industry to plan for and manage these risks, but if this consultant is right, it sounds like the car manufacturers are going to have their hands full managing suppliers both on the declining ICEV side and on the rapidly scaling EV side.

Risk Level: "All hands are on deck to manage suppliers to the best of our abilities throughout this difficult transition." - VP of Supply Chain at large car manufacturer

Challenge #8: Battery Technology

With this challenge we're getting into the territory of very serious challenges, that are going to hurt and/or be difficult to overcome for even the most well intentioned companies that overcome challenge #6 and go all-in on EVs.As I previously alluded to in Challenge #5 (Lack of value add), it looks like many car companies are going to rely on 3rd party suppliers for their battery needs. So far only Volkswagen looks to be serious about developing expertise in battery technology and manufacturing in-house, but even with this willingness to do so it will not be easy. Volkswagen decided that investing 1B$ in lithium-ion battery startup Northvolt, and starting construction on a 50/50 joint venture 16 GWh battery factory was the best way for them to get started, but they still have a long way to go on this journey.

Other companies meanwhile will be completely reliant on suppliers to produce cheap, high quality EV battery cells, and in many cases also the battery packs. The big problem that I foresee happening in the next decade is that demand will far outpace supply. As a matter of fact, this is already happening, and the real EV revolution has barely started. Many cities and countries are going to start completely banning the sale of ICE vehicles in the next decade, and it won't be long before EVs are cheaper than an equivalent ICE vehicle even before accounting for cheaper TCO (Total Cost of Ownership). I think all of this will lead to suppliers being much more incentivized and focussed on keeping up with demand than keeping up in technology.

If Tesla did not exist, this wouldn't be much of a problem. But the fact of the matter is that Tesla is the clear world leader when it comes to battery technology:

|

| https://www.reddit.com/r/teslamotors/comments/cevc99/ev_core_efficiency_comparison_chart/ |

I personally don't see any way for traditional car manufacturers nor their suppliers to reliably catch up to Tesla in terms of battery technology, and I think that only some unforeseen battery breakthroughs from a 3rd party could close the gap.

However, most worrisome of all to the automotive industry in terms of battery technology is the upcoming Tesla Battery Investor Day. When you take into account all the things that have recently happened:

- Tesla acquires Maxwell, officially takes over the battery technology

- Tesla acquires Hibar Systems in push toward in-house battery cell development.

- Elon Musk said Tesla might get into the mining business.

- Elon Musk talks about producing a Terawatt-Hours of batteries.

I'm starting to get a feeling that through integrating Maxwell's technologies, through developing its own battery cells, through further vertical integration, and through new and so far unheard of economies of scale, Tesla is about to get even further ahead of the rest of the automotive industry.

I honestly don't see how the automotive industry can possibly overcome this challenge. The only reason this isn't higher on the list is that Tesla Battery Investor Day has not happened yet, and therefore the gap isn't so large that no customer would ever buy a non-Tesla EV... yet.

Risk Level: "Please Tesla, don't unveil any new battery technologies at Battery Investor Day. Please Tesla, don't unveil any new battery technologies at Battery Investor Day." - Every Executive at every car company

Challenge #9: Dealerships

If you think some of the previous challenges can cause serious problems for car manufacturers, wait until you hear about the headaches dealerships will cause them as the world transitions to AEVs. All car manufacturers (except for Tesla) sell their cars not direct-to-consumer, but through middlemen called dealerships. During the next decade these dealerships will cause an entire list of challenges to established automakers all on their own:- Dealership take a piece of the pie. Granted, this isn't the biggest deal and dealerships do take care of some work for automakers, but we've already talked about how manufacturers will add less and less value in the AEV future, so outsourcing the sale and service of their vehicles doesn't exactly help with this. Furthermore, service is a large profit center for dealerships, whereas Tesla aims to break even on service, providing a competitive advantage to consumers.

- Inventories & Inefficiencies. Compared to Tesla's sales model the traditional dealership model is incredibly inefficient. Tesla's cars used to be 100% and nowadays still are for a large part built to order (although I believe not 100% anymore due to production batches). As a result, Tesla's inventory levels at the end of the 3rd quarter were just 17 days of sales, which is 4x lower than industry average, and about 5x lower than GM's inventory right before the strike of 83 days of sales. This isn't something new for the auto industry, but it means they're simply not able to be as lean nor as capital efficient as Tesla.

- Terrible customer experience. I won't dwell on this one too long, but it's well known that buying a car from a dealership is often a terrible experience. Because car manufacturers outsource the sale of their vehicles, there isn't a whole lot car manufacturers can do about this.

- Anti-selling EVs. Far and away the biggest problem that automakers will face in terms of dealerships, is the fact that dealerships are not incentivized to sell EVs. I would go so far as to say that what dealerships are to traditional car manufacturers, is almost what the oil industry is Tesla. Dealerships make the majority of their money from servicing vehicles. And because EVs require far less servicing than ICEVs, dealerships are incentivized to do everything they can to not sell EVs. The only way I see to counteract this is to shift the dealerships' incentives somehow. Perhaps they could take a bigger profit cut from the sale price of an EV? But that would increase prices for consumers. Perhaps automakers could help dealerships to develop a new line of business? But what? Even if there is a solution to this problem, I still don't expect dealerships to be quick to embrace the EV revolution. This is a very serious problem for traditional car companies indeed.

- Franchise laws & Dealerships associations. You might wonder why, if dealerships are going to cause car manufacturers so many problems, they don't just abandon the dealership model and start selling direct-to-consumer like Tesla. The answer to that is franchise laws and dealerships associations. Tesla has had to battle in numerous courtrooms to get to where they are today in terms of retail presence, and they still are not allowed to operate in many parts of the USA specifically, due to laws that protect the incumbent dealerships. Furthermore, dealerships band together in associations, and lobby and fight desperately against change. If the president of a dealer association said the quote below about what Tesla is doing, how do you think dealers would react to a traditional car manufacturer trying to sell directly to consumers. I'm skeptical that traditional car manufacturers will ever be able to get rid of dealerships.

“For the last 29 years I have fought as a gladiator to protect the rights of the Virginia auto dealers and their franchise system. We are under attack. This system is under attack by the likes of Tesla and many others out there who believe the franchise system is a dinosaur and no longer works. Let’s all strap on whatever it takes to win and let’s win this fight to protect the franchise system.”Risk Level: "I think we're kind of stuck with this one." - Discouraged Head of Dealership Relations at large car manufacturer

Challenge #10: Wall Street & Finances

A company may be run by its CEO and managers, and the CEO and managers may report to the board of directors, but a company is owned by its shareholders, and sadly often judged by Wall Street's shortsighted desire for perfect quarterly execution. As a result companies have to aim for strong financial results on a quarterly and yearly basis, or face Wall Street backlash, sudden steep drops in stock price, and a host of other problems (fleeing investors, unhappy employees, bad press, etc.).

This somewhat goes back to challenge #6 (lack incentives to go all-in on EVs), because a CEO that is required to deliver short-term profits to his shareholders is not going to invest all the company's profits into disrupting its own business. However, at this point that is what a number of automotive companies have to do if they want to have any chance at surviving the next decade. The entire transportation sector is about to experience disruption on a scale it hasn't seen for over a century, and if car manufacturers cannot transition their entire business from producing ICEVs to producing compelling EVs by the end of the next decade, they will be obsolete, and they will go bankrupt.

But being forced to invest large parts, if not all, of their profits into transitioning their entire business isn't the only financial problem car manufacturers will be facing in the 2020s. Their profits itself are already under heavy attack, and will only continue to be assaulted further by Tesla, and perhaps other companies that are ahead of the pack in terms of EVs such as the Chinese BYD:

And this is just the beginning. Most of the profits that car manufacturers make are not from sedans like the Model 3, but from crossovers and SUVs, and from pick-up trucks. So I expect things to get far worse for traditional auto after the launch of the Model Y and Tesla Pick-up Truck. In the case of Ford, I don't know why their profits are down in the gutter as much as they are already, but if Tesla's pick-up is a success and they are able to scale production fast, Ford might be looking at serious financial troubles, perhaps even bankruptcy, in a matter of years.

Even if you gave every automotive company a cash grant equal to their market cap to help them through the transition to EVs, I would fear for a number of them because some are so far behind the likes of Tesla, and some of these challenges cannot be overcome even with lots of money. But given the financial challenges car manufacturers will face throughout the transition, I fear that many will not survive the next decade.

This somewhat goes back to challenge #6 (lack incentives to go all-in on EVs), because a CEO that is required to deliver short-term profits to his shareholders is not going to invest all the company's profits into disrupting its own business. However, at this point that is what a number of automotive companies have to do if they want to have any chance at surviving the next decade. The entire transportation sector is about to experience disruption on a scale it hasn't seen for over a century, and if car manufacturers cannot transition their entire business from producing ICEVs to producing compelling EVs by the end of the next decade, they will be obsolete, and they will go bankrupt.

But being forced to invest large parts, if not all, of their profits into transitioning their entire business isn't the only financial problem car manufacturers will be facing in the 2020s. Their profits itself are already under heavy attack, and will only continue to be assaulted further by Tesla, and perhaps other companies that are ahead of the pack in terms of EVs such as the Chinese BYD:

|

| https://ir.tesla.com/static-files/f1acc7b1-da77-4dde-a2e7-769ca1e6b847 (slightly different, but very similar chart) |

|

| https://www.bloomberg.com/graphics/2019-tesla-model-3-survey/market-evolution.html |

|

| BMW's Income - https://finance.yahoo.com/quote/BMW.DE/financials?p=BMW.DE |

And this is just the beginning. Most of the profits that car manufacturers make are not from sedans like the Model 3, but from crossovers and SUVs, and from pick-up trucks. So I expect things to get far worse for traditional auto after the launch of the Model Y and Tesla Pick-up Truck. In the case of Ford, I don't know why their profits are down in the gutter as much as they are already, but if Tesla's pick-up is a success and they are able to scale production fast, Ford might be looking at serious financial troubles, perhaps even bankruptcy, in a matter of years.

|

| Ford's Income - https://finance.yahoo.com/quote/F/financials?p=F |

|

| Ford's Balance Sheet -https://finance.yahoo.com/quote/F/balance-sheet?p=F |

Even if you gave every automotive company a cash grant equal to their market cap to help them through the transition to EVs, I would fear for a number of them because some are so far behind the likes of Tesla, and some of these challenges cannot be overcome even with lots of money. But given the financial challenges car manufacturers will face throughout the transition, I fear that many will not survive the next decade.

Risk Level:

"We are forecasting significantly reduced profits as we invest in the future and transition our business model." - Honest CFO at relatively well positioned car manufacturer

"There are some indicators forecasting headwinds for the industry, but there is no reason to be concerned about the company's financial health." - Not so honest, or delusional CFO at not so well positioned car manufacturer

"The chances that we survive the next decade are slim." Non-existent, honest CFO at not so well positioned car manufacturer

Challenge #11: Battery Supply

If you thought challenge #8 battery technology was tough, it's nothing compared to the battery supply challenge. There have already been battery shortages in recent years, and even Tesla has suffered through battery cell supply constraints, but this is nothing compared to upcoming battery cell supply shortages. The market share of pure EVs is still less than 2% after all.A recent report from McKinsey outlines some of the challenges. They project that in 2040 about 70 percent of all vehicles sold in Europe will be electric. I think the demand for this will be there a decade earlier though, so if traditional car companies cannot secure enough batteries, they risk losing market share to companies who can like Tesla. They also project that battery demand from EVs produced in Europe will be more than five times the volume of currently confirmed projects, which include, Northvolt in Sweden, LG Chem in Wroclaw, Samsung SDI in Göd, and CATL in Erfurt.

|

| https://www.mckinsey.com/industries/oil-and-gas/our-insights/recharging-economies-the-ev-battery-manufacturing-outlook-for-europe |

McKinsey also states that growing battery demand is putting pressure on a scarce materials supply. They say that the price of lithium ion has tripled since 2015, and that global cobalt production in 2025 will likely need to be double that of 2016 production goals to satisfy global EV demand. And if McKinsey's predictions about cell phones are anything to go by, they tend to significantly underestimate the adoption rate of new technologies.

In the 1980s, AT&T reduced investments in cell towers due to McKinsey's prediction that there would only be 900,000 cell phone subscribers by 2000. According to The Firm this was "laughably off the mark" from the 109 million cellular subscribers by 2000.

Tesla's determination to vertically integrate more and more of its battery supply chain is another indicator of future battery shortages. During their annual shareholders meeting they said that they might even get into the mining business, even though they would really prefer not to. This to me indicates a lack of confidence in the materials suppliers and lithium ion battery cell manufacturers to keep pace with increasing demand.

There are two reasons why I am so much more concerned for car manufacturer about their battery supply challenge than their battery technology challenge. The first reason is that prices of raw materials are already rising, and the prices of battery cells are also much less likely to come down as much as Tesla's, if demand further outpaces supply. This would trickle down to the end-consumer, and I think they will be more sensitive to steeper prices than they would be to a little less advanced battery.

The second, and most important reason is that outdated battery technology does (at least in theory) not stop car manufacturers from selling EVs. A lack of actual battery cells on the other hand, will most certainly make it impossible for car manufacturers to sell a large number of EVs and to stay relevant in the transportation industry. Once EVs reach cost parity with ICEVs in the middle of the next decade, and the lower TCO of EVs make them a no-brainer purchase for practically any consumer, demand is going to shift rapidly. At this point, features and desirability of EVs could for a while become secondary to availability. Basically, the company that is able to mass produce the largest number of EVs and has the battery supply to support it, is going capture the largest market share. I'm afraid that this is not going to be most car manufacturers.

Risk Level: "EVs will not be mainstream. I do not believe there will be a dramatic increase in demand for battery vehicles." - Takahiro Hachigo, actual super-ignorant CEO of Honda on November 11th, 2019

Challenge #12: Autonomy & MaaS

And with that we've come to the single biggest challenge the automotive industry is currently facing: Autonomy and MaaS (Mobility as a Service). The autonomy section of my Tesla Investment Thesis is my favorite part of the entire blog, and it gives a great explanation of why Tesla is going to crush autonomy, so I highly suggest reading that if you haven't done so already.

As things are currently going, it seems clear that none of the major car manufacturers are going to be among the companies to solve autonomy. The only exceptions might be GM with its acquisition of Cruise. However, Cruise is taking the same approach to Waymo, and is years behind and unlikely to leapfrog Waymo. Besides, all of them are using the LIDAR approach, which is inferior to Tesla's vision-centered approach.

Funnily enough, the only companies that could theoretically gather enough data and copy Tesla's approach are traditional car companies. I just don't see this happening though (at least not before it is already too late) for a number of reasons:

As things are currently going, it seems clear that none of the major car manufacturers are going to be among the companies to solve autonomy. The only exceptions might be GM with its acquisition of Cruise. However, Cruise is taking the same approach to Waymo, and is years behind and unlikely to leapfrog Waymo. Besides, all of them are using the LIDAR approach, which is inferior to Tesla's vision-centered approach.

Funnily enough, the only companies that could theoretically gather enough data and copy Tesla's approach are traditional car companies. I just don't see this happening though (at least not before it is already too late) for a number of reasons:

- As discussed, traditional car companies are notoriously bad at software.

- They have their hands full with challenges #1 through #11 and surviving the EV revolution that threatens to destroy them.

- None of them are even aware of what is happening, and that Tesla's vision-centered approach is the way to go.

- For many of them it'd require admitting to mistakes of having invested in companies using the LIDAR approach.

- Even if they started right now, I doubt they would ever come close to catching up to Tesla in terms of hardware, software, and infrastructure (Data Collection, Project Dojo, Project Vacation, etc.), and every day that passes is a day that Tesla gets further ahead. It's looking like Game, Set, & Match that Tesla will win Autonomy.

Even if all of this is wrong, and some how some way GM gets a monopoly on autonomy with Cruise, it is unquestionable that the vast majority of car manufacturers are not going to solve autonomy. This alone will not be the end of the world for them though, because I'm sure that as long as Tesla doesn't get a monopoly on autonomy, some of the companies that solve autonomy will (have to) license the technology to traditional car manufacturers, or at a minimum buy their vehicles. The real threat to traditional car manufacturers that lies in Autonomy and on-demand MaaS has to do with the drastic changes to the cost of mobility, and where that cost comes from.

Currently, the situation is as follows:

- An ICEV lasts close to 200,000 miles.

- The average miles per driver per year is 13,764 in the USA, 7,900 in the UK, and about 7,500 in the EU. So let's say the total average is about 10,000 miles per driver per year.

- This means that the average vehicle will be replaced every 20 years. This matches up with comments from Elon that it takes 20 years to replace the global fleet of 2B vehicles.

This means that as of right now, the total automotive industry sells 2B vehicle per 20 years, or an average of about 100M vehicles globally per year.

In the AEV future, the situation will be very different:

- EVs have less moving parts, and therefore last longer. Tesla is working on a 1,000,000 mile battery and powertrain.

- Robotaxis could drive up to almost 100,000 miles per year. This means they would last approximately 10 years.

- Autonomy will do away with private car ownership, because autonomy will massively decrease the cost of MaaS, and at the same time massively increase the up front costs of vehicle ownership.

- The advent of autonomy will drastically change the form of our vehicles. Private car ownership means cars have to be able to handle a wide variety of use cases. Widespread MaaS will lead to more optimized vehicles, such as small 1-or-2 seat vehicles with limited cargo space for a large portion of taxi rides. I expect that as a result the average cost of vehicles will drop significantly compared to what it is today.

- The high utilization rate of an autonomous robotaxi will mean we need far less vehicles on the road. I've seen figures that said we'll need 5 times less vehicles, but then again cars are parked 95% of the time, so maybe we'll need even less than that.

- The drop in cost of transportation that AEVs will bring with them, will lead to a larger demand for transportation, as long as our road network can keep up. I expect AEVs will mainly transport passengers during the day and peak hours, and mainly transport cargo during the night and off-peak hours. This is also why we need TBC (The Boring Company).

This means that in the AEV future, the global fleet will shrink from 2B vehicles to 400M vehicles (5 times less). Maybe a lot less, but this will be mitigated somewhat by an increase in demand for transportation, so let's say 500M. This 500M fleet will be replaced by the total automotive industry every 10 years, for a global vehicle production of 50M vehicles globally per year. However, most of these vehicles are likely to be much much cheaper, and perhaps more commoditized. Performance and brand won't matter as much anymore as low cost (to the fleet operator) and infotainment. Gone will be the days of the high margin SUVs and pick-up trucks. The name of the game will be small, inexpensive robotaxis.

So not only will the market for global vehicle sales eventually be cut in half (possibly a lot more if the longevity of battery + powertrain is further improved, which I think is highly likely), the price and profit margins of cars will also drop significantly. With the advent of AEVs, both the revenue and profits in transportation will shift from the sale price, maintenance cost, and fuel consumption of the vehicle, to the software making it all possible and perhaps new lines of business such as in-car infotainment. The revenue and profits in transportation will shift from the car manufacturers to the companies that create the self-driving software, and to the companies that operate and manage the gigantic fleets of self-driving vehicles.

The only thing that car manufacturers can possibly hope to do about this is to get in on these new businesses, but we've already determined that it's not looking like any of them (except for maybe GM with Cruise) have any chance of solving autonomy. What about in-car infotainment? I doubt any of them are going to beat the likes of Netflix, Disney, and Amazon in content. Fleet operator / MaaS provider? Maybe there is some sort of angle where a large car manufacturer like Toyota or Volkswagen could license autonomous technology from a company like Waymo, and then start an Uber competitor ala Tesla Network with just their own brand's vehicles. This seems like a long shot though, and it doesn't change the fact that Tesla is on track to solve autonomy years ahead of everybody else, and Tesla is so vertically integrated (Supply Chain, Manufacturing, Autonomy, Sales, Infotainment, Charging, Service, Insurance, Tesla does it all) that it's going to have significant advantages launching a robotaxi service. Tesla is scary indeed.

Risk Level: "The entire automotive industry appears to be unaware that even if they overcome the challenges they're facing in light of electrification, they'll still be pretty screwed due to the even more disruptive autonomy revolution." - Me

Part 2: Who will survive?

It's clear that the automotive industry has a very difficult time ahead. I personally think it's very obvious that this degree of disruption will drastically change the landscape of the industry, and I think it's pretty much a given that there are going to be casualties. The only question to me is how many will survive and who. So let's take a look at the 12 largest automotive companies and alliances.

#12 BMW

|

| https://finance.yahoo.com/quote/BMW.DE/key-statistics?p=BMW.DE |

|

| https://en.wikipedia.org/wiki/BMW |

BMW started off the last decade very promising by bringing to production the i3 and i8, and getting an early lead in EVs over the majority of the industry. But then suddenly it looked like BMW got scared, because they delayed their electrification effort, the leadership responsible for its electric EVs left for China, and various executives started making questionable statements such as:

|

| https://www.theverge.com/2019/6/28/19154233/bmw-electric-vehicles-ev-event-executive-overhyped |

| https://insideevs.com/news/357048/bmw-development-head-europeans-evs/ |

|

| https://www.bmwblog.com/2019/10/31/bmw-says-consumers-and-infrastructure-not-ready-for-ev-takeover/ |

And as if that wasn't enough, earlier this year BMW's CEO left after a four-year tenure because the automaker saw its early head start in electric vehicles evaporate. Kind of makes you wonder if this Harald Krueger guy was somehow a secret operative for the oil industry.

This leaves BMW in a precarious position. It doesn't have much of an EV program, and most of its upcoming EVs are still a number of years away. The attitude towards EVs within the company appears to be one of ignorance. And maybe worst of all, its new CEO seems to have the same poor attitude towards EVs as the last one.

My prediction is that BMW will at some point be taken over by either Daimler or Volkswagen because of brand value. They will then relaunch the brand with a new line of electric performance vehicles.

Likelihood of Survival: Low

#11 Daimler

|

| https://finance.yahoo.com/quote/DAI.DE/key-statistics?p=DAI.DE |

|

| https://en.wikipedia.org/wiki/Daimler_AG |

Daimler, similar to BMW, started off their move into EVs with a stroke of brilliance. In 2009 Daimler bought a nearly 10% stake in Tesla for just 50M$. Today this stake would've been worth about 5B$, and I bet that in 10 years this stake would've been worth more than all of Daimler, but they sold 40% of it just two months after the acquisition, and the remainder in 2014. Oh well... what could've been.

Nonetheless, unlike BMW Daimler has not been sitting still since then. Daimler has a subsidiary that produces battery packs and a small battery factory, so it's not completely reliant on its suppliers, although it still sources a portion of its batteries from companies such as SK Innovation. Furthermore, Daimler has made the very intelligent move to abandon the development of internal combustion engines in favor of EV technologies. They're also working on electrifying their truck and bus businesses. They're still somewhat lacking in terms of actual EVs that are available for purchase, with the first, the EQC, only just going into production. Daimler has also yet to show that it can build a compelling EV that can compete with the likes of Tesla, but it is taking steps in the right direction and somewhat well positioned to deal with many of the challenges it will face in the next decade.

Likelihood of Survival: Fairly High

#10 SAIC

|

| https://finance.yahoo.com/quote/600104.SS/key-statistics?p=600104.SS&.tsrc=fin-srch |

|

| https://en.wikipedia.org/wiki/SAIC_Motor |

I have to admit that I don't know much about this Chinese car company, but I know that it is owned by the Chinese government and those guys don't mess around when it comes to EVs. China is dealing with massive pollution and the Chinese government is trying to switch the country over to EVs as soon as it can. I'd imagine that a car manufacturer owned by the state is taking drastic measures in order to go along with this transition, and if these sales numbers I found are accurate, they are doing quite a good job so far.

|

| https://wattev2buy.com/electric-vehicles/saic-electric-vehicles/ |

Likelihood of Survival: Very High (Chinese state owned after all)

#9 Suzuki

|

| https://finance.yahoo.com/quote/7269.T/key-statistics?p=7269.T&.tsrc=fin-srch |

|

| https://en.wikipedia.org/wiki/Suzuki |

Suzuki has not done a whole lot in terms of electrification. As a matter of fact, I am not aware of a single electric vehicle or motorbike launched by Suzuki. Apparently they were planning on launching a tiny electric vehicle in India in 2020, but it has been delayed indefinitely due to a lack of charging infrastructure and battery supply in the country. Astonishingly, Suzuki is going to build a large battery factory in India themselves, but they said this factory is "only for hybrid batteries and not fully electric batteries". Hopefully they'll be able to re-purpose this factory at some point, but I think it's more likely that it will be sold off during Suzuki's inevitable bankruptcy.

Likelihood of Survival: Very Low

#8 Honda

|

| https://finance.yahoo.com/quote/7267.T/key-statistics?p=7267.T&.tsrc=fin-srch |

|

| https://en.wikipedia.org/wiki/Honda |

Out of all Japanese car manufacturers, I think Honda might be in the relatively best position:

- Honda has a number of other non-automotive lines of business.

- Honda has been building hybrid electric cars since the late 90's, so they are more familiar with the technologies than most.

- Honda is considering building a battery factory in India.

- Honda seems like it has gotten very serious about EVs as of late, and is aiming to sell only electrified vehicles in Europe starting in 2022.

- Honda has inked a deal with CATL for a battery supply to support the production of 1 million electric vehicles by 2027.

Electrified hybrid vehicles are going to be at a cost disadvantage compared to pure EVs, and a battery supply for 1 million vehicles between now and 2027 isn't actually a whole lot. So Honda is far from safe, and still has ways to go, but at least they appear to be somewhat aware of what is coming. Will that awareness be enough to overcome all the challenges in the next decade and survive? Time will tell.

Likelihood of Survival: Decent

#7 Ford

|

| https://finance.yahoo.com/quote/F/key-statistics?p=F&.tsrc=fin-srch |

|

| https://en.wikipedia.org/wiki/Ford_Motor_Company |

Ford may be the world's second largest manufacturer of hybrids, their efforts in terms of true electric vehicles have so far been rather disappointing, and last year an executive VP at Ford also made some concerning comments in response to a question about building a battery factory:

"There is not yet enough demand for electric vehicles to justify the enormous investment it would take to build a battery factory."

There is quite a bit of hype around the electric SUV that Ford is set to debut in a couple of days, however, and Ford is working on an electric version of their best-selling F-150 pick-up truck that could go into production as soon as 2021.

I fear that this is a classic case of too little too late though. I am most worried about Ford's ability to compete for talent with Tesla, and about its recently deteriorating finances that I showed off earlier. Especially because Tesla's electric pick-up truck is coming, and if it's going to achieve anywhere close to the success that Tesla's other vehicles have achieved, Ford is headed for some serious financial pain that I think might drive them to bankruptcy. Some people are (incorrectly) claiming that Tesla is at risk of bankruptcy during the next recession, but if the Tesla pick-up truck starts taking away market share around the same time as we head into a recession, I think Ford is done for.

Likelihood of Survival: Low

#6 GM

|

| https://finance.yahoo.com/quote/GM/key-statistics?p=GM&.tsrc=fin-srch |

|

| https://en.wikipedia.org/wiki/General_Motors |

Not unlike some of the other companies in the list, GM got off to a decent early start in their electrification efforts with cars such as the EV1, the Volt, and the Bolt. However, as the famous documentary Who Killed the Electric Car detailed the EV1 project was scrapped under pressure from the oil industry, and the Volt and the Bolt ended up being low volume compliance cars that lost GM money before accounting for credits.

As of right now there are some vague plans for electric trucks and SUVs, but these are still years away. And the majority of GM's electrification efforts still seem to be aimed towards complying with regulations, in spite of CEO Mary Barra's well intentioned promises to sell 1 million EVs a year. I don't know whether Mary Barra is serious about this and simply facing internal resistance, or if these announcements scarce in details are just for outward appearance, while GM has no intention of being serious about EVs. Either way, I don't think GM is in a strong position right now.

A small glimmer of hope for them is Cruise, which gives them an insurance policy against Waymo in terms of autonomy. But they should've gotten themselves an insurance policy against Tesla instead.

Likelihood of Survival: Low

5. Hyundai

|

| https://finance.yahoo.com/quote/005380.KS/key-statistics?p=005380.KS |

|

| https://en.wikipedia.org/wiki/Hyundai_Motor_Company |

Hyundai might be the most veteran EV manufacturer in the world, because they've been developing electric and hybrid vehicles on and off since 1988. Their sales are not massively impressive considering the amount of time they've already been working on EVs, but nonetheless they have some in-house expertise when it comes to developing electric vehicles. Furthermore, Hyundai has two brands among the top selling brands in Europe (Hyundai and KIA), and appears to be selling the second most electrified vehicles in the EU, only second to Tesla:

|

| https://eu-evs.com/ |

This doesn't mean they're a sure shot to survive the next decade, because a number of challenges still remain, and their EVs are not of comparable quality to Tesla's. However, for now it seems like Hyundai has been able to capture market share on the bottom end of the EV market, and being a Korean company might give them some advantages in securing battery contracts with some of the giant Korean battery companies like Samsuns and LG Chem.

Likelihood of Survival: High

#4 PSA - FCA

|

| https://finance.yahoo.com/quote/UG.PA/key-statistics?p=UG.PA |

|

| https://en.wikipedia.org/wiki/Groupe_PSA |

|

| https://finance.yahoo.com/quote/FCAU/key-statistics?p=FCAU&.tsrc=fin-srch |

|

| https://en.wikipedia.org/wiki/Fiat_Chrysler_Automobiles |

A few weeks ago PSA (Peugeot) and FCA (Fiat-Chrysler) announced that they will be merging their companies. Will this increase or decrease their chances of surviving the AEV revolution?

PSA seems to be in an okay position. The electric and hybrid vehicles they are currently selling might be very low volume, but they are working on more offerings that will start coming to market in 2020. They are also investing in their own battery pack assembly facility in Slovakia. Last but not least, if PSA Group's electric and connectivity boss Helen Lees is an example of the mindset within the company, PSA might be the car manufacturer most well aware of the situation the industry is facing:

“EVs are far simpler [than internal combustion engined vehicles]," she explained. "They need less parts, less time in the workshop. Ultimately, it means less time in aftersales. That’s why we’ve chosen to diversify into areas such as shared mobility.”

“We haven’t commercialised a lot of [mobility services] in the UK, but we will do, such as Free2Move, which encompasses anything complementary to car ownership or substitutes such as leasing or rental, but also our use of telematics and technology to enable peer-to-peer car-sharing."

“Obviously, that helps build the total cost of ownership model at the moment, but longer-term, maybe our dealerships will become mobility hubs where there's dealership-based rental.”FCA's previous CEO on the other hand, was perhaps the biggest naysayer when it comes to EVs in the entire auto industry:

- "Fiat Chrysler CEO: Please don't buy our Fiat 500e electric car."

- "Marchionne: Electric cars not worth investment."

- "FCA's Marchionne says accelerating EV sales prematurely will endanger the planet."

- "Fiat-Chrysler chief Sergio Marchionne doesn't think electric cars, Tesla are viable."

However, Marchionne tragically passed away last year, and since then FCA has changed course. FCA executives are now saying EV's are the future. They are now planning to launch a new EV in 2020 with a planned production capacity of 80,000 units per year. They're even planning a battery assembly facility in Italy, albeit a very tiny one.

I feel like PSA is in a slightly better position than FCA, because FCA started everything so late. Also, even after the merger PSA - FCA will still be relatively small in terms of market cap compared to companies like Volkswagen and Toyota, and a large corporate merger like this brings with it further challenges in addition to the challenges they are already facing. I find this one hard to predict, but my intuition says it will be a tough one.

Likelihood of Survival: Not great

#3 Renault - Nissan

|

| https://finance.yahoo.com/quote/RNO.PA/key-statistics?p=RNO.PA |

|

| https://en.wikipedia.org/wiki/Renault |

|

| https://finance.yahoo.com/quote/7201.T/key-statistics?p=7201.T |

|

| https://en.wikipedia.org/wiki/Nissan |

Renault and Nissan are part of an alliance. Renault owns a 43.4 percent stake in Nissan, and Nissan owns a 15 percent stake in Renault.

Nissan was just like BMW and GM one of the first to follow in Tesla's footsteps with the very successful Nissan Leaf, which has sold over 400,000 units. Since then it's been awfully quiet though. Nissan marginally upgraded the battery pack of the Leaf a couple of times offering slight range increases, but that's been about it. They are now planning to produce additional EV models, but these are all a couple of years away. It seems like Nissan has thrown away its early lead.

Renault has a somewhat successful EV on the market in the form of the Zoe, but yearly sales numbers of 30-40 thousand are not going to cut it. Just like Nissan, Renault has a number of EVs planned for the coming years, but all in all these companies don't strike me as if they're taking EVs quite serious enough to survive the coming decade.

Likelihood of Survival: Not great

#2 Volkswagen

|

| https://finance.yahoo.com/quote/VOW.DE/key-statistics?p=VOW.DE&.tsrc=fin-srch |

|

| https://en.wikipedia.org/wiki/Volkswagen_Group |

In my opinion Volkswagen is the single best positioned company to survive at least the electrification part of the transition to AEVs. I've already mentioned a number of the reasons for this throughout this blog, but here they are once more:

- Volkswagen went all-in on EVs back in 2016. Years ahead of the rest of the industry.

- Volkswagen is serious about investing in batteries. Their own battery factory may still be a very small step thus far, but it is a step nonetheless. Almost no other automaker has been willing to invest as deeply into battery tech as Volkswagen.

- They are aiming for large scale by outfitting 16 factories to build EVs by the end of 2022.

- Volkswagen is one of the largest car manufacturers in the world, so they have more scale and money to help them adjust their business into the right direction.

- Their CEO appears to be fully on-board and realises the things that have to be done.

Don't get me wrong. Volkswagen may be in the best position of all, but they still face tremendous challenges. Especially autonomy is a big wild card, and could still cause a lot of harm to Volkswagen's business. But for now, Volkswagen is a top-of-the-class student among mostly slack-offs.

Likelihood of Survival: As good as it gets

#1 Toyota

|

| https://finance.yahoo.com/quote/7203.T/key-statistics?p=7203.T |

|

| https://en.wikipedia.org/wiki/Toyota |

Toyota, just like Daimler, had a stroke of brilliance and invested 50M$ in Tesla for a ~10% stake in the company. However, also just like Daimler, Toyota too sold this investment in 2014. And just like with Daimler, I believe a 10% stake in Tesla will likely be worth more than all of Toyota in 2030, but alas.

Toyota has an impressive record in terms of hybrid sales. It all started of course with the now famous Prius of which Toyota has sold millions. When it comes to pure EVs though, Toyota's decisions throughout the last decade have been nothing short of disappointing. In 2012 Toyota killed its EV plans. Toyota has also continuously invested in fuel-cell technology, and claimed that it would take over. Even as the years passed, and it became more and more obvious that fuel-cell vehicles are a waste of time, Toyota still wasn't ready to give up on them. Having lived in Japan for a few years, it seemed to me like they didn't want to bring shame upon themselves and admit that they were wrong about fuel-cell technology.

Even to this day, Toyota is doing the bare minimum to comply with regulations, and building almost exclusively hybrids. Toyota is investing in battery factories here and there, but they are all meant for hybrid battery production. I think the following picture sums up the sad state of affairs pretty well:

|

| https://cleantechnica.com/2019/08/16/the-ev-future-volkswagen-vs-toyota-in-one-picture/ |

Toyota may currently be the largest car company in terms of market cap, I fear that they will not be around in 2030. I also fear for Japan's economy, because it is so dependent on its automotive industry, and none of its car manufacturers are very well positioned to survive the transition to AEVs.

I do see a little bit of hope for Toyota, because they have a relatively strong balance sheet and are sitting on over 50B$ in cash. They are also the most highly valued car manufacturer for a good reason, because of their astonishing operating efficiency and profit margins. However, time is running out, and if Tesla ever enters Toyota's market segment and develops a cheaper vehicle that directly competes with Toyota's bread and butter, I fear for Toyota's ability to adapt, and ultimately its survival.

Likelihood of Survival: Not good

Conclusion

And with that, we've come to the end of another massive blog post. I sincerely hope you enjoyed this Tesla blog, that's not really a Tesla blog, because I spent a good 40-50 hours on this. It took a fair bit more research than my other blogs thus far, because although I know every in and out about Tesla and a lot about the state of the general automotive industry, I know about all these individual car manufacturers in a lot less detail.

I'm extremely happy with this post, and personally like certain parts of it as much, if not more than my Tesla Investment Thesis. Tesla is definitely the most exciting thing going on in the world today, but the disruption that is about to hit the automotive industry and the degree to which it will change the world are almost just as exciting to follow.

I'm extremely happy with this post, and personally like certain parts of it as much, if not more than my Tesla Investment Thesis. Tesla is definitely the most exciting thing going on in the world today, but the disruption that is about to hit the automotive industry and the degree to which it will change the world are almost just as exciting to follow.

Such good work on here. I'll have to reread it a few times to really let it sink in. But I do think you're quite right, there's a massive shift (well, a few of them really) coming and a few of these companies won't survive

ReplyDeleteThanks Gary!

DeleteLooks like you didn't take Mobileye (acquired by Intel) into account in the above analysis. They recently held an investor day which you really should watch:

ReplyDeletehttps://newsroom.intel.com/press-kits/2019-mobileye-investor-summit/#gs.gmhxar

Would love to see if this affects any of the conclusions.

TL;DR:

1) Mobileye is a supplier to many traditional car companies.

2) Their older-gen equipment is already installed in 10s of millions of cars worldwide.

3) Newer equipment produces 2mil km/day of data, and rising.

Could they be a threat to Tesla in terms of autonomy?

I saw the brief demonstration video on YouTube, which looked impressive, but I wasn't aware they did a full on investor day. I'm definitely going to watch this, thank you!

DeleteRegarding your second point: MobilEye's older-gen equipment does not allow for any data collection. These cars do not have the ability to send data OTA to MobilEye nor the car manufacturers.

Last time I checked MobilEye still planned to use LIDAR (although it was noticeably missing from the demo I saw), and they're also heavily relying on high precission mapping. They do seem like a strong contender to at least Waymo, but I'm going to have to watch that presentation before I can form an opinion about whether they have any chance of competing with Tesla.

I've only listened to the first 5-10 minutes of the autonomy part of the presentation so far, but I can already tell you MobilEye is not going to change that Tesla is far ahead of everybody else. They're talking about consumer AVs being much farther away than robotaxis because:

Delete1) 15k$ cost of the system. This implies they are still using LIDAR.

2) Necessity of geo-fancing through maps.

I'm still going to watch the rest of it, but MobilEye will definitely not leapfrog Tesla, and I think the reason Tesla is launching in Israel right now is to start gaining some market share in MobilEye's initial launch market.

Yes, they are targeting L4 and are using LiDAR.

DeleteTheir argument for doing robotaxis first is that to convince regulators/gain public acceptance, you first need a robotaxi fleet operator to be accountable should accidents occur, and collect lots of data. Only then would public acceptance be enough to allow for consumer AVs.

I don't buy this argument. First, consumer AVs can also collect the data. Second, I don't see why public/regulator acceptance cannot be achieved by having the car do X% of the daily average drive, where today probably X=85%, rising to 95%, then 99% and eventually 100% - why won't this gradual approach work?

The only edge they might have over Tesla is the sheer number of vehicles which will collect useful data - b/c they work with multiple vendors selling in the millions.

I agree that the 15k$ cost is a severe headwind. They also have the one-supplier-has-to-please-many-customers problem. In a sense they are vertically integrated because they own the suite of self-driving, but surely not as vertically integrated as Tesla.

I've watched all of it now. I don't actually think the 15k$ cost is a severe headwind. 15k$ cost is only severe if it needs to be put in a large number of vehicles to collect data, but once the technology works it'll add so much value that the 15k$ isn't that big a deal.

DeleteThe data collecting edge you mention is much more nuanced. Up until recently all of MobilEye's systems were single forward facing cameras. It sounds like that might've changed with the new L2++ systems they're now shipping though, but to me that wasn't 100% clear. It also isn't clear to me if MobilEye's fleet sends data specifically when there is an 'intervention' like Tesla's fleet does (this is important). It sounds like MobilEye is using their data-collecting fleet purely for mapping and sending those 10kb of data per 1KM into the cloud, not to improve their vision system.

Some of the most important take-aways for me were:

1) MobilEye does not see a near-term or mid-term path to solving autonomy with only vision, but they are developing a vision-only system independently of their LIDAR system as part of their solution.

2) The mapping is interesting. It's definitely still a far less ideal solution than Tesla's, but considering their fleet's scale maybe it could work? I feel like they'll want to get rid of the mapping at some point, but it's possible that the mapping could be a transitionary solution for MobilEye.

3) MobilEye sees a lot more difficulties convincing regulators. This is still a huge advantage of Tesla over MobilEye, that they are deploying their FSD software to millions of cars and are having their test drivers validate the system over billions of miles. They can eventually take those billions of miles of data to regulators and get approval pretty easily if the safety statistics are there.

MobilEye has definitely surpassed Waymo in my opinion as the #2 in the industry. I could also see them launch successful MaaS services in smaller portions of the world, but I still see Tesla as the clear leader and on track to be first to develop an easily scalable worldwide robotaxi service.

One thing I question is how will the following competing forces play out:

ReplyDelete- the shift to MaaS/less vehicles on road

- having enough vehicles to support demand during rush hours

Hopefully this plays out to the tune of more people working from home, and more flexible work hours.

Yeah, that'd be a great way to help combat congestion during rush hours.

DeleteHowever, I think the fleet of robotaxis will simply be used for other purposes in non-peak hours as much as possible. Liked I mentioned, I think peak-hours will focus on passengers transportation, and off-peak hours will focus on cargo transport.

This comment has been removed by the author.

ReplyDeleteFrank,

ReplyDeleteAwesome work on your blog. Thank you for sharing. Are we able to talk about some of your research assumptions? Thx - Bill

Thanks Bill!

DeleteYeah sure. If you send me a private message on Reddit, we can exchange Discord or Skype or something from there.

https://www.reddit.com/user/Peel7

Good, thorough research. I still think that things may develop in a much more unexpected manner, and I wouldn't be so negative about battery technology. I've worked in the battery industry for a few years now and the fact of the matter is that, as far as I can tell, even Tesla continues to improve on intercalation Li-ion batteries. These batteries are already at around 73% theoretical efficiency and, as long as graphite continues to be the anode of choice, there is only so much room for improvement (no matter how smart you arrange your batteries or how many supercaps you introduce). I have no doubt that there will be another revolution in battery design, similar to that brought about by Sony in 91 with the Li-ion battery. My bet is that someone will make the metallic lithium anode work, or replace Li by heavier, yet more electrically charged polyions. If Tesla comes up with this, it will be game over. But it can also be an independent provider, remember that phones also use batteries.

ReplyDeleteI'd also like to add that we don't know what a 15 year old Tesla model S will be like. Li-ion batteries degrade, and at a faster rate towards the end of their life cycle. Tesla will use supercaps to extend battery life and might be victorious in the durability metric, but it may not. And I think this will matter in the near future.

ReplyDeleteMauro,

DeleteThanks for sharing your insights! We indeed don't know what a 15 year old Tesla's battery will be like, but I assume that Tesla's claims about soon having a 1M mile battery are based on accelerated testing done in labs.

There are also some reports about high mileage Teslas (from the company Tesloop in particular) that indicate Tesla batteries should perform well, even in old age.

Really enjoyed this! I’ve been using Super Shopper Hub lately to find reliable promo codes and exclusive deals—it’s made online shopping so much easier and more affordable. Definitely worth checking out for anyone who loves saving money!

ReplyDeleteThanks

ReplyDeleteJust got my car coated at Astonishing Detail, and the results are unbelievable! Their ceramic coating in richmond va gives my car a deep mirror shine and protects it from UV rays, dirt, and water spots.

ReplyDelete